Why It’s So Hard for the Solar Industry to Quit Xinjiang

(Bloomberg) -- (This story was originally published on Feb. 11. The U.S. House passed legislation Wednesday to punish China for its treatment of Uyghur Muslims.)

Chinese solar companies are among 175 around the world that signed a non-binding pledge by a U.S. trade group to avoid forced labor. It will be much harder for them to actually cut ties with Xinjiang, the western China region facing increasing scrutiny for human-rights abuses.

The pledge from the Solar Energy Industries Association, a U.S. trade group, doesn’t specifically mention Xinjiang. That region in Western China plays a dominant role in global solar supply chain, and it's also become the center of widespread accusations that President Xi Jinping’s government is systematically oppressing Muslim Uyghurs. An accompanying press release, however, calls on the pledge’s signatories to quit the territory over evidence of forced labor.

The move sheds light on a dirty secret of the solar industry: it relies on Xinjiang and its cheap coal power to produce half of its key raw material. And with demand for panels set to explode as the U.S. and China commit to more clean power, it will be even harder for the industry to quit the troubled region.

“Political pressure is building up within the industry to reconsider the supply chain,” said Johannes Bernreuter, head of polysilicon market intelligence firm Bernreuter Research. “It’s hard to have a supply chain right now without Xinjiang.”

About 45% of the world’s supply of solar-grade polysilicon comes from Xinjiang, according to Bernreuter. That’s the base material for solar power used around the world. The conductive metal is shaped into bricks, sliced into razor-thin wafers, wired into cells and pieced together into the large panels that are installed on rooftops and large fields.

Polysilicon starts off as grains of sand — one part silicon to two parts oxygen — that are turned into silicon metal at industrial furnaces. The refining process that makes the material conductive enough to generate electricity is where solar companies and their investors are concerned forced labor may be used.

Polysilicon makers take the 99% pure silicon metal and remove impurities until it is 99.9999% pure. The process most commonly used to do that includes highly corrosive chemicals and heat above 1,000 degrees Celsius.

That level of heat is why Xinjiang is so important. Electricity accounts for about 40% of operating costs, and Xinjiang has some of the cheapest power in China thanks to an abundance of coal. The region's reliance on the dirtiest fossil fuel also means that carbon emissions are generated in the process of making solar panels that use its polysilicon.

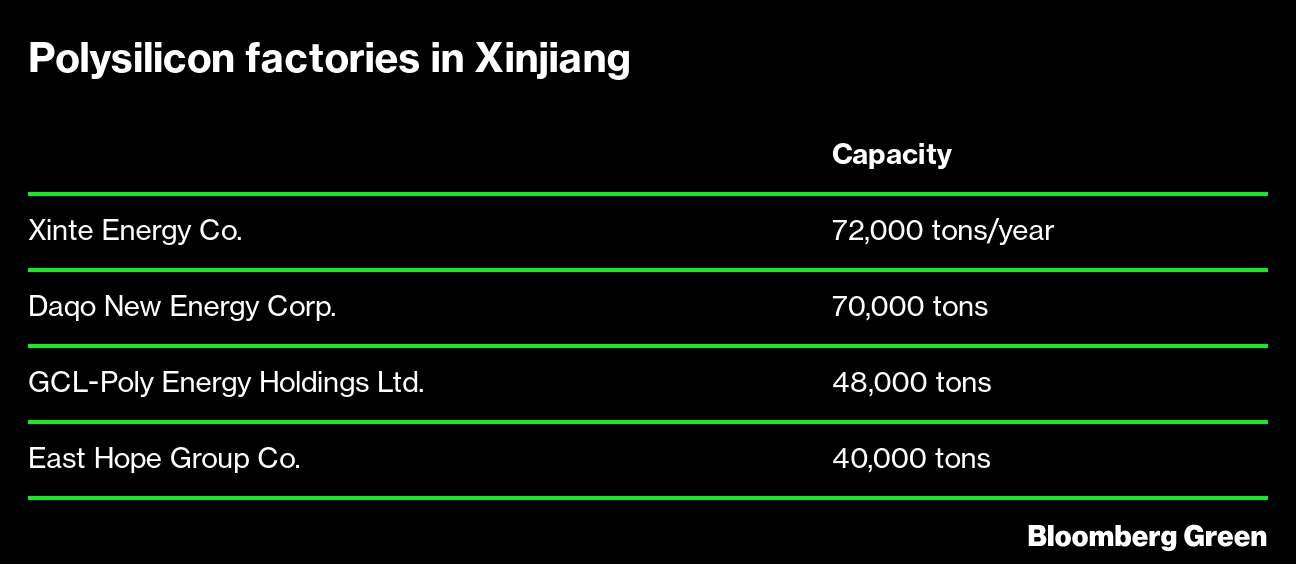

Units of massive Chinese solar manufacturers Longi Green Energy Technology Co., JA Solar Technology Co. and JinkoSolar Holding Co. all signed the pledge, and all have polysilicon contracts with Xinjiang-based manufacturers. Four of the world’s five biggest solar polysilicon factories are in the region, according to clean energy research group BloombergNEF.

“It’s a complete lie to say ‘forced labor’ exists in Xinjiang and the purpose of the lie is to limit and suppress the development of China and Chinese companies,” the foreign ministry said in response to questions from Bloomberg.

Longi, JA Solar, Jinko, GCL-Poly, Xinte, East Hope and Daqo New Energy did not respond to questions. In a Jan. 15 press release, Daqo said it has a "zero-tolerance policy" toward forced labor in its own facilities and across its supply chain, and is based in Xinjiang because of access to materials and energy.

“The biggest driver for setting production in Xinjiang is the cheap power,” said Yali Jiang, an analyst with BNEF. Rates can be as low as 0.22 yuan ($0.03) per kilowatt-hour, compared with 0.6 to 0.7 yuan in central China, she said.

Tariffs may have also played a role, as China adopted anti-dumping charges of as much as 57% for imports from some U.S. and South Korean companies starting in 2013, in retaliation for U.S. solar panel tariffs the year before. In 2012, China accounted for 23% of global polysilicon production, according to BNEF. That rose to 66% by 2019.

“After the duties were imposed, polysilicon production in China took off,” Bernreuter said.

As Xinjiang was growing in importance to the solar industry, it became the center of international controversy. Human rights activists have accused the Chinese government of using internment camps and forced labor on ethnic Uyghur Muslims, along with other minorities there.

The U.S. government stepped up pressure last month, barring entry of all cotton products and tomatoes from the region on grounds of “modern slavery.” China said the U.S. decision violated trade rules.

Investors certainly haven’t shied away. Since Xi announced China’s carbon-neutrality plans in September, GCL’s shares in Hong Kong are up more than 1,100%, while Xinte is up 460% and Daqo has gained 440% in New York.

With China seen setting new solar power records and Joe Biden bringing a clean energy zeal back to the U.S., polysilicon factories will need to go all out to produce enough material to meet global demand. The sector could be a bottleneck for solar panel production this year, BOCI Research Ltd. analyst Tony Fei said in a research note last month.

With a tight supply of polysilicon, other companies won’t be able to refuse supplies from Xinjiang. If there's greater scrutiny, suppliers in the territory may move to ensure products using their material are used mainly within China or exported to countries outside of the U.S. and Europe, Berneuter said.

“That’s the big question mark, how do you trace the supply chain?” he said. “It’s going to be very difficult.”

(Repeats story published Feb. 11, 2021. )

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More renewables news

GE Vernova Expects More Trouble for Struggling Offshore Wind Industry

Climate Tech Funds See Cash Pile Rise to $86 Billion as Investing Slows

GE Vernova to Power City-Sized Data Centers With Gas as AI Demand Soars

Longi Delays Solar Module Plant in China as Sector Struggles

Australia Picks BP, Neoen Projects in Biggest Renewables Tender

SSE Plans £22 Billion Investment to Bolster Scotland’s Grid

A Booming and Coal-Heavy Steel Sector Risks India’s Green Goals

bp and JERA join forces to create global offshore wind joint venture

Blackstone’s Data-Center Ambitions School a City on AI Power Strains