Asian Stocks Hit Record on Tech Rally, Yen Gains: Markets Wrap

(Bloomberg) -- Asia’s tech-led rally pushed equities to new highs after strong earnings from a chip bellwether eased worries about overheating in the artificial intelligence sector and encouraged investors to add bets.

The MSCI Asia Pacific Index climbed 0.3% on Friday to a record and was set for a fourth weekly gain. A regional gauge of technology shares and South Korea’s benchmark index — a poster-child for the AI theme — also hit all-time highs as Taiwan Semiconductor Manufacturing Co. rose to its highest ever after blowout results.

The optimism looks set to continue as futures for Nasdaq 100 Index rose 0.3%. Elsewhere, the yen gained 0.3% against the dollar after Japan’s finance minister said she’s concerned about the currency’s weakness. Oil steadied after its biggest decline since June, while gold and silver edged lower.

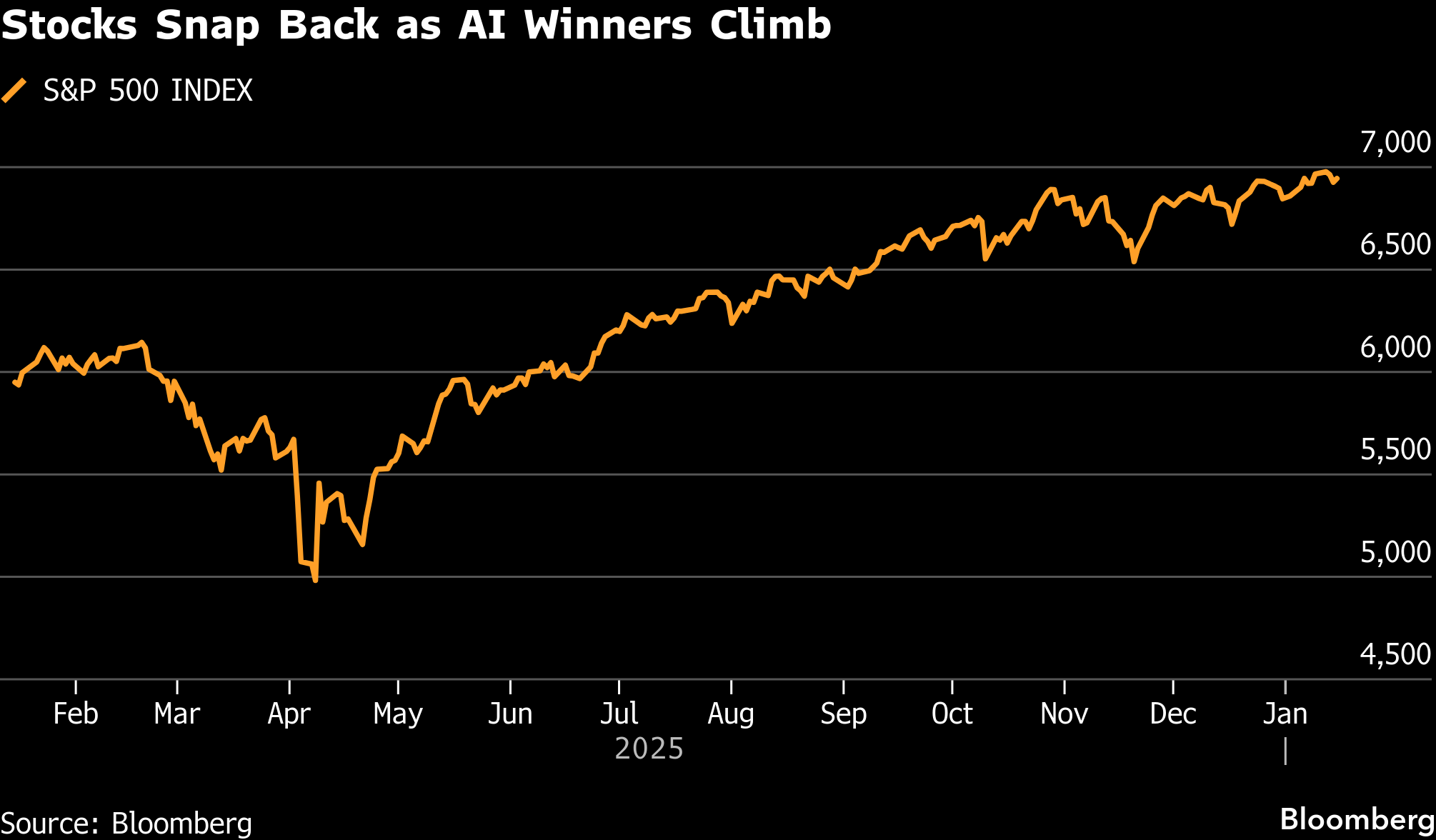

Stocks pushed higher as confidence in the durability of the tech rally, a key bull-market driver, strengthened following concerns over stretched valuations and heavy investment. Equities have rebounded from April lows as Federal Reserve interest-rate cuts and optimism around AI-supported earnings lifted sentiment.

“Technology stocks had looked vulnerable in recent weeks as investors rotated away from megacap names and into more cyclical areas of the market,” said Fawad Razaqzada at Forex.com. “TSMC’s update, though, appears to have stabilized that ‘rotation’ rather than reversed it outright.”

As Asian shares keep rising, a key relationship they have with currencies is flashing a signal for global funds to rethink their investment strategy in the region.

The 30-day correlation between the MSCI Asia Pacific Index and the Bloomberg Asia Dollar Index — which typically move in lockstep — has dipped below zero for the first time since September 2024.

In other corners of the market, Treasuries were little changed in Asia after falling in US trading when jobless claims unexpectedly dropped to the lowest since November.

The 10-year’s yield is headed for a fifth straight week of minimal change, rivaling its longest stretch of inertia in the past two decades.

The trend — a function primarily of expected stability in US monetary policy — is stoking anxiety among bond-market investors because previous instances of constricted yield ranges have been followed by selloffs.

Traders will also be watching the rising tensions in the Middle East after Fox News reported that at least one US aircraft carrier is moving to the region. US military planners are preparing a range of options depending on the actions of the Iranian government in the next few days, Fox reported.

Separately, the US and Taiwan agreed to a long-sought trade pact that would lower tariffs on goods from the self-governed island to 15% and see Taiwanese semiconductor companies increase financing for American operations by $500 billion.

What Bloomberg strategists say...

The yen received a fresh dose of protection against the potential for a snap election to spur further declines, as Tokyo ratcheted up jawboning efforts. A move above 160 seems inevitable in the coming weeks should Prime Minister Sanae Takaichi call a vote and gain an increased majority.

— Garfield Reynolds, MLIV Team Leader. For full analysis, click here.

In Asia, focus is also on Japan, where central bank officials are closely watching the yen’s potential influence on inflation.

Most Bank of Japan watchers judge that Governor Kazuo Ueda and his colleagues have been slow in ratcheting up interest rates, and expect the next move still to be several months away in their base case scenarios.

Traders are also parsing capital flows in and out of Japan Friday as the yen inches toward the 160-per-dollar mark.

Official intervention to strengthen the currency is a topic of discussion among market participants as the yen trades near a one-and-a-half-year low. The yen was a touch stronger at 158.40 against the dollar on Friday.

“We have obviously previously seen Japan intervene above the 160 level and as we get closer to that, I think that becomes a possibility,” said Divya Devesh, co-head of FX research for Asean and South Asia at Standard Chartered. “It is an unstable equilibrium,” he said of Japan’s macro backdrop.

Corporate Highlights:

- Mitsubishi Corp. agreed to buy Aethon Energy Management LLC’s US gas and pipeline assets for $5.2 billion, the biggest purchase by a Japanese company in the American shale sector.

- Goldman Sachs is set to raise $16 billion with the largest investment-grade bond sale ever from a Wall Street bank.

- China Vanke Co.’s bonds extended their rally, a day after the distressed developer unveiled sweetened proposals to extend payments on some notes.

- Ford Motor Co. is in talks with China’s BYD Co. about potentially supplying batteries for hybrid vehicles to the American automaker’s overseas factories.

- Walmart Inc. said Kathryn McLay, chief executive officer of the company’s international business, is stepping down.

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 1:03 p.m. Tokyo time

- Japan’s Topix fell 0.4%

- Australia’s S&P/ASX 200 rose 0.4%

- Hong Kong’s Hang Seng fell 0.3%

- The Shanghai Composite fell 0.2%

- Euro Stoxx 50 futures fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1613

- The Japanese yen rose 0.3% to 158.13 per dollar

- The offshore yuan was little changed at 6.9649 per dollar

Cryptocurrencies

- Bitcoin fell 0.2% to $95,313.14

- Ether fell 0.2% to $3,292.23

Bonds

- The yield on 10-year Treasuries was little changed at 4.17%

- Japan’s 10-year yield advanced 2.5 basis points to 2.185%

- Australia’s 10-year yield advanced three basis points to 4.71%

Commodities

- West Texas Intermediate crude fell 0.2% to $59.06 a barrel

- Spot gold fell 0.4% to $4,597.23 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2026 Bloomberg L.P.