Oil Holds Decline After Fed Rate Cut, Rising US Fuel Stockpiles

(Bloomberg) -- Oil held a decline as traders weighed a Federal Reserve interest-rate cut and an increase in US fuel inventories.

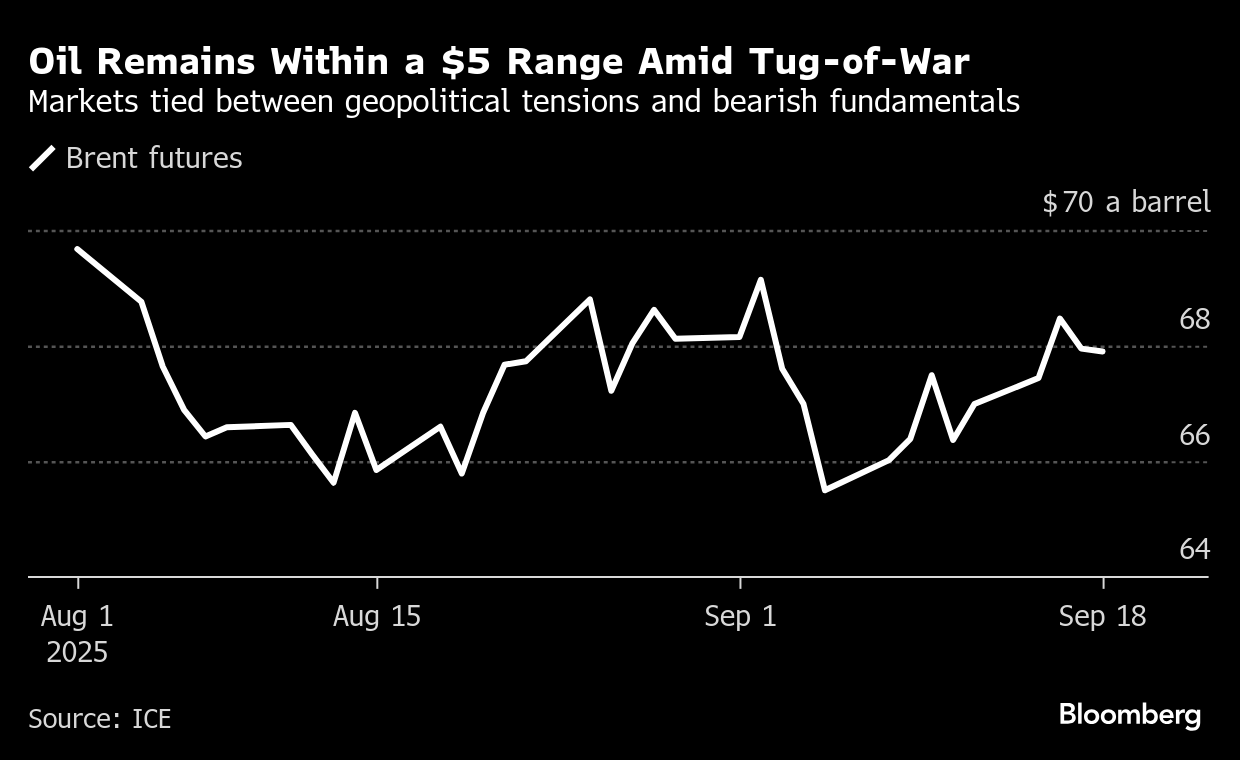

Brent traded under $68 a barrel, after losing 0.8% on Wednesday, while West Texas Intermediate was close to $64. While lower interest rates typically boost energy demand, traders had mostly priced in the 25 basis-point cut ahead of the Fed’s decision and unwound hedges against a larger move.

Wednesday’s drop brought oil back to the mid-point of the $5 range it has been trading in since early August. Prices have been buffeted by geopolitical risks, including increased attacks by Ukraine on Russian energy infrastructure, the accelerated return of OPEC+ supply that has boosted predictions of a looming glut later in the year, and the economic impacts of US President Donald Trump’s tariffs.

US data on Wednesday showed crude inventories fell 9.29 million barrels, their biggest drop in three months, amid a sizable increase in exports. However, the adjustment factor ballooned and distillate inventories rose to the highest since January, adding a bearish tilt to the report.

“Once short-term geopolitical and macroeconomic factors are digested, the market’s attention will return to fundamentals,” Gao Jian, a Shandong-based analyst at Qisheng Futures Co., said in a note. Crude’s upside potential “remains limited” given weak broader market trends, he added.

©2025 Bloomberg L.P.