Niche Corner of the Oil Market Is Rocked by Huge Bet — on Tankers

(Bloomberg) -- A niche but crucial part of the oil market is being rocked by a huge bet from a South Korean tycoon who has amassed a large share of the tanker market, with help from one of the industry’s wealthiest men.

Over the past month or two, the Sinokor group has quickly moved to buy or charter a significant number of ships and now controls roughly 120 very-large crude carriers, according to estimates from several senior industry executives. Some industry veterans said the huge position amassed by the company, overseen by shipowner Ga-Hyun Chung, is unprecedented in their experience.

But the Seoul-based shipping firm isn’t acting alone. At least two large ship owners that have recently negotiated vessel sales with Sinokor found that the final buyer was in fact an entity linked to Gianluigi Aponte, the founder of a sprawling shipping empire that includes Mediterranean Shipping Co. It’s not clear what the relationship between the two companies is, or how many of the other Sinokor deals have involved MSC.

This story is based on interviews with a dozen shipping brokers, vessel owners and executives, most of whom asked not to be identified discussing private information. Many of Sinokor’s purchases and charters have also been disclosed in industry broker reports. Several shipowners added that the venture is still showing interest in acquiring more vessels.

A representative for MSC declined to comment. Sinokor did not respond to multiple emails and phone calls seeking comment.

The move in itself is eye-grabbing, even by the standards of the opaque world of shipping. Many of the tankers carrying oil around the globe tend to be tied up on long-term leases or regular routes, and a growing share have been hit by sanctions over the illicit trade of Russian and Iranian oil, leaving fewer and fewer vessels available for hire a time when the global oil trade is surging.

Sinokor’s aggressive buying has spooked the market, traders say, in turn dramatically driving up the cost of freight as nervous charterers rush to book space in case prices rise further in the future due to the concentrated ownership. Crude-tanker earnings have had the strongest start to a year in more than three decades, according to Clarkson Research Services Ltd., a unit of the world’s largest shipbroker, while traders say that prices for physical oil in some regions are being pushed lower by the turmoil in the shipping market.

“You have one party or group of people who are working together who effectively control around a third of the available or traded tanker VLCC fleet out there,” Ole Hjertaker, Chief Executive officer of shipping firm SFL Corp. said on a call with analysts last week, without naming the parties.

The tanker market is a niche but vital cog within the global oil trade. It has long been dominated by owners from a handful of nations with significant maritime history like Greece and Norway, as well as countries with major oil interest like Saudi Arabia and China.

While Sinokor is a lesser-known name with its roots in container shipping, the group has in the past gone on chartering sprees that have tightened the market. However, at least one person involved in the market said that the current run of deals far outpaces any of its previous runs.

For Aponte, the purchases only serve to expand the reach of a massive global empire. The billionaire last year emerged as a key investor in a consortium looking to acquire a substantial share in two ports along the Panama Canal. In 2022, after scooping up hundreds of ships, MSC overtook Maersk as the world’s largest container line, a title the Danish company had held for decades.

The move to amass a large share of the world’s available tankers — roughly 15% of the total non-sanctioned fleet, and around a quarter to a third of the VLCCs that aren’t already locked up — would provide greater influence over pricing if the ships aren’t quickly made available for hire.

‘Fundamental Shift’

Demand for non-sanctioned tankers has soared in recent months as a flood of supplies hits global oil markets, at the same time that a chunk of the fleet is subject to western sanctions. Together the two have boosted the amount of ships being used at any given time, spurring higher earnings and the risk of further spikes.

The extent of the venture’s fleet is difficult to measure because it includes a mix of vessels that have been purchased and hired, as well as ones that Sinokor already controlled. Some of the people involved in the market estimate that the group had fewer than 120 ships.

But on a recent call with investors, Svein Moxnes Harfjeld, chief executive of tanker company DHT Holdings Inc. referred to a “fundamental shift” in global fleet ownership consolidation, without naming the parties involved.

“We can say with confidence that this is taking place and already making an impact, both on freight rates in the spot market, customer demand for time charters, and values of second-hand VLCCs,” he said. “This consolidation is shifting the pricing dynamics and is putting pressure on timely availability of ships.”

Benchmark earnings for VLCCs, which can haul 2 million barrels of oil, are currently higher than $120,000 a day, up more than fourfold over the last month in part because of the Sinokor deals, people involved in the market said.

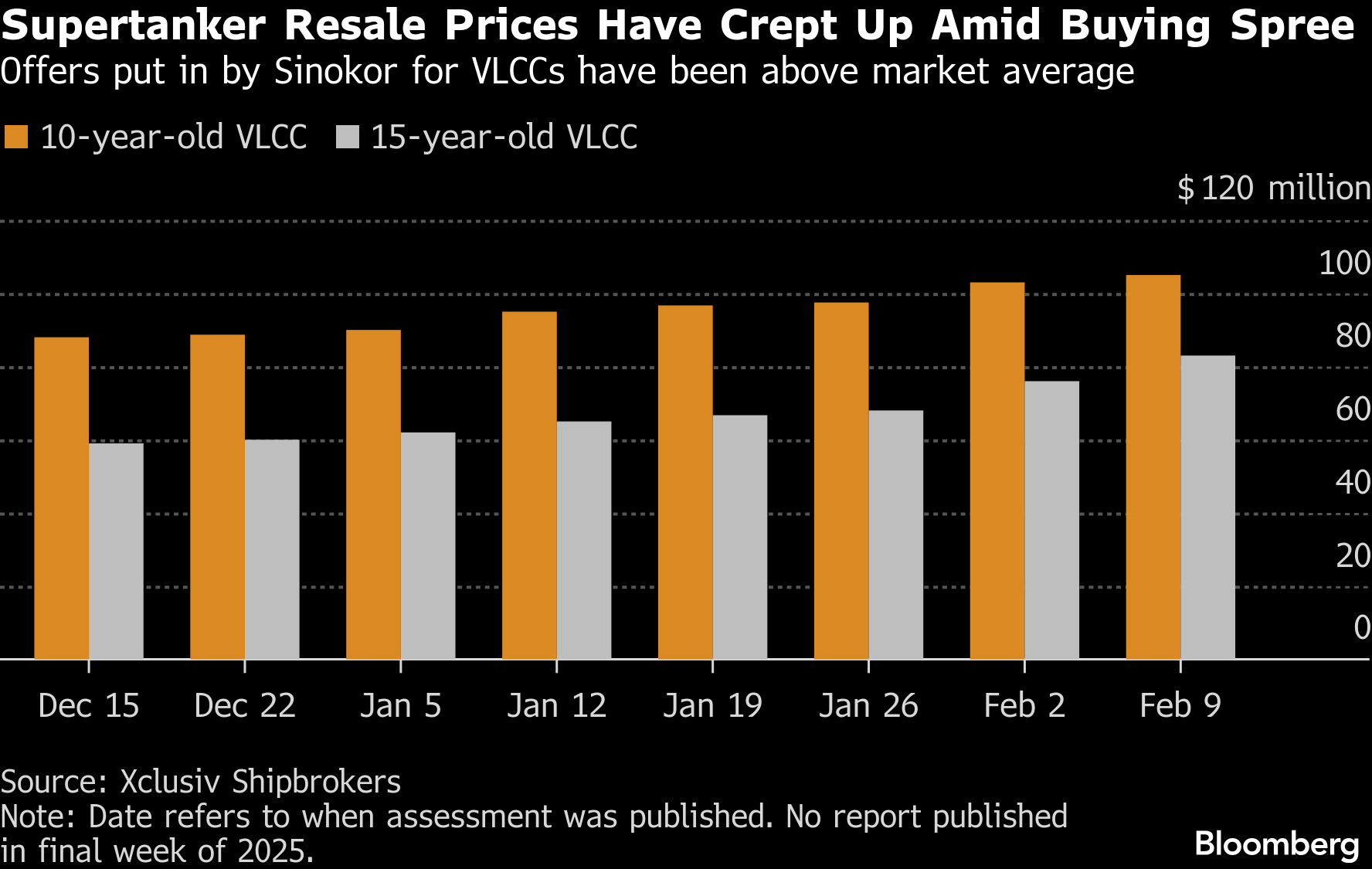

Sinokor’s purchases have largely been focused on vessels that are 10 years and older, and the resale price for older supertankers has been creeping up in recent weeks.

The rise in the outright value of ships can also bolster long-term hire prices, people involved in the market said. Higher ship values offer unrealized gains if the vessels aren’t sold, and so one way of shipowners realizing some of the profit from an upswing in prices is through higher chartering costs for their ships.

Boom and Bust

Still, the shipping industry is notoriously boom and bust because periods of high earnings are usually met with large periods of vessel ordering that flood the market with new ships years down the line. Higher rates in recent weeks have already started to boost the number of tanker orders, which as a percentage of the current fleet is now the highest in a decade, Clarkson Research data show.

Although the precise details of the arrangement between Sinokor and Aponte are unclear, there was a pre-existing commercial relationship. Late last year, Sinokor sold a series of container ships to Aponte’s MSC, according to data from Clarkson Research.

Even at the lowest end of estimates for the number of ships purchased, the recent buying spree would have cost about $1.5 billion, while some market participants pegged the sum closer to $3 billion.

“This market consolidation, occurring at an unprecedented level, by a buyer with deep financial power, occurs at a time when market fundamentals continue to get tighter,” said Aristidis Alafouzos, chief executive officer of Okeanis Eco Tankers. “It all creates an amazing opportunity if you have tankers on the water today, and the commercial ability to capture such market to its full extent.”

©2026 Bloomberg L.P.