China’s Solar Leader Looks Away From Sun to Solve Grid Glut

(Bloomberg) -- China’s top province for solar panels plans to accelerate the development of other renewables as well as battery storage, as it seeks to keep promoting clean energy while dealing with a glut of midday electricity.

Shandong, the northern coastal province with a $1.4 trillion economy, delivered enough solar generation last year to power Austria. But much of that electricity comes in the middle of the day, overwhelming the grid, raising curtailment rates, and causing frequent bouts of negative prices in the region’s power market.

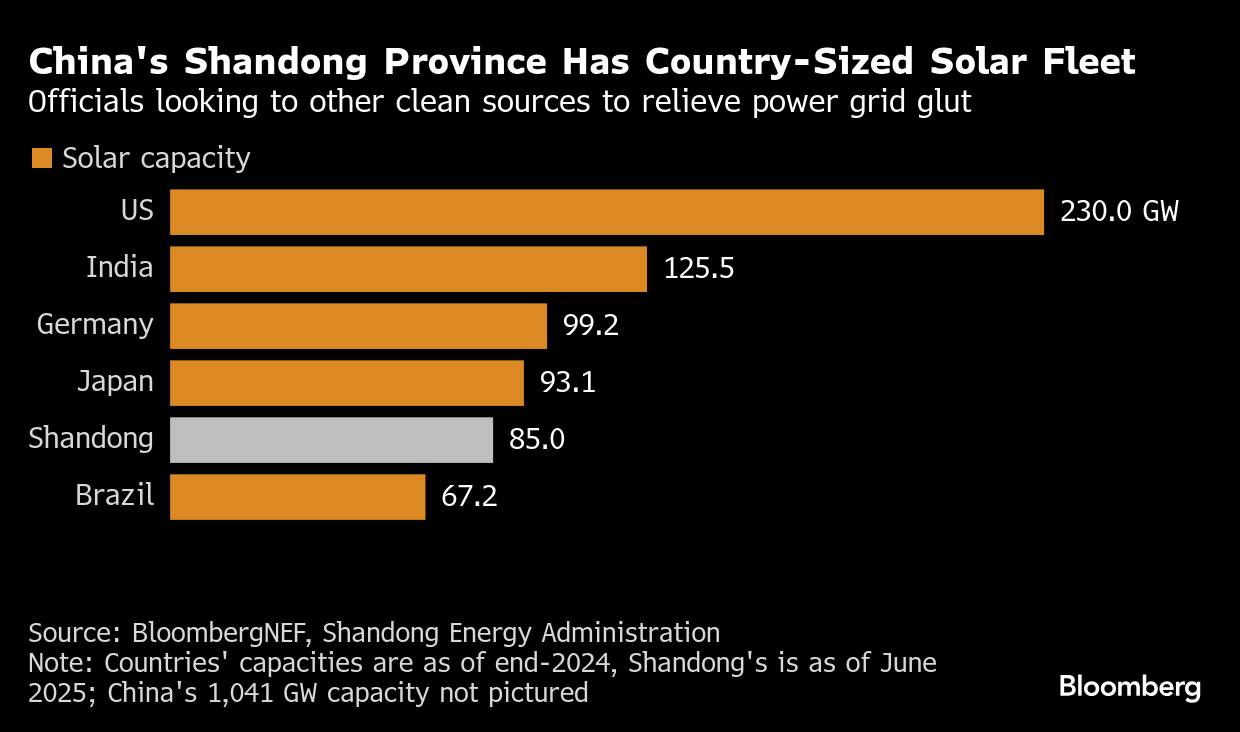

If Shandong were a country, it would be the world’s sixth biggest for solar. As such, its renewables strategy is likely to inform other regions as they adopt cleaner but more intermittent power. The direct threat to solar is that any shift away from the technology threatens to further injure panel makers already suffering billions of dollars in losses.

“The rapid expansion of solar has led to an increase in consumption pressure,” Sun Aijun, director of the Shandong Development and Reform Commission, said in a group interview in Jinan late last week. “To solve it, we want to take advantage of our coastal location and accelerate the development of nuclear power, and offshore and onshore wind, to gradually change the structure of new energy that’s currently dominated by solar.”

Shandong’s solar capacity has surged from 23 gigawatts at the end of 2020 to more than 85 gigawatts in June, led by the push to put rooftop panels on homes and buildings in smaller settlements throughout the country. Outside China, only the US, India, Germany and Japan have more solar installed than the province, according to BloombergNEF data.

The first sign of trouble came in 2023, when officials in the region asked rooftop panel owners to unplug during the Lunar New Year holiday because there weren’t enough users to soak up all the power. Later that year, the province’s pilot power market saw prices turn negative when too much generation hit the grid. Negative pricing, when traders are paid to take electricity, persisted for about 1,000 hours in both 2023 and 2024.

One solution has been to add batteries that can store the midday power and release it in the evening. The province doubled its new-energy storage capacity to 9.6 gigawatts over the past two years, and can double that again in the next three to five years, Sun said. The nationwide plan is to more than double energy storage capacity by 2027.

Shandong’s taking measures to induce consumption, lowering power prices during the middle of the day and raising them in peak evening hours. The province is also supporting the development of zero-carbon industrial parks to soak up more clean energy, Sun said.

On the generation side, Shandong intends to “optimize” the solar-to-wind ratio by adding more turbines, according to a statement in June. That effort was apparent in an auction held earlier this month as part of China’s efforts to move renewables toward market-based pricing.

The province allotted 6 million megawatt-hours for wind and just 1.2 million megawatt-hours for solar for the rest of this year. The price floors for wind and solar were set at 319 and 225 yuan per megawatt-hour, respectively. The coal power benchmark in the province is 395 yuan per megawatt-hour.

That solar price was below expectations, and if it was repeated across the country it could make it challenging to develop profitable solar farms in many other parts of China.

On the Wire

President Xi Jinping’s export engine has proved unstoppable during five months of sky-high US tariffs, sending China hurtling toward a record $1.2 trillion trade surplus.

China’s solar panel industry is engulfed in a wave of lawsuits and countersuits over TOPCon technology, with almost every major player battling each other.

A group of US lawmakers called for fair and reasonable access to China’s market for American businesses during talks with Vice Premier He Lifeng, as both sides work to stabilize ties ahead of a potential leaders’ meeting.

Zijin Gold International Co., which is currently taking orders to raise $3.2 billion in the world’s biggest initial public offering in months, may have to delay its trading debut in Hong Kong next week because of super typhoon Ragasa.

Shares of Chinese cobalt producers rose after the Democratic Republic of Congo announced a plan to replace a months-long ban on shipments with a system of export quotas that’s set to start in October.

This Week’s Diary

(All times Beijing)

Tuesday, Sept. 23

- CRU Copper Market Outlook Webinar, 16:00

Wednesday, Sept. 24

- China Copper Week in Xiongan, Hebei, day 1

- CCTD’s weekly online briefing on Chinese coal, 15:00

- CSIA’s weekly polysilicon price assessment

Thursday, Sept. 25

- China Copper Week in Xiongan, Hebei, day 2

- CSIA’s weekly solar wafer price assessment

Friday, Sept. 26

- Tsinghua University in Beijing hosts carbon neutrality forum, 09:00

- China Copper Week in Xiongan, Hebei, day 3

- China’s weekly iron ore port stockpiles

- SHFE weekly commodities inventory, ~15:30

Saturday, Sept. 27

- China’s industrial profits for August, 09:30

©2025 Bloomberg L.P.