Bessent Sparks Record Argentine Bond Rally With Support Pledge

(Bloomberg) --

Argentine assets surged after the US pledged financial support for President Javier Milei just as he rushes to contain a massive selloff in the nation’s financial markets ahead of midterm elections next month.

Bonds jumped by the most on record, stocks leaped 8% and the currency was set for the biggest advance since May as US Treasury Secretary Scott Bessent vowed to provide “all options for stabilization,” according to an X post on Monday. Later, he told CNBC that the US is ready for a large, forceful intervention in Argentina.

While full details of the aid will likely only emerge after Milei meets US President Donald Trump, along with Bessent, on Tuesday in New York, the news offered a much needed respite to Argentina’s battered assets.

“I don’t ever recall a rally like this in global dollar bonds in any given day,” said Thierry Larose, a portfolio manager at Vontobel Asset Management. Bessent’s offer is very much political as “Milei’s Argentina stands out as the only sizable strategic ally in the region, playing a crucial role in securing supplies of key commodities and deepening military cooperation.”

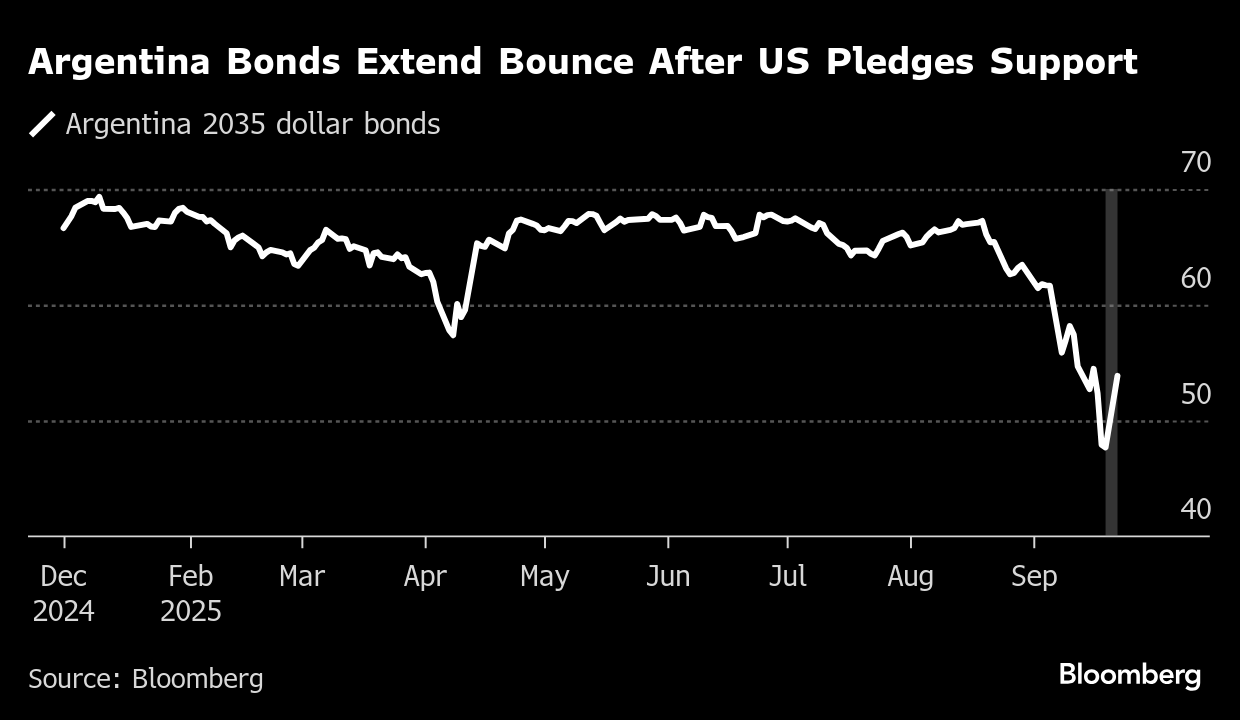

Argentina’s dollar notes maturing in 2035 — some of the most liquid — leaped by the most since they were issued in 2020, jumping as much as 8 cents to above 55 cents on the dollar, according to indicative pricing data compiled by Bloomberg.

Still, the bonds remain well below their pre-election level, with the yield above 16%.

Free-Fall

The country’s markets had been in free-fall ever since Milei’s party landslide loss in the Buenos Aires’ provincial election earlier this month, which raised the prospect of his free-market reform agenda stalling after the midterms. The central bank spent $1 billion in just two days last week to keep the peso from plunging as it fell on almost single session this month.

“This positive confidence shock eases concerns and puts aside the anxiety that had been stirred up in the last few weeks,” said Pedro Siaba Serrate, head of research and strategy of PPI Argentina. “The midterm elections will be the fundamental catalyst for the next two political years.”

The currency gained as much as 4.4% Monday, also aided by Milei’s decision to suspend export tariffs on all crop cargoes in a bid to bring more dollars into the country, which was announced on Monday. The benchmark S&P Merval stock index advanced as much as 8.1%.

Pedro Quintanilla-Dieck, a strategist at UBS, said the speed with which Bessent publicly voiced support for Argentina was unexpected, as well as the tone of the comments.

“He characterized Argentina as a systemic ally and indicated that all stabilization tools are being considered,” Quintanilla-Dieck said. “The sustainability of the rally will depend on the specific tools the US Treasury ultimately uses to support Argentina, as well as the magnitude and conditions of any aid package.”

(Updates with asset prices, analyst comment starting in the fourth paragraph)

©2025 Bloomberg L.P.