Oil Hits $65 as Geopolitical Risks Swirl From Iran to Black Sea

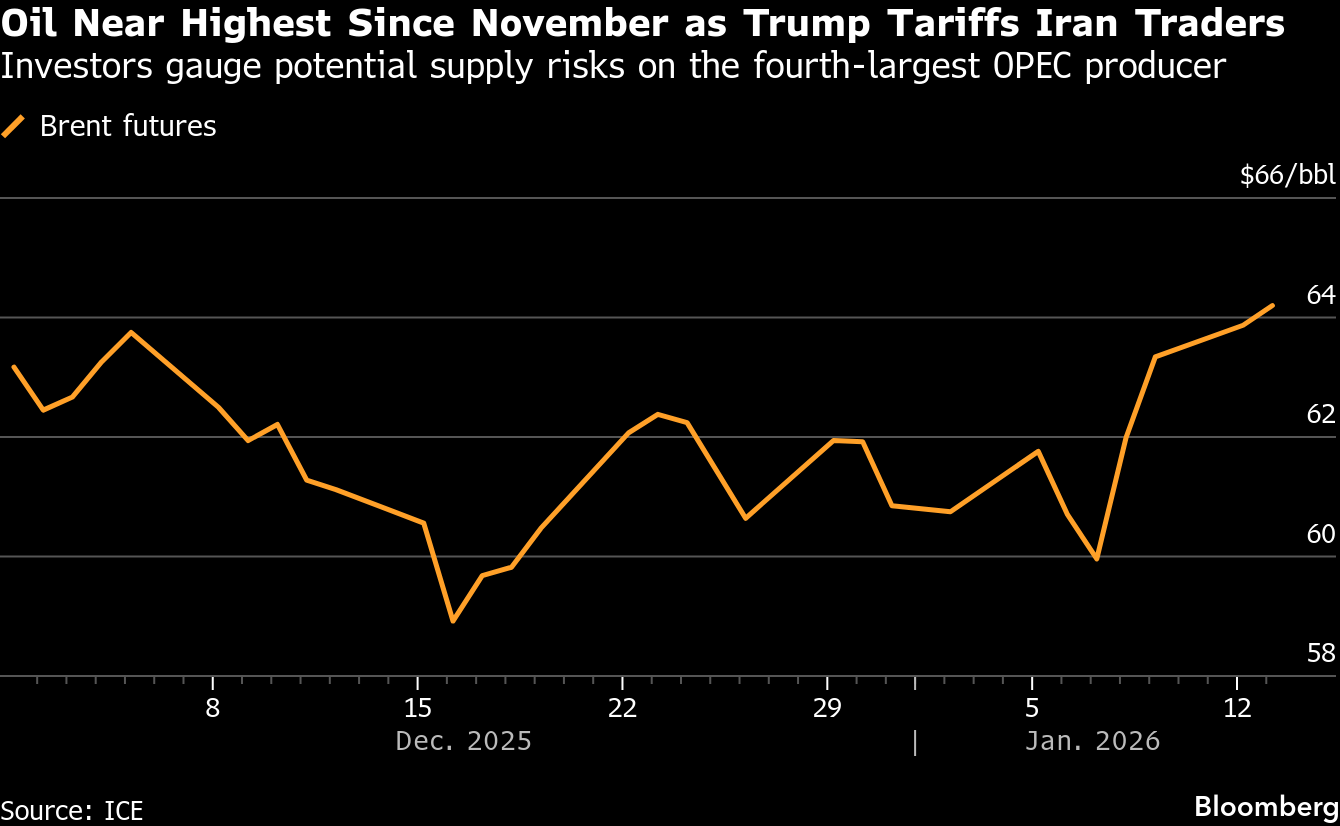

(Bloomberg) -- Oil briefly rose above $65 a barrel for the first time since November after the US escalated pressure on Iran, while tankers were attacked near a vital terminal for Kazakh crude on Russia’s Black Sea coast.

Brent futures extended gains of more than 6% over the previous three sessions. President Donald Trump announced a 25% tariff on goods from countries “doing business” with Iran and has not ruled out military strikes on the Persian Gulf state, just days after a stunning move to take control of Venezuelan oil production.

Meanwhile, the biggest source of crude supply disruption has been at the Caspian Pipeline Consortium terminal that loads Kazakh oil into tankers, with a combination of bad weather, drone attacks and maintenance threatening exports. On Tuesday, two vessels were struck near the facility, underscoring fresh risks to supply, with loadings already revised down by almost half to around 900,000 barrels a day.

“Geopolitical risk is at an all-time high,” Jeff Currie, chief strategy office of energy pathways at Carlyle, said in a Bloomberg television interview. “That’s a recipe for a spike in prices now.”

The risk of a surge is also showing up in options markets where traders are demanding the biggest premiums for bullish contracts since Israel and the US launched airstrikes on Iran last year. A record volume of bullish Brent call options changed hands on Monday, in part led by large wagers on higher prices.

Oil has gained ground in the early new year period, following a run of five monthly losses spurred by expectations for a glut. The climb has come amid US intervention in Venezuela, with Washington’s capture of leader Nicolás Maduro, followed by the worsening wave of unrest in Iran. The rally caught an oil market that was steeped with bearish bets off guard.

While, authorities in Tehran have said they have now quelled the protests, the unrest appears to be persisting and an activist group warned that the civilian death toll could be in the thousands.

The possibility of a disruption to Iran’s daily exports, which account for just under 2% of global demand, has tempered some of the concerns over the global glut.

“Regime change in Iran could ultimately amplify the downtrend in crude markets as the strong supply picture still holds,” said Florence Schmit, an analyst at Rabobank. “But there are is a potential for another rally before that if the unrest - directly or indirectly - targets energy flows.”

©2026 Bloomberg L.P.