Oil Falls on Concerns Another OPEC+ Supply Boost Will Swell Glut

(Bloomberg) -- Oil declined at the start of the week as expectations that OPEC+ will hike production again in November exacerbated concerns about a glut.

Brent fell below $70 a barrel after advancing 5.2% last week, and West Texas Intermediate was around $65. The alliance led by Saudi Arabia is considering raising output by at least as much as the 137,000 barrel-a-day hike scheduled for next month, according to people familiar with the plans.

The Organization of the Petroleum Exporting Countries and its allies are pursuing a strategy to reclaim market share rather than their typical role of managing prices, bringing back an additional layer of idled output. Still, prices have held up reasonably well, underpinned by robust buying from China.

The planned October hike — and potentially the boost for November — is much lower than the increments announced by the group for prior months. Delegates have also emphasized that the actual supply increase would be much lower as some member countries lack the ability to produce more.

“Given that many producers, excluding Saudi Arabia, have essentially hit their production ceilings, future OPEC+ supply increases will be materially lower than the announced headline numbers,” according to a note from RBC Capital Markets LLC analysts including Helima Croft.

OPEC+ is scheduled to decide its supply policy for November on Oct. 5.

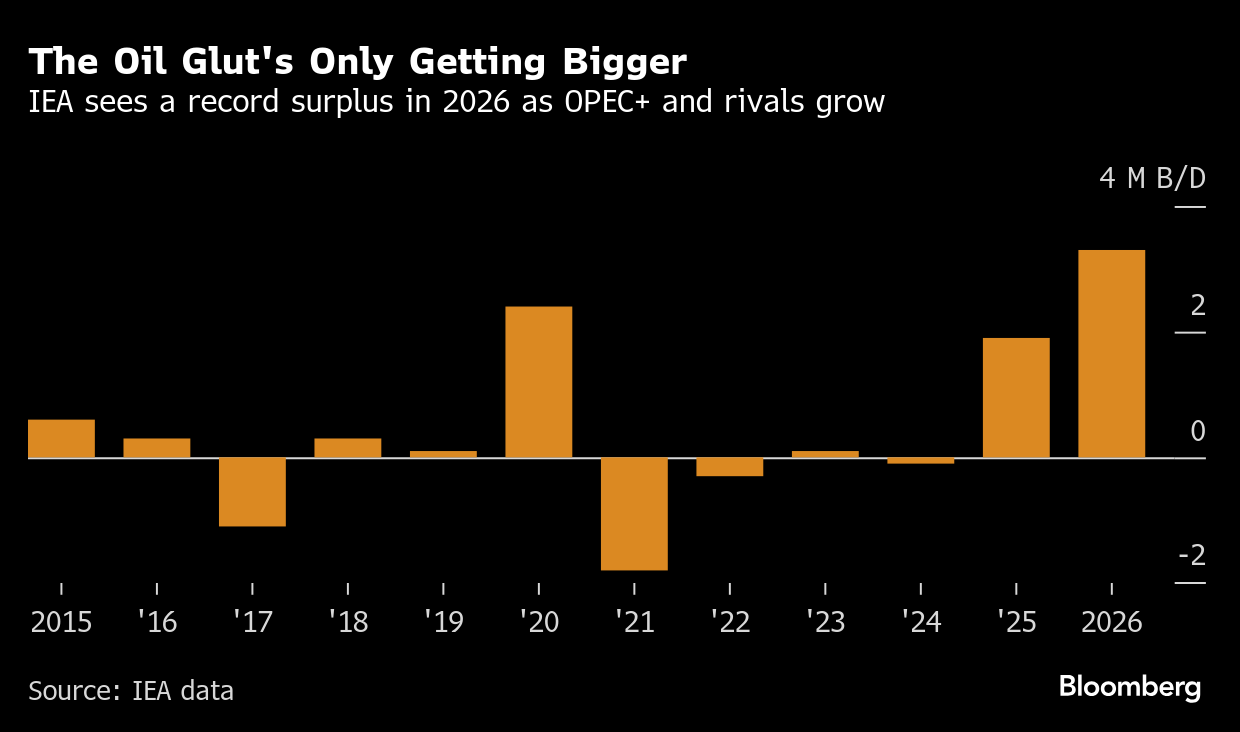

However, the International Energy Agency is projecting a record glut in 2026 as OPEC+ continues to revive production and supply from the group’s rivals climbs. Goldman Sachs Group Inc. sees Brent falling to the mid-$50s a barrel next year, despite crude stockpiling from China.

©2025 Bloomberg L.P.