Oil Holds Gains With Focus on Further Russian Sanctions, Glut

(Bloomberg) -- Oil steadied after two days of gains as investors weighed the potential of further western sanctions on Russian supplies against a looming glut.

Brent traded above $67 a barrel after adding 1.6% in the two previous two sessions, while West Texas Intermediate was near $63. The European Union is considering sanctions on companies in India and China that enable Russia’s oil trade as part of an upcoming package of fresh restrictions, according to people familiar with the matter.

China and India have been the biggest Russian oil buyers since Moscow’s 2022 invasion of Ukraine, and Washington has imposed 50% “secondary tariffs” on New Delhi but has so far spared Beijing in its bid to end the war. Treasury Secretary Scott Bessent said that the US wouldn’t follow through with threats to penalize Russian crude unless Europe also does so.

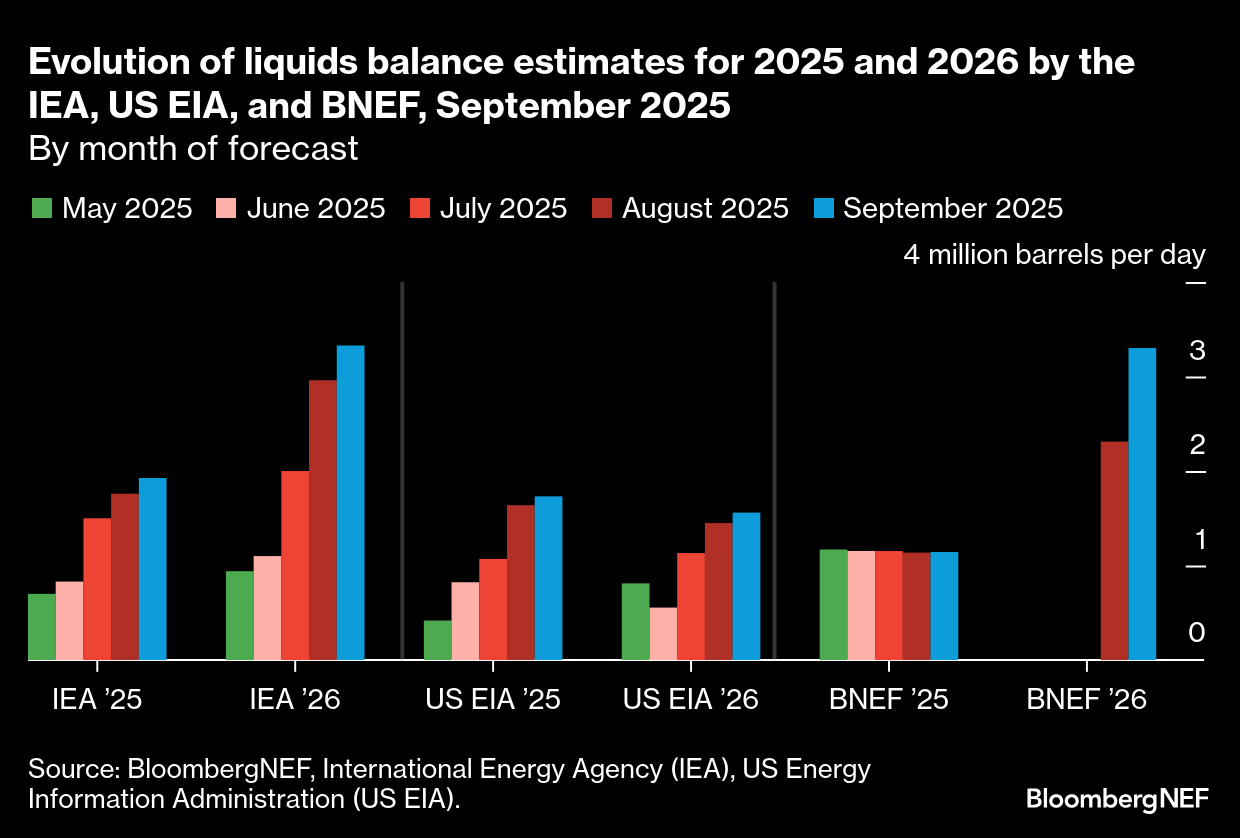

Futures have traded in a narrow range in the past month, caught between heightened geopolitical tensions and bearish fundamentals — the biggest of which is a faster-than-scheduled return of OPEC+ supply that has prompted the International Energy Agency to forecast a record glut next year.

“Short-term geopolitical risk premiums are supporting the oil market but the mid-term glut pressure continues to grow,” said Gao Mingyu, chief energy analyst at SDIC Essence Futures Co., who estimates a global surplus of 2.67 million barrels a day in 2026, up from 1.64 million this year, with the biggest overhang to be clustered in the first quarter.

Commodities including oil are set to find support from a Federal Reserve interest-rate cut expected this week. Monetary easing would be a boon for the US economy and energy demand.

Some market metrics are pointing to softness. The prompt spread for Brent — the difference between its two closest contracts — is trading at 40 cents a barrel, down from almost a dollar two months ago, narrowing a bullish structure known as backwardation.

©2025 Bloomberg L.P.