Oil Declines After Iran Confirms US Negotiations Set for Friday

(Bloomberg) -- Oil fell for the first time in three days after Iran confirmed it would hold negotiations with the US, easing the immediate risk of military strikes against the OPEC producer.

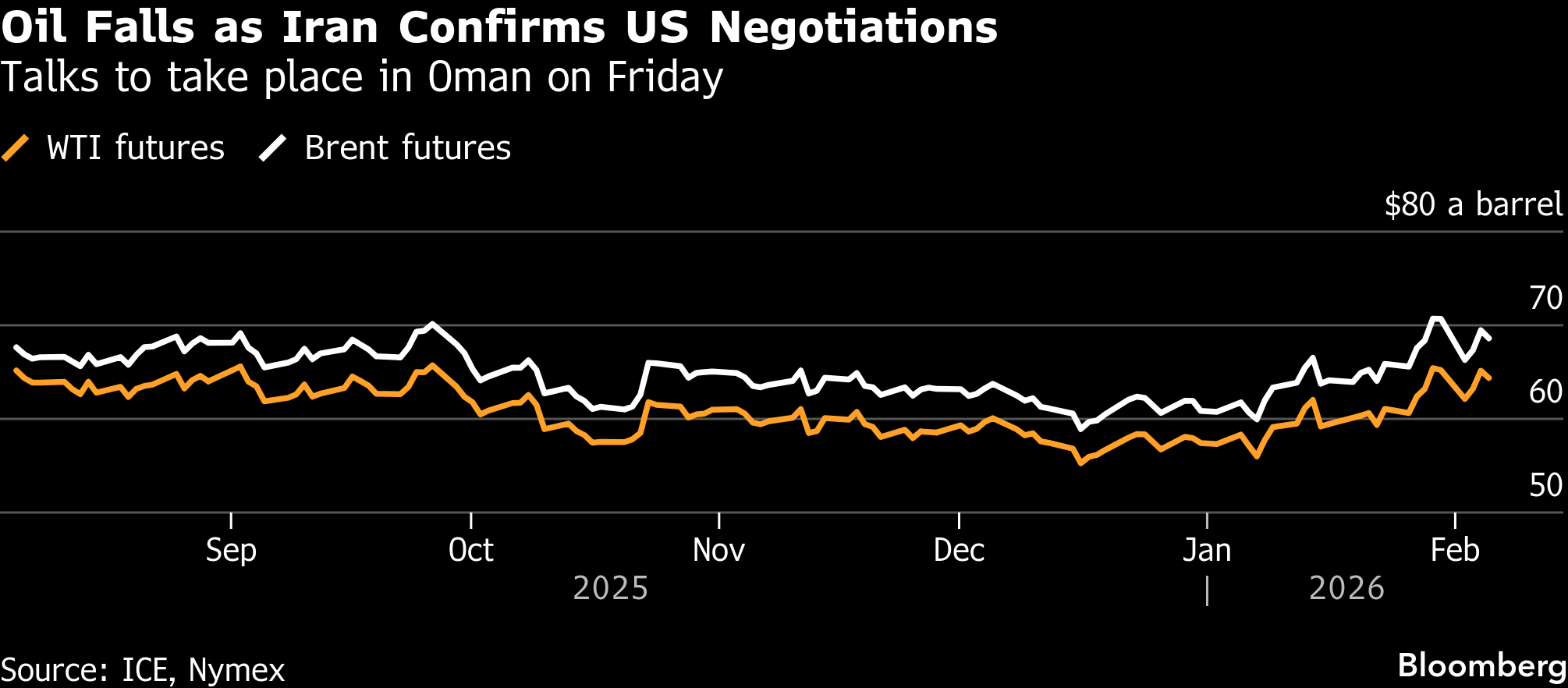

Brent dropped toward $68 a barrel, after adding 4.8% over the previous two sessions, while West Texas Intermediate was below $64 a barrel. Iranian Foreign Minister Abbas Araghchi confirmed in a social media post that the negotiations will be held in Oman on Friday, clarifying the location of the encounter.

“Despite some of the ongoing aggressive rhetoric, the market appears focused on Friday’s planned talks and the potential for diplomacy to play out,” said Warren Patterson, head of commodities strategy at ING Groep NV in Singapore. “But clearly as reflected in recent price action, there is still plenty of uncertainty over how this ends.”

Differing positions over the parameters of US-Iran negotiations mean it is still unclear whether the two sides can realistically bridge major differences at a time of heightened tensions in the region, which supplies about a third of the world’s crude. That has reinserted a risk premium in oil prices, which have rebounded this year after slumping in the second half of 2025 on signs of a growing global glut.

Traders also looked to Ukraine peace talks this week, which Ukrainian President Volodymyr Zelenskiy said will be impacted by major oil producer Russia’s attacks on his country’s energy infrastructure. He asked his US counterpart Donald Trump for more weapons to force Moscow to end the war.

Oil is also under pressure amid a broader seloff in precious metals. Silver tumbled more than 16%, erasing a two-day recovery, while gold fell as much as 3.5% in choppy trading.

Elsewhere, US crude inventories fell to the lowest level in a month, according to EIA data released Wednesday, but less than earlier expectations of a larger decline.

©2026 Bloomberg L.P.