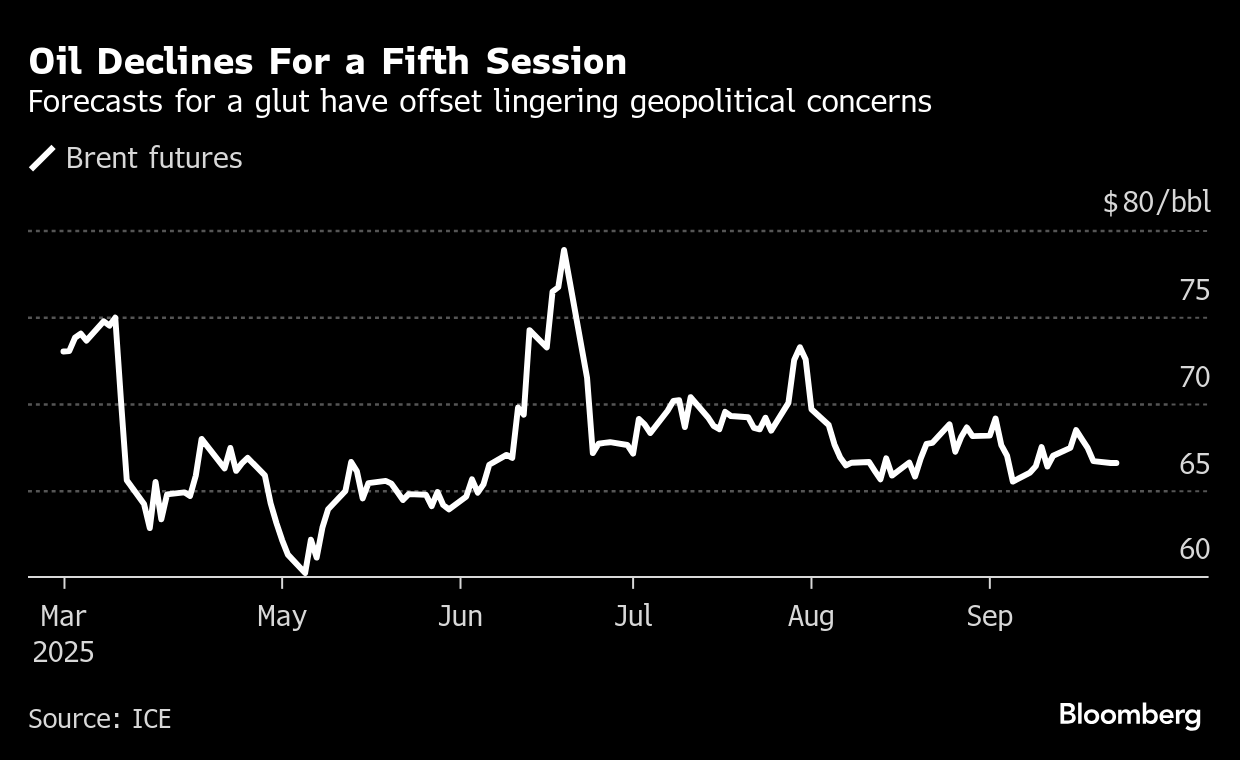

Oil Declines for Fifth Day as Supply Concerns Come to the Fore

(Bloomberg) -- Oil dropped for a fifth day — on pace for the longest losing run since early August — on signs that global supplies are set to increase, potentially feeding a surplus in the fourth quarter and into 2026.

Global benchmark Brent fell toward $66 a barrel after slipping 2.8% over the previous four sessions, while West Texas Intermediate was near $62. Iraq may shortly resume exports via Kurdistan after a two-year halt over a payment dispute. That could see about 230,000 barrels a day return to international markets, according to people familiar with the matter.

Crude is on course for a narrow quarterly decline, as forecasts for a glut have offset lingering geopolitical concerns, including threats to flows from Russia. A rapid return of shuttered barrels by the Organization of the Petroleum Exporting Countries and its allies, as well as increased production from outside the group, have seen market watchers including the International Energy Agency warn that supplies are set to top demand by a record margin.

“The bearish momentum continues, with Iraqi crude exports reportedly bound for a surge,” said Gao Mingyu, chief energy analyst at SDIC Essence Futures Co.

On the geopolitical front, Canadian Prime Minister Mark Carney said he wanted to see western allies impose secondary sanctions on Russia quickly in order to ramp up pressure on President Vladimir Putin. That follows recent remarks from President Donald Trump, who has urged European countries to stop buying Russian energy, although the US has so far spared China — the biggest buyer of Moscow’s barrels — from additional tariffs.

©2025 Bloomberg L.P.