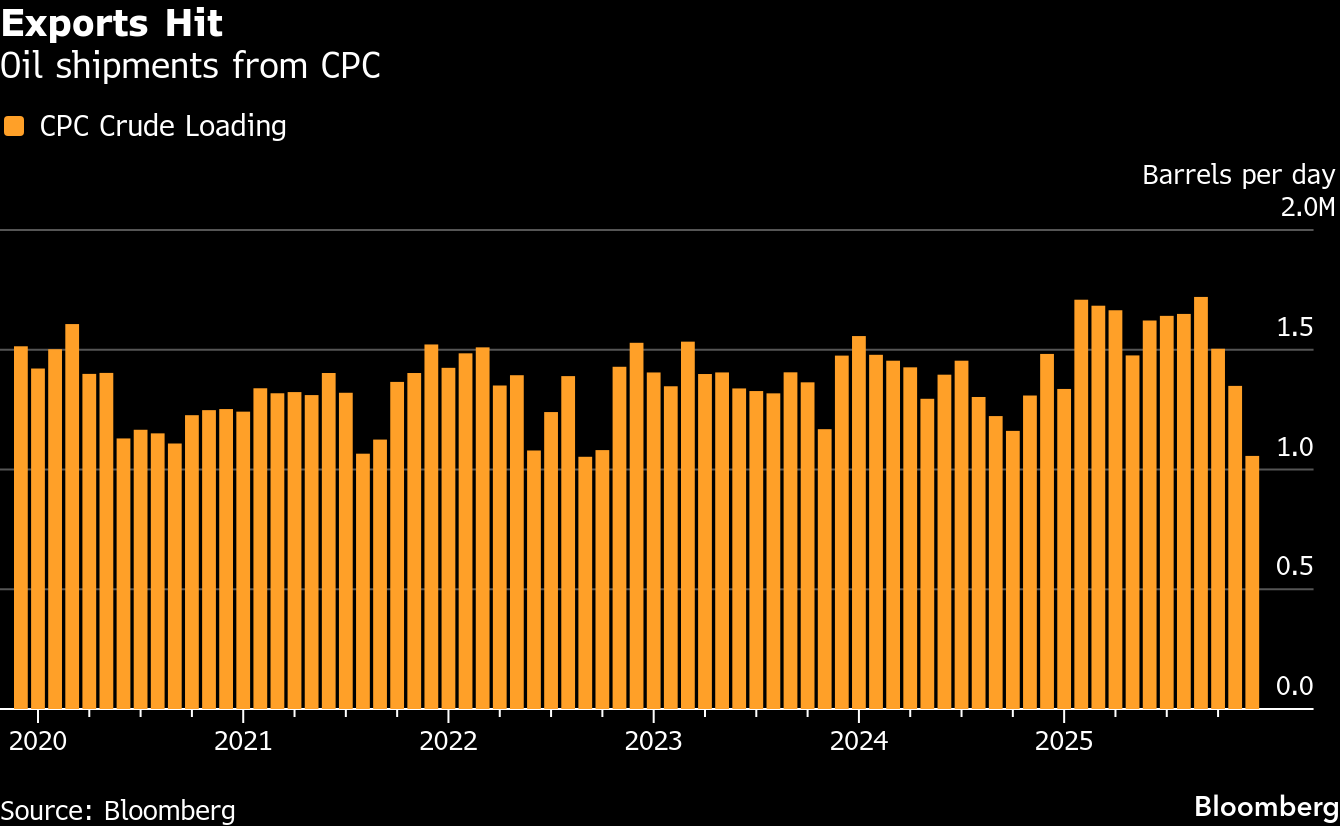

Kazakh Oil Shipments Slashed Again as Key Port Is Disrupted

(Bloomberg) -- Kazakh crude exports from a key port in the Black Sea were slashed again as bad weather, maintenance and drone damage cut the nation’s loadings, bolstering a closely-watched oil price gauge.

Caspian CPC Blend shipments will now be between 800,000 to 900,000 barrels a day this month, around 45% below the loadings that were anticipated in mid-December, traders who monitor cargo loading said. Prices for the barrels surged and the difference between the nearest two benchmark Brent futures contracts hit the biggest in about six weeks, a move that indicates tighter European supplies.

Much of the crude market’s attention this year has been focused on Venezuela — where the oil-producing country’s president was captured by US forces — and unrest in Iran. However, disruption at CPC has had a more tangible impact on supply, impeding Kazakhstan’s ability to pump oil because the country is unable to export all the barrels it pumps via other routes. It’s also reducing an oversupply in the market in the short-term.

“Continued disruption to the CPC terminal has helped sustain bullish prompt Brent timespread flows,” Energy Aspects analysts Christian Scott-Mcwall, Craig Marsh and Nick Stadtmiller wrote in a note to clients.

CPC handles the vast majority of Kazakhstan’s shipments plus a small amount of Russian supply. For Kazakh-origin oil, a total of at least 21 cargoes have been canceled from the 45 shipments originally scheduled.

The reductions follow persistent disruption at the terminal.

Bad weather has repeatedly halted operations over the past few weeks, delaying the return of a second mooring from maintenance and leaving just one facility working intermittently. Another mooring was damaged by drones in late November — an act that Kazakhstan blamed on Ukraine — something Kyiv did not deny. Kazakhstan needs two operational CPC moorings to maintain full production levels, with the third acting as backup.

The CPC pipe system has stopped once again receiving oil because of how full its storage tanks have gotten, the people said.

Kazakhstan pumped about 1.8 million barrels a day last year, according to secondary source data compiled by the Organization of the Petroleum Exporting Countries. The nation’s capacity to consume and to export via routes other than CPC comes to about half that amount, meaning that protracted curbs can hit output.

The disruption tightened availability of CPC Blend crude, pushing differentials into positive territory for the first time over a year, traders said. One such cargo recently traded at a premium of as much as $1.20 a barrel to Dated Brent, while most discussions were at 60 to 80 cents above the benchmark.

It also bolstered premiums for European crude over barrels from the Middle East. The gap between Brent and Dubai prices — known by traders as the EFS — hit $1.55 a barrel on Monday, according to data from PVM Oil Associates Ltd. That would be the biggest close since July.

CPC declined to comment.

About 90% of CPC volumes typically originate in Kazakhstan. Russian barrels usually account for roughly 150,000 barrels a day, though those flows have dropped sharply since drone attacks damaged Lukoil facilities in the Caspian Sea.

(Updates with prices in second and tenth paragraphs.)

©2026 Bloomberg L.P.