Bulking Up Battery Sector May Add Billions to Australian Economy

(Bloomberg) --

Australia could add billions to its economy by accelerating work to extend the battery supply chain beyond mining, according to an industry group backed by major firms like Tesla Inc. and BHP Group.

Adding more capacity to refine metals into specialist chemicals or materials and building expertise in manufacturing lithium-ion cells or battery packs, would enable the battery industry to contribute about A$7.4 billion ($5.6 billion) to the nation’s economy by 2030 and create 16,000 extra jobs.

That compares to A$4.1 billion in value that would be generated by sticking to a current path of focusing mainly on extracting raw materials for export, Accenture Plc said Thursday in a report commissioned by the Future Battery Industries Cooperative Research Centre.

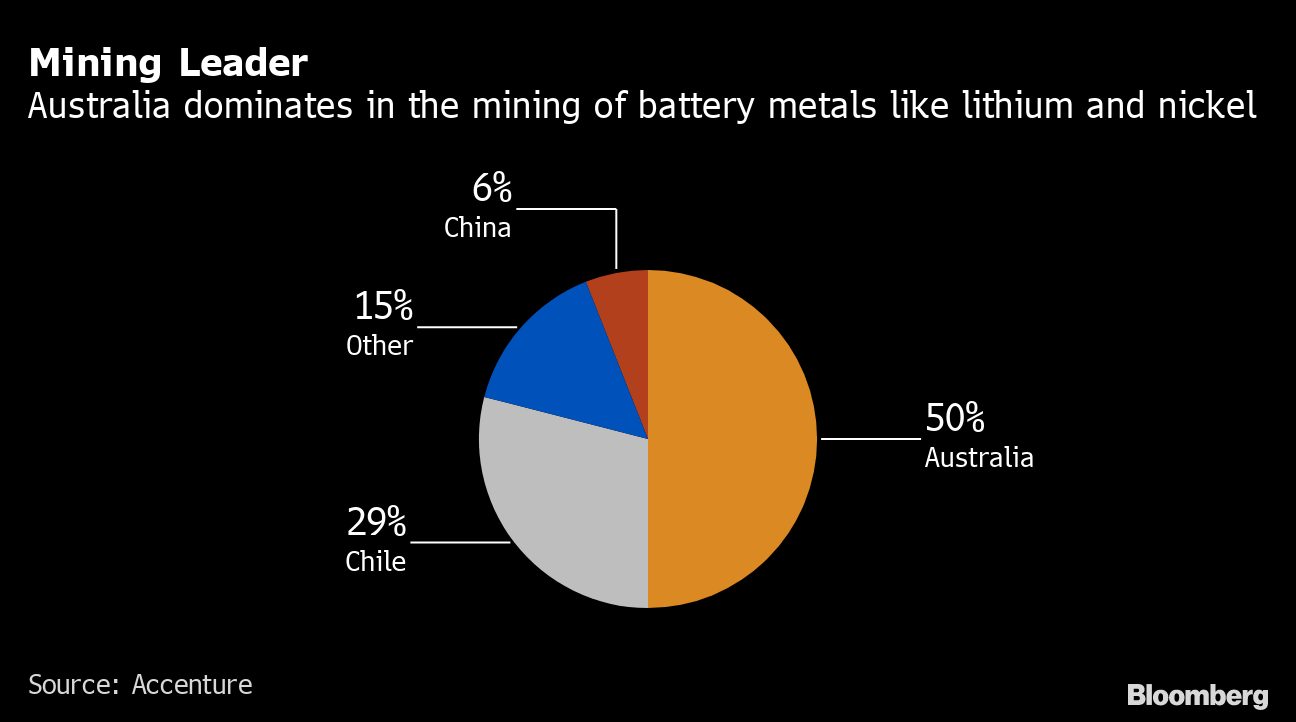

Australia dominates mining of metals needed for batteries, accounting for about half the global total, while China has a grip on most processing of the materials, Accenture said in its study. China has more than 80% of battery cell manufacturing capacity, though Europe is adding new plants and increasing market share as electric car sales rise, according to BloombergNEF.

“Australia has many strengths for succeeding in this ambition,” said Stedman Ellis, chief executive officer of the Future Battery Industries group. “There is substantial economic value to gain if we capture the opportunity.”

Mining-focused nations including Australia, Chile and Indonesia have for years been attempting to win a larger share of the battery supply chain, which would allow them to generate more value from raw materials like lithium, nickel and cobalt. Governments are seeking to avoid a repeat of their history with metals like copper and iron ore, which are typically dug up for export and turned into more valuable products overseas.

Obstacles including a shortage of skilled workers, high labor costs and a lack of domestic customers, including electric automakers, have hampered some of those attempts. The development of planned lithium refineries in Australia also stalled as prices slumped between mid-2018 and late last year.

Global sales of batteries for electric vehicles and energy storage systems will jump as much as tenfold to $151 billion by 2030, according to the study. The task of meeting fast-rising battery demand will need “unprecedented but achievable increases in materials, components and cell production,” BNEF said in a June report.

Australia should also consider potential integration of the battery industries with its nascent hydrogen sector, the Accenture report said. “The technologies are also complementary,” the report said. “Batteries can support 24/7 green hydrogen production, meaning that both industries can prosper.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.