UK Risks Exodus of North Sea Oil and Gas Contractors, Lobby Says

(Bloomberg) -- UK oil and gas producers — already suffering from high taxes and waning output — now also face the imminent risk of being hit by a pullback in operations by equipment and services suppliers, a lobby group warned.

Offshore Energies UK has previously said that the lack of new developments and uncertainty over projects mean firms in the supply chain — from engineers to specialist manufacturers to technology providers — could choose to instead invest overseas. On Wednesday it emphasized the urgency to address the risk, which could pose another headache for the government ahead of the autumn budget.

The country needs “a competitive fiscal regime that increases investment in oil and gas projects,” OEUK said in its 2025 economic report. “Without this, there is a very real risk that by next year, the UK will face a strategic exodus of critical supply chain capability as companies respond to the pull from busier countries with more supportive policies.”

Many producers in the UK’s aging North Sea basin have been reassessing activities after several increases and extensions of a windfall levy that was introduced in 2022 brought the headline tax rate to 78% for the industry. The regulatory environment has also become more challenging with the ruling Labour party’s commitment to not issue new exploration licenses. That has prompted companies to sell, merge or reduce operations.

Harbour Energy Plc, the UK’s biggest independent oil and gas producer, earlier this year said it expects to cut about 250 jobs in its Aberdeen-based unit. And Hunting Plc, a supplier to the oil and gas sectors, recently announced plans to reduce and restructure UK and European operations amid a focus on the Middle East.

OEUK says a pullback by contractors could threaten the UK’s upstream industry, the economy and the government’s budget.

“Maintaining UK supply chains will be critical to the success of the energy transition,” Ben Ward, market intelligence manager at OEUK, told Bloomberg. Many of the capabilities the country holds now in the sector “will be required for the scale up of our offshore low-carbon and renewables,” he said.

The North Sea is dividing politics, with the government pledging to ban new exploration licenses and Kemi Badenoch saying her main opposition Conservative Party will maximize drilling if elected. Badenoch has come under fire for the policy, with some casting doubt that more drilling will contribute significantly to UK needs as the basin is largely explored.

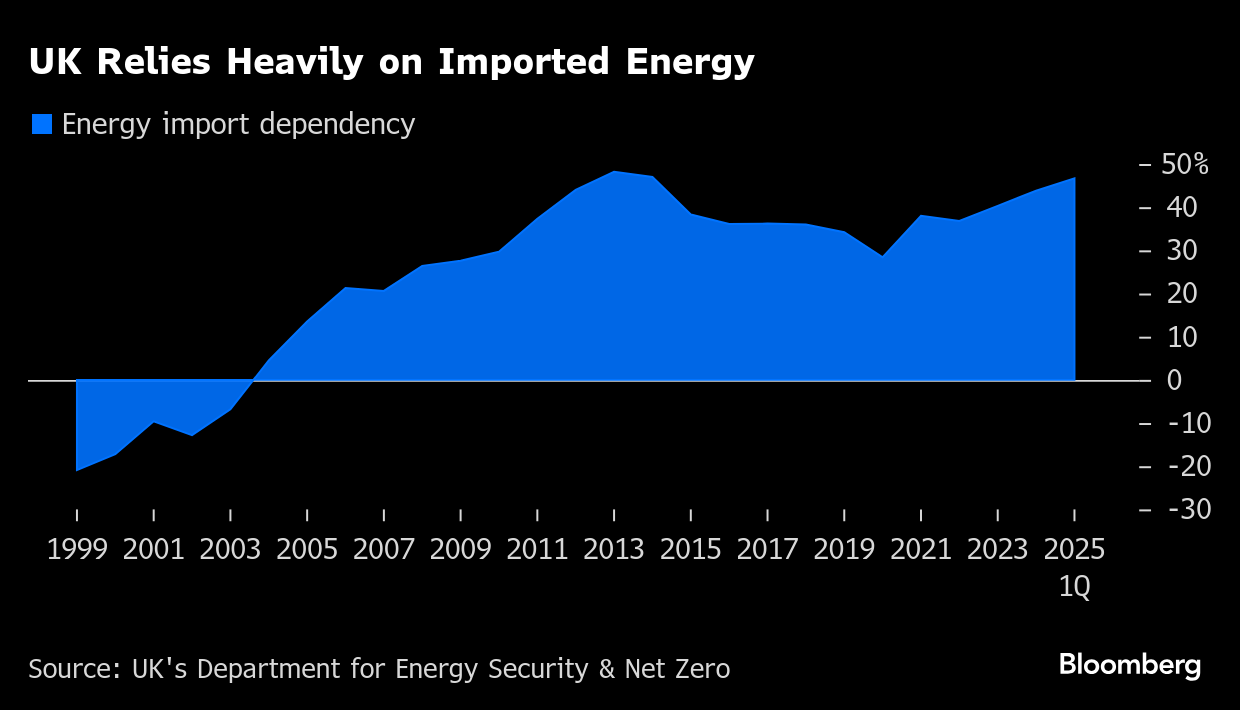

Government policy over the next 12 months will influence energy security and jobs, and creating a stable investment climate could reduce the country’s energy import gap by the end of the decade, according to the report.

The UK’s reliance on imports for its energy needs has remained above 40% in recent years, making consumers vulnerable to volatile global prices amid geopolitical uncertainty.

OEUK has urged the government not to wait until 2030 and replace the contentious windfall tax as early as next year. Faster changes could unlock about £41 billion ($55 billion) of additional capital investment through 2050, resulting in bigger output and generating almost 25% more in taxes over the period, it said Monday.

©2025 Bloomberg L.P.