Oil Holds Two-Day Advance as Traders Focus On Middle East Risks

(Bloomberg) -- Oil held a two-day gain as tensions in the Middle East centered on OPEC member Iran supported a risk premium in prices.

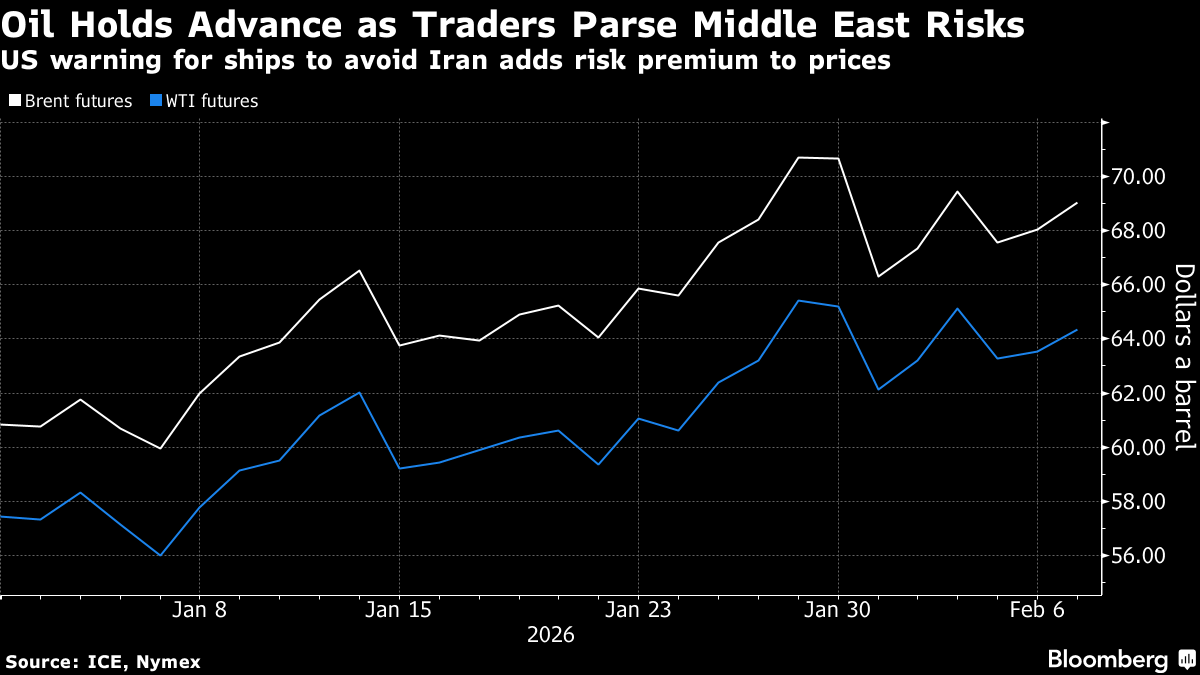

Brent traded just below $69 a barrel after rising more than 2% over the prior two sessions, while West Texas Intermediate was near $64. The US said on Monday that American-flagged vessels should stay as far as possible from Iranian waters when passing through the Strait of Hormuz. The warning came despite signs of progress in nuclear talks between Washington and Tehran.

The Strait of Hormuz is a critical trade artery for Middle East energy shipments that links a slew of producers to global markets, especially in Asia. Tehran has threatened to close the maritime chokepoint during periods of geopolitical tension, though it has never actually followed through.

Crude has risen more than 10% this year as recurrent geopolitical flare-ups eclipsed concerns a global surplus would lift inventories and hurt prices. A raft of data this week will give traders fresh insights into market conditions, starting with an update from the official US forecaster later Tuesday.

Washington has amassed a powerful military force in the Middle East, even as it also pursues talks with Tehran over its nuclear ambitions, with an initial round held in Oman last week and more expected. The face-off has spurred concerns that the US may opt to strike targets in Iran, potentially disrupting oil flows.

“Both Washington and Tehran seem to have put a positive spin on the Oman talks, signaling that further discussions will likely be held,” RBC Capital Markets LLC analysts including Helima Croft said in a note.

During a recent visit to the Gulf, “well-placed regional observers suggested that the fear of higher oil prices could ultimately push” US President Donald Trump to seek a negotiated settlement, the RBC analysts added.

In recent days, ship-tracking data have shown that some supertanker operators — nervous about US-Iran tensions and risks to shipping in the Strait of Hormuz — were speeding their vessels through the waterway.

Elsewhere Monday, US forces boarded a Venezuelan-linked tanker in the Indian Ocean, expanding Washington’s reach in cracking down on the shadow fleet used to export sanctioned crude. Last month, the US seized former President Nicolás Maduro and asserted control over the nation’s oil industry.

Oil, as well as metals, are “substantially underinvested” and have significant upside, according to Carlyle Group Inc.’s Jeff Currie, a long-standing commodity bull. Crude’s oversupply narrative was overblown, he added.

“If you are having to scrape the data to find evidence of the glut, it is not an oil-supply glut,” Currie, Carlyle’s chief strategy officer, energy pathways, told Bloomberg Television.

Brent’s prompt spread — the difference between its two nearest contracts — remains in backwardation, a positive pattern that signals near-term tightness. The gap was 64 cents a barrel on Tuesday.

©2026 Bloomberg L.P.