A Trader’s Guide to Venezuela as Trump Eyes Its Oil

(Bloomberg) -- President Donald Trump is targeting billions of dollars of investment from US energy companies in Venezuela’s oil industry, and said it will make the people of the South American nation rich.

For investors hoping to get in on the bonanza, however, the calculus isn’t so simple. And the list of risks is a long one.

At the top are questions about how long it will take — and how much it will cost — to boost energy production significantly, and how enthusiastic oil executives will be to make the necessary investments. And the timeline will likely extend well past Trump’s tenure in the White House, raising concerns about whether the political will shall remain both in the US and Venezuela to see his plans reach fruition.

Then there is the basic fundamental outlook for a petroleum market that arguably is already over-supplied.

“Right now, global capital spending in oil is declining because supply is abundant and demand is lower than expected,” said Edward Morse, adviser to Hartree Partners and former global head of commodities research at Citigroup Inc. “Venezuela is trying to reopen during a down cycle rather than an up cycle.”

On the back of it all rides a slew of ancillary investment themes outside the oil patch — from other commodity markets to bonds and foreign exchange — each with its own set of risks.

Below is a guide to how investors are approaching the sudden opportunity set created by Trump’s decision to topple Nicolás Maduro, the longtime leader of Venezuela, and lay claim to what is purported to be the world’s largest oil reserves.

Betting on Oil

Trump’s vision includes encouraging US companies to rebuild Venezuela’s deteriorated oil infrastructure and revive production. For starters, Trump said Tuesday that Venezuela would relinquish as much as 50 million barrels of oil for the US to sell, valued at roughly $3 billion at current prices.

In the longer term, the president’s hope is that US companies will rebuild an oil-production infrastructure that’s in tatters after years of underinvestment, corruption and mismanagement under Maduro and his predecessor, Hugo Chávez, a period that also saw some foreign oil producers pushed out, all resulting in a precipitous decline in crude output.

Chevron Corp. is currently the only major US producer still operating in Venezuela, so it naturally has a head-start if Trump can deliver on his goal. The company could grow its cash flow by as much as $700 million annually if Venezuela production gets back to previous levels, according to Jason Gabelman, an analyst at TD Cowen.

Exxon Mobil Corp. and ConocoPhillips previously operated in the country but left in the early 2000s. Their assets were seized and ConocoPhillips is owed more than $8 billion awarded following arbitration with Venezuela, while Exxon is owed around $1 billion.

Any hope that a new regime in Venezuela could aid in recovery of those funds dimmed on Friday, when Trump said the US would not consider the prior losses suffered by companies.

That complicates prospects for a turnaround in the industry that was already expected to be expensive and lengthy. Experts believe that restoring Venezuela to its former glory as an energy producer could cost as much as $100 billion over the next decade.

US oil executives expressed caution in a meeting with Trump on Friday, with the head of Exxon Mobil Corp. calling the nation currently “uninvestable.”

And with oil prices currently in the neighborhood of $60 a barrel, some investors are skeptical the needed capital will be there.

“The price of oil has to go a lot higher to incentivize people to go out and provide more capital,” said Cole Smead, CEO and president of Smead Capital Management. “They’re not going to do that unless they get paid a very attractive return, because it has to be more attractive than AI. This just isn’t that attractive.”

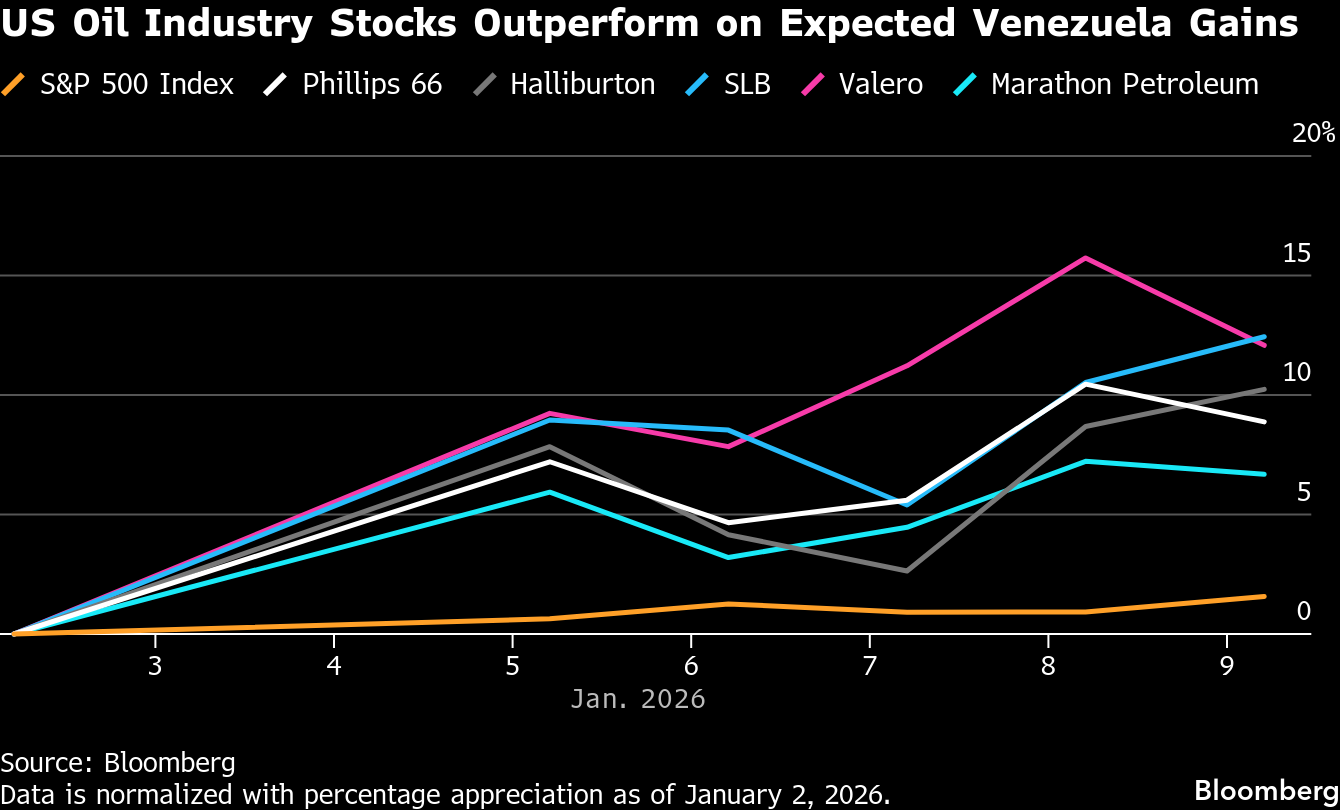

Still, should progress be made in lining up the needed investments as well as the necessary legal and security guarantees, oilfield services companies such as Baker Hughes Co., Halliburton Co. and Weatherford International Plc are a major area to watch.

Refining Capacity

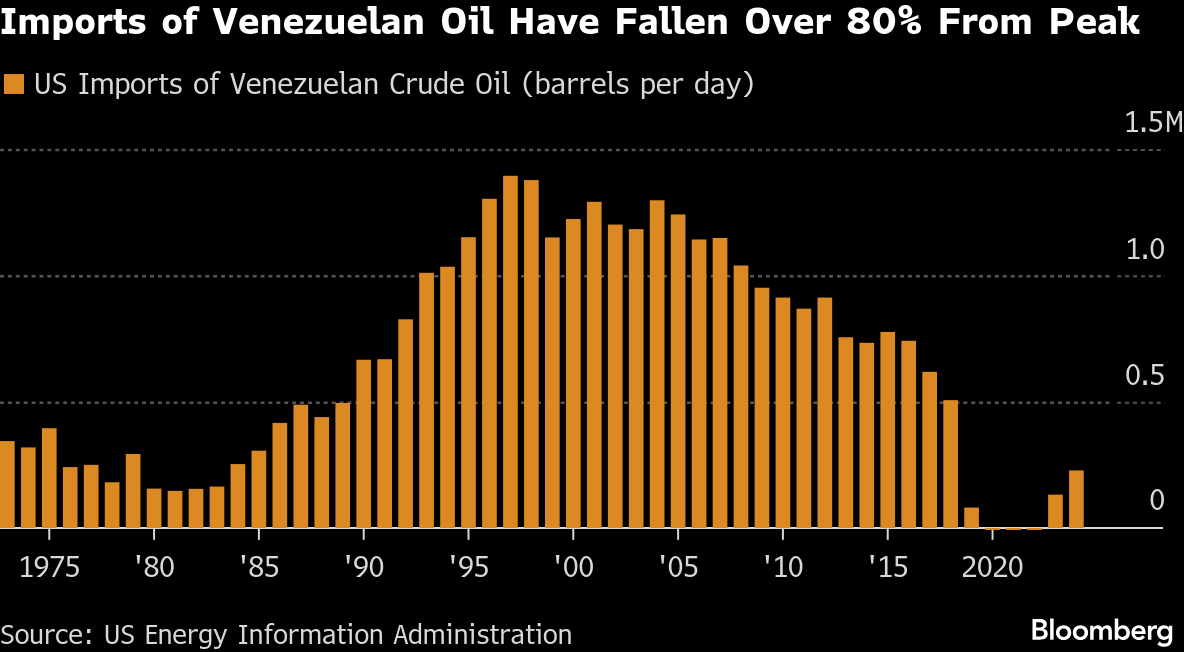

One of the most intriguing opportunities involves who will refine Venezuela’s heavy crude, and investors have already pushed shares of some US refiners higher. About 140 million barrels of Venezuelan crude ran through US refiners in 2025, accounting for 0.8% of total US throughput, according to Tudor Pickering Holt & Co. Greater flows into the US would favor complex refiners such as Valero Energy Corp. and PBF Energy Inc., according to Bloomberg Intelligence.

Venezuela’s heavy crude also requires imported diluent to be produced and transported, creating potential upside for companies like Phillips 66.

Investors also should watch tanker owners such as DHT Holdings Inc. and Frontline Plc., according to Dwight Anderson, managing partner at Ospraie Management, a hedge fund that invests in commodities and derivatives. The potential for Chevron to charter compliant vessels to replace the shadow fleet used to skirt US sanctions could benefit legitimate operators, he added.

Risks for Canadian Oil

Risks abound for Canadian oil producers. The country exports the majority of its crude to the US, and Venezuela produces a similar type of oil.

“Light-heavy spreads could widen, which would hurt the Canadian oil sands sector, especially less integrated names,” Hedgeye Risk Management analyst Fernando Valle wrote in a note, referring to the difference in prices between different varieties of oil.

Valle expects that Imperial Oil Ltd. and Cenovus Energy Inc. will be more affected than Suncor Energy Inc. or Canadian Natural Resources Ltd.

Mining Resources

It’s not all about oil. Venezuela has some of the largest gold deposits in the Western Hemisphere, as well as bauxite, coltan, coal, copper and iron ore. Companies that may be interested in mining these minerals include Glencore Plc, Rio Tinto Plc and Alcoa Corp., according to Ospraie’s Anderson.

Yet investors looking to turn a quick profit may be disappointed. Venezuela’s mining industry lacks recent data and some mines have been taken over by criminal cartels, among other problems.

“The issue is that the infrastructure is in such a terrible shape that it would take years to fix it, so it’s probably a 2028-2030 time horizon,” Anderson said.

Rebuilding Infrastructure

Infrastructure is viewed as an early but long-term opportunity for equity investors with patience.

“History shows post-crisis stories in Iraq, post-peace Colombia, or post-apartheid South Africa took years before local markets really rewarded equity investors,” said Oscar Decotelli, founder and chairman of DXA Group, an investment firm operating in Latin America and the US.

Decotelli favors high-quality regional energy, infrastructure and real-asset companies with indirect exposure to Venezuela, treating direct investments as long-dated options rather than core holdings. He pointed to Equinix Inc. as a beneficiary of a potential increase in digital infrastructure spending, as well as Latin American utilities and logistics firms such as Centrais Elétricas Brasileiras SA, Equatorial SA, and Rumo SA.

“It’s not about rushing into Venezuela,” he said. “It’s about positioning around Venezuela.”

Defense Spending

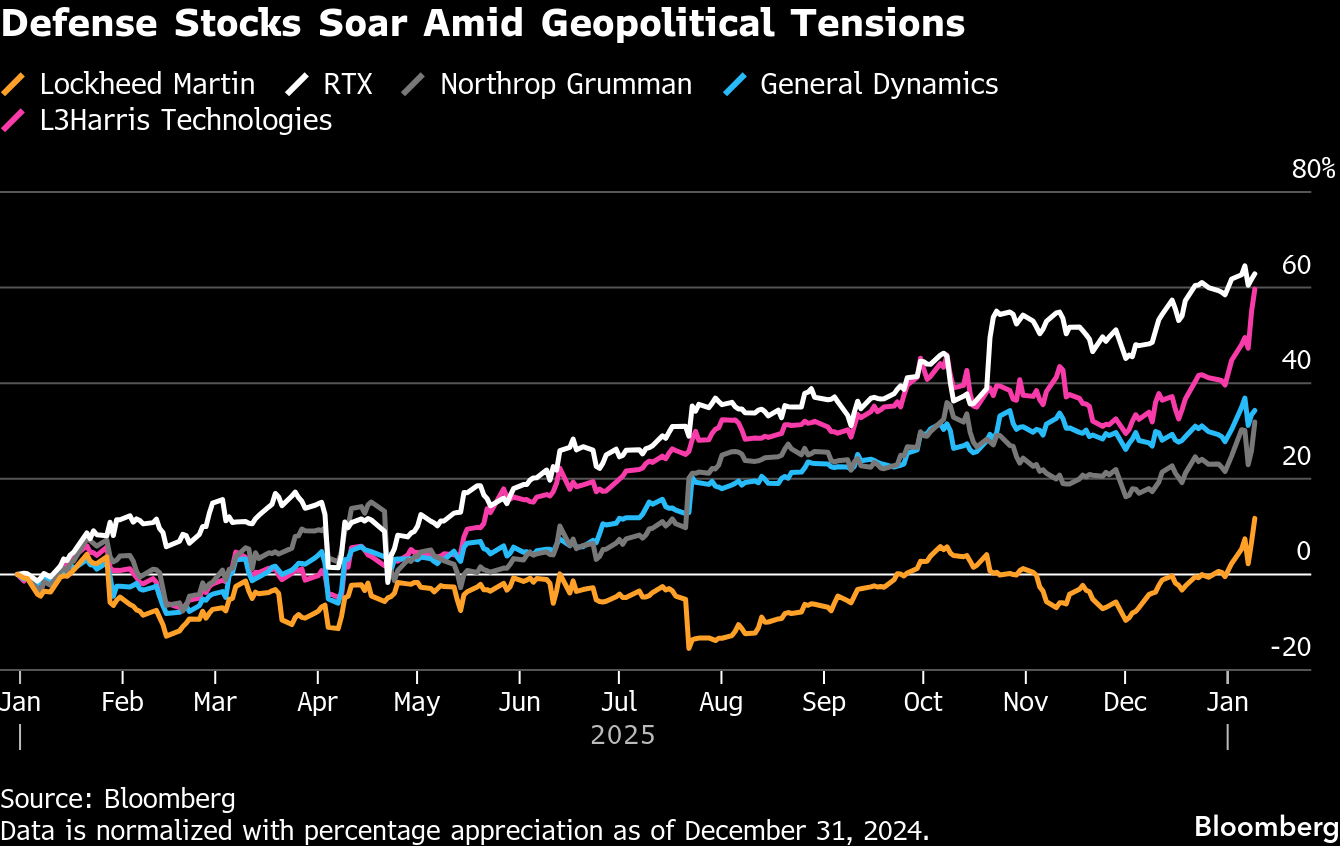

Heightened geopolitical uncertainty following Maduro’s capture as well as Trump’s push to increase the US military budget has fueled a global rally in defense companies. Lockheed Martin Corp., RTX Corp., Northrop Grumman Corp., Elbit Systems Ltd. and General Dynamics Corp. could be beneficiaries, wrote David Miller, chief investment officer at Catalyst Funds.

Food Exports

While Venezuela is a relatively small agricultural market for US exporters, some investors are weighing opportunities across global food producers and Latin American agribusiness companies if Venezuela’s economy recovers. Decotelli pointed to stocks like Bunge Global SA and Archer-Daniels-Midland Co. as beneficiaries from shifts in regional trade.

Venezuela’s Bonds

Maduro’s removal has turbocharged a rally in the $60 billion pile of defaulted debt from Venezuela and its state oil company. Some investors who bought the notes for pennies on the dollar in recent years are taking profits, with average prices hovering around 30 cents. Still, higher recovery values could be in store as part of an eventual debt restructuring.

“They’re going to run it hot,” said Ray Zucaro, chief investment officer at RVX Asset Management. “They want to get everything back online. I don’t think that’s bad for the finances on Venezuela.”

Veteran emerging-markets investor Mark Mobius said bonds linked to Venezuela’s oil assets offer the most compelling opportunity for foreign investors interested in the country. Securities associated with Petroleos de Venezuela S.A. and Citgo Petroleum Corp., the US-based refiner partly owned by Venezuela’s state oil company, stand out as particularly attractive, he said.

Macro Outlook

Zooming out beyond Venezuela, the shakeup presents implications even for macro-oriented investors.

For one thing, the uptick in geopolitical uncertainty could fuel bullish options bets on the US dollar, noted Wells Fargo strategist Aroop Chatterjee.

And should Trump succeed in significantly boosting oil output, it could suppress the price of crude and crimp profits and the major oil companies. On the other hand, lower energy prices obviously have the potential to boost consumer confidence and risk appetite.

Since 1983, the S&P 500 has gained an average 11.8% in the year following periods when oil prices were at their lowest — between $10 and $30 a barrel — and averaged 13% in the year after crude traded in a $30-to-$50 range, according to Bloomberg Intelligence data.

Still, with the S&P 500 Index trading near an all-time high following a three-year rally, some market prognosticators warn that the room for absorbing sudden shocks is shrinking. That has some investors considering tactical hedges. The CBOE Volatility Index, or VIX, is hovering near 15, a sign of complacency even as geopolitical risks stir.

“This is an attractive entry point to hedge against a potential downside in equities and a spike in volatility,” said Frank Monkam, head of macro trading at Buffalo Bayou Commodities.

(Corrects oil flow data in 18th paragraph of story orginally published Jan. 10.)

©2026 Bloomberg L.P.