Private Equity Follows the Money—and the Money Is Ditching Fossil Fuels

(Bloomberg) -- The buyout industry has long been a major backer of fossil-fuel deals. Now it’s rolling out new green asset funds at a record clip in a bid to lure the institutional money flocking to climate-friendly investments.

Today’s private equity shops—including the world’s largest alternative asset manager, Blackstone Group Inc.—are pouring capital into fast-growing sectors such as solar, carbon capture, and battery storage. Part of the attraction stems from the rapid adoption of wind and solar as public demand for climate accountability rises. It’s a shift in investment strategy that comes after years of fits and starts for the once struggling renewables space.

Especially over the last 18 months, environmental, social, and governance factors have also become a much stronger consideration for North American investors, said Kelly DePonte, a managing director at Probitas Partners, which helps raise money for private equity funds. Like their European counterparts, they’re beginning to prioritize so-called ESG factors in earnest. And where the money goes, so does private equity.

Investors in private equity, like pension funds, “are moving away from investing in oil and gas no matter the returns in pursuit of their carbon neutral goals,” DePonte said. “Though this is small right now, it is growing—and many of these first movers are large.”

The New York State Common Retirement Fund, the U.S.’s third-largest public pension fund, pledged in December to reach net-zero greenhouse gas emissions across its investments by 2040. The California State Teachers' Retirement System, the nation’s second-largest public pension, is planning to create a sustainable portfolio for private markets and invest between $1 billion to $2 billion over the next couple of years, while earlier this year the Ontario Teachers’ Pension Plan committed to reaching net-zero emissions across its investment portfolio within three decades.

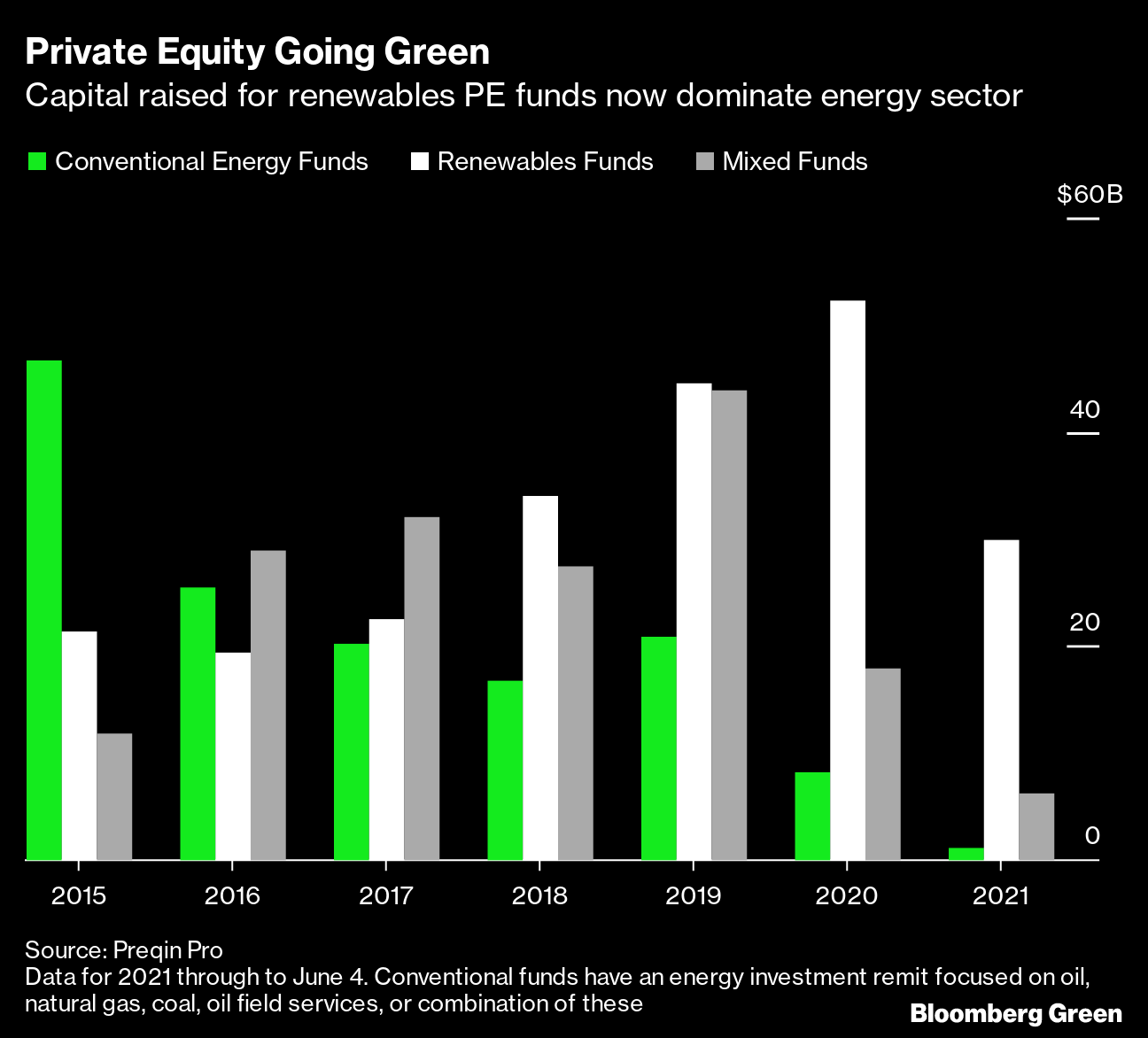

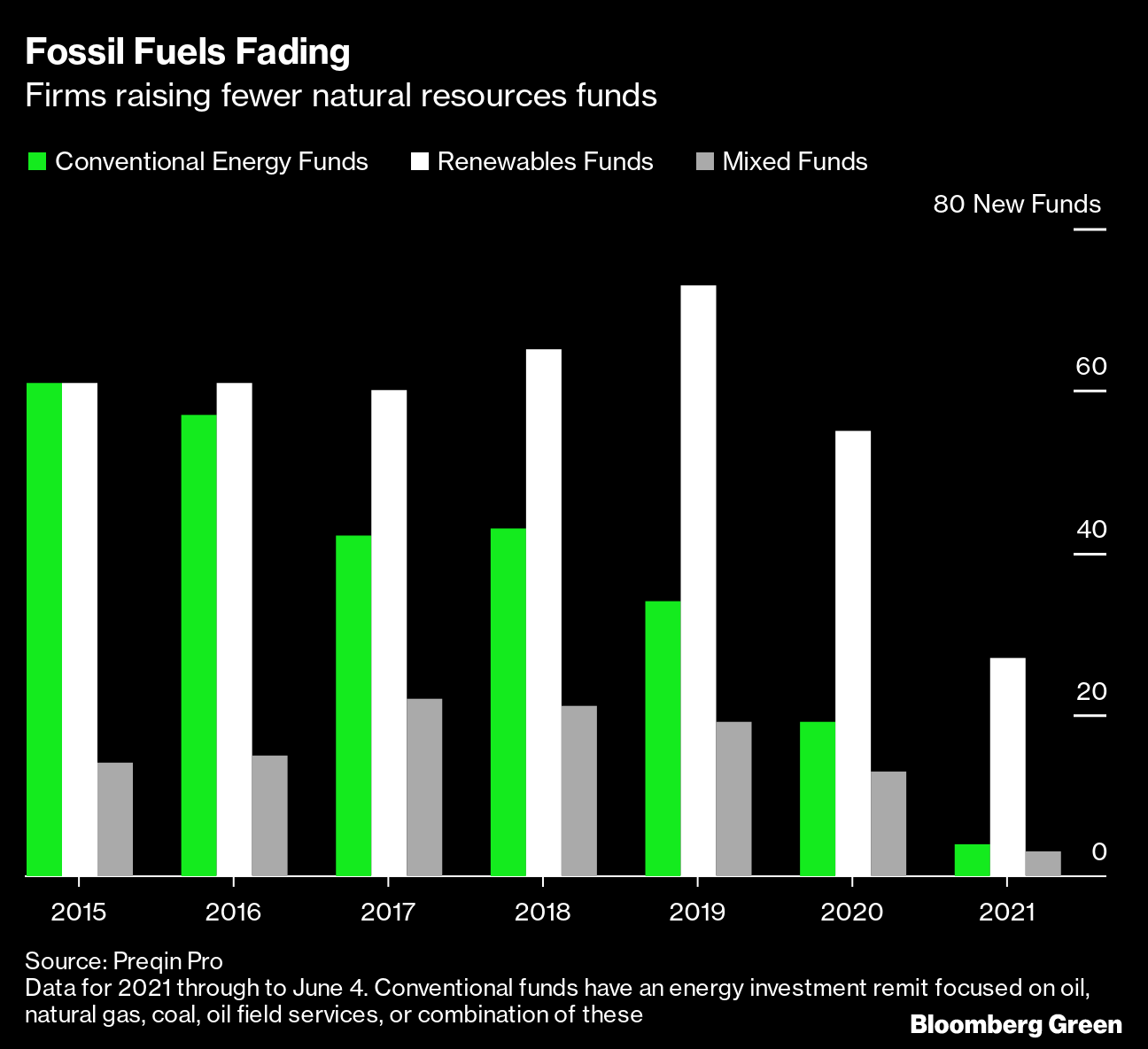

Private equity funds that invest solely in renewable energy assets raised about $52 billion last year—a record, according to Preqin, a data provider. On top of that, the money garnered so far this year for such funds is outpacing fossil fuel asset fundraising by a factor of roughly 25.

“The move towards ESG-focused investing is starting to starve the supply of capital to the conventional energy space,” said Dave Lowery, head of research insights at Preqin. Renewable energy funds raised $258 billion in the decade through 2020, representing about a third of the overall energy sector, he said. But the share of funds going towards renewable energy has increased significantly since 2016, and stands at about 80% so far in 2021, Preqin data show.

Read More: EnCap Turns Toward Clean Energy With New $1.2 Billion Fund

Blackstone, which has longstanding stakes in fossil fuel firms, has been among those to make a push for deals that focus on the transition to cleaner energy in both its private equity and credit business. Notable investments include energy-infrastructure company Sabre Industries Inc., energy storage provider Aypa Power, solar companies Loanpal LLC—now known as GoodLeap—and Altus Power America, and Therma Holdings, which provides energy-efficiency services.

Other private equity players—burned by the shale boom and bust and collapse in oil prices when Covid first hit—are making a similar push. Warburg Pincus is shifting away from fossil-fuel investments, which dragged on its portfolio; its next global buyout fund will instead invest in renewables and energy technology. Riverstone Holdings, one of the world’s biggest energy-focused private equity firms, is said to be increasing its exposure to more sustainable forms of energy, Bloomberg reported in March.

Likewise, investors have also cut back on their commitments to traditional oil and gas funds due to poor returns in the sector.

Fund managers now realize that investors want to see a shift to renewables, or at least a strategy for reducing emissions from dirty assets, said Will Jackson-Moore, head of Global Private Equity, Real Assets and Sovereign Investment Funds at PwC. “There is going to be significant amounts of money made and lost in the energy transition,” he said.

That shift forms part of a bigger story for a finance industry that’s steadily reassessing its investments in industries that contribute directly to climate change and other environmental and social problems. This year, for the first time, banks are on track to commit more financing to climate-friendly projects than oil, gas, and coal producers. U.S. President Joe Biden has attempted to put climate at the center of his agenda, as have lawmakers in Europe, where disclosure rules around ESG metrics are setting the global pace for change.

Read More: Biden Infrastructure Win Ramps Up Fight Over Economic Agenda

That’s not to say conventional energy investments by private equity funds will die out. Fossil fuels will remain a vital cog in the world’s economy for decades to come. KKR & Co. in early June announced plans to build a shale-oil acquisition vehicle with the $5.7 billion combination of two little-known explorers. The combined entity will vacuum up over-leveraged and stranded shale oil assets, Bloomberg reported. And U.S. crude prices are doing better this year, with oil closing above $75 last week for the first time since 2018.

Adding to that, one energy-focused manager said it’s hard to put money to work to generate private equity-like returns in renewables, with some projects still lacking the scale an investor might be looking for. Go back about a decade and renewables proved a poor bet, with U.S. and European solar panel manufacturers in particular collapsing amid a flood of cheap Chinese imports. The high-profile failures left a stigma around renewables, another manager said, whereas others thought the projects were too costly or dependent on government subsidies.

Still, older renewable-focused energy funds have managed to outperform conventional energy, though the performance advantage looks to have reduced over time, according to data compiled by Preqin. For instance, the median net internal rate of return for conventional energy funds that started investing in 2010 was a loss of 5.6% since inception through March 2021, while renewable-focused funds from the same period gained 8%. For the 2018 vintage of these funds, the most recent meaningful data available, the median gains since inception were 13% and 8%, respectively.

“Renewable-focused funds closed early in the period between 2010 and 2018 were able to significantly outperform conventional energy-focused funds,” said Lowery. “This suggests that it may have become harder to deliver outperformance as the asset class has grown in both popularity and size, and returns appear to be converging.”

Private equity remains a significant investor in the energy sector, completing $261 billion of deals since 2017, around 20% of total transactions, according to data compiled by Bloomberg. U.S. renewable energy investments by private equity firms topped $23 billion in 2020, the largest annual amount to date, according to the American Investment Council.

Read More: Shadow Lenders Pile Into U.S. Energy Debt After Bank Retreat

Unlike a mutual fund owner, who typically holds a tiny percentage in hundreds of publicly listed stocks, a buyout fund can drive change through control over management and board appointees. That’s important because with capital usually locked up for a decade both managers and investors need to consider how regulation and environmental changes will crimp operating profits and impact the value of any asset over that time.

The fear of being stuck holding an unsellable asset is one reason some managers won’t touch anything that doesn’t meet ESG metrics. “One of the critical questions we have is who will buy this business in five years’ time,” said Philippe Poletti, head of the buyout team at private-equity firm Ardian. “If we don’t find strategic players who could be interested in buying it, we will not do a deal.”

That’s just one of the lessons learned from back-to-back oil busts. “Energy companies have lost a lot of money, they’ve been very poor stewards of capital,” said Wil VanLoh, founder and chief executive officer of Houston-based Quantum Energy Partners.

Quantum is raising a new fund that will dedicate as much as 30% of its investments to the energy transition and decarbonization, according to a person with knowledge of the matter.

VanLoh declined to comment on the firm’s fundraise but said that many investors have “soured” on the fossil fuel space not just out of concern for the future, but also because of its checkered past. “Quite frankly,” he said, “they left it.”

(Updates eighth paragraph to reflect that Loanpal has changed its name to GoodLeap.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.