Goldman Money Managers Like New ESG Fund So Much They’re Buyers

(Bloomberg) -- Goldman Sachs Asset Management will debut a new ESG-friendly exchange-traded fund Thursday, one it likes so much that it’s pledging to put its own money in.

The New York-based firm will invest its capital in the Goldman Sachs Future Planet Equity ETF (ticker GSFP), according to Mike Crinieri, GSAM’s global head of ETFs. That’s an “unusual” move for the asset manager, which expects to see the fund grow significantly within days, he said.

The product is GSAM’s first transparent, actively managed ETF and it will invest in companies seeking solutions to environmental problems in clean energy, resource efficiency, sustainable consumption, the circular economy and water sustainability, according to a statement. It’ll be run using bottom-up security selection and carries a 0.75% fee.

“We do believe that we are on the cusp of a sustainability revolution that could have the scale of the industrial revolution and the speed of the digital revolution,” Katie Koch, co-head of fundamental equity, said on a call with reporters.

GSFP reflects arguably the two hottest trends in the $6.6 trillion U.S. ETF industry right now: surging demand for products that meet higher environmental, social or governance standards and a boom in actively managed funds.

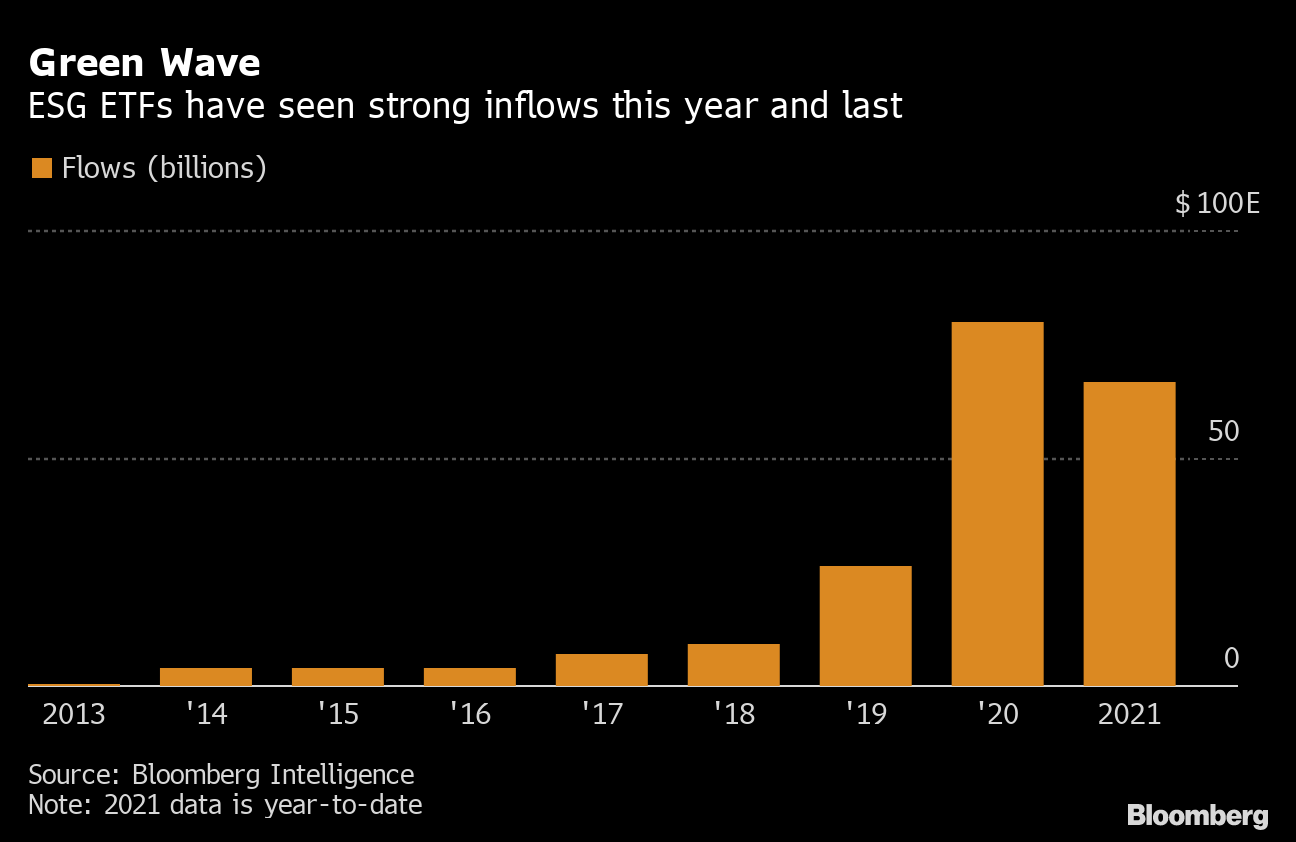

With just 4% market share, active ETFs remain a tiny part of the industry but are launching at more than double the rate than passive funds so far in 2021. Meanwhile, ESG-focused products have lured more than $66 billion in flows year-to-date, on course for a record alongside the broader ETF market.

Read more: Wall Street Surrenders to the $500 Billion ETF Rush

GSAM has about $22 billion in ETFs overall, according to Bloomberg Intelligence data. About $19 billion is in thematic equity funds, the statement said. Around $467 million is in the Goldman Sachs Innovate Equity ETF (GINN), an index-following fund that is up more than 10% this year.

“Traditional benchmarks are very backward-looking — by definition they’re allocating capital to the companies and themes that have worked well in the past,” Koch said. “That ends up with clients being short innovation.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.