Oil Trading Giants Say Western Sanctions Driving Up Prices

(Bloomberg) -- A vast hoard of sanctioned oil that’s stranded at sea is driving up global prices as buyers compete for other barrels, several of the world’s top traders said.

Refineries that would typically buy Russian and Iranian crude are increasingly turning elsewhere, Russell Hardy, the chief executive officer of Vitol Group, the world’s biggest independent oil trader, said at an event in London on Thursday. His views are widely echoed by traders from around the world, including at Gunvor Group and Pacific Investment Management Co.

A ramp-up of sanctions pressure on Russia and Iran has tightened the screws on flows from the two nations over the past few months, forcing buyers in countries like India to seek alternatives. The shift marks a potential turning point after years of sanctioned oil flowing with little restriction, and is supporting prices even as analysts warn of a mounting excess of supply.

“The traditional buyers of those two supply sources are reaching for more Western or Saudi supply sources, which is in turn tightening the real market,” Hardy said at the International Energy Week conference in London. “The global supply demand balance needs to factor in some of these difficult situations — because that’s roughly a million barrels a day that’s not reaching a refinery — it’s just sitting on the high seas.”

The US and European nations have stepped up moves to seize tankers from the shadow fleet that helps keep sanctioned barrels flowing, while restrictions on Russia’s biggest producers, and American political pressure have forced Indian refiners to look elsewhere for barrels.

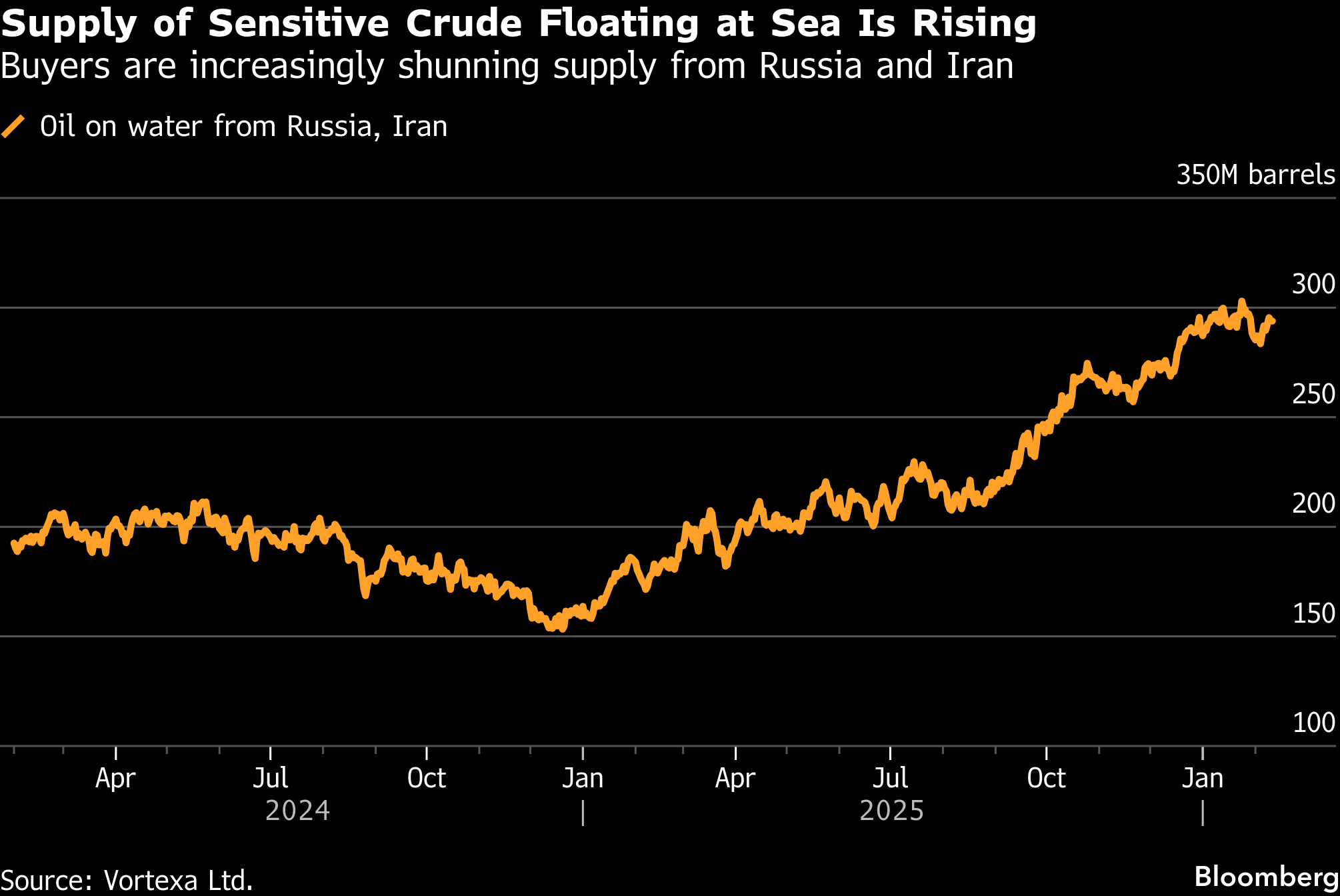

The result has been a large volume of oil building up at sea that’s not getting bought.

While a flotilla of oil tankers can often be very bearish because it points to oversupply, this time it’s pressuring refiners to look elsewhere for cargoes. There are about 292 million barrels of Russian and Iranian crudes currently on the water, more than 50% higher than a year ago, according to ship-tracking firm Vortexa Ltd. Of that figure, 140.5 million barrels are Russian — close to double the level a year ago — while 151 million are Iranian, the data showed.

“There’s an awful lot of oil that is temporarily at sea because of blockades, sanctions, etc. around the world,” said Jason Prior, the head of oil trading at Bank of America Corp. “That is holding up molecules getting to the market.”

As traders and analysts gathered in the bars and restaurants of London’s Mayfair district for the International Energy Week event, the impact of sanctions on prices was one of the main talking points. The year began with warnings of record oversupply from the International Energy Agency, but benchmark Brent futures are up about 14% so far in 2026, paring much of their slump from last year.

“We have seen a challenging market where you have a bifurcation between those barrels you can easily trade and those barrels you can’t,” Greg Sharenow, who helps manage nearly $20 billion as head of Pimco’s commodity portfolio investment team, said at a Bloomberg event during IE Week on Wednesday. “You can have a macro view on the oil market, we are building 1.5 million barrels a day, and not actually have a very strong translation of that into price formation.”

It’s not just sanctioned oil leading to a more fragmented market.

The IEA said on Thursday that global oil inventories grew at the fastest pace since 2020 last year. Still, a sharp increase in Chinese crude stockpiles — which have risen by around 200 million barrels over the last 12 months, according to analytics firm OilX — has fed into this. By contrast, US inventories, which have a far bigger impact on crude futures prices, have fallen over the same period.

A key question for oil traders now, is whether the current disruptions can be sustained. A US-brokered peace deal between Russia and Ukraine could quickly open the floodgates, as could any agreement between Washington and Tehran. At the same time, a slowdown in Indian buying of Western barrels could lead to stockpiles growing at a faster place in key pricing centers.

“The point is, what’s next?” said Frederic Lasserre, global head of research and analysis at commodity trader Gunvor Group. “We feel we may have almost saturated what can be put at sea.”

(Adds breakdown of oil on water in seventh paragraph)

©2026 Bloomberg L.P.