Beijing’s Plan to Cut Oil Refining Capacity Stumbles in Regions

(Bloomberg) -- “Build the new before abolishing the old” could be written on the tombstone of China’s pledge to fix its problem with industrial overcapacity.

The Politburo slogan has been adopted by the Shandong government, among others, as one piece of the solution to its oil refining glut. The province houses most of the smaller, independent processors that make up over a fifth of China’s capacity. Barely profitable, the so-called teapots are first in the firing line as Beijing wages its so-called anti-involution campaign against cutthroat competition in the oil industry.

Or they should be. Shandong is also a focal point for the simmering tension between central government mandates and how they’re applied in the regions, which still rely on declining industries to employ people, generate tax receipts — and support the GDP targets set by Beijing.

“This is probably the most common reason that market participants give for skepticism about the anti-involution campaign,” said Christopher Beddor, deputy China research director at Gavekal Dragonomics.

“Local officials might curb output in some areas, but as long as there’s a growth target, they will always be tempted to pull punches or subsidize something else instead,” he said. “When the rubber hits the road, there’s nearly always a bias in favor of growth.”

In Shandong’s case, the province has pledged to reduce its refining operations in favor of more profitable petrochemicals plants. But it’s also restored tax rebates to its legacy processors and even helped resurrect capacity in service of its local economy.

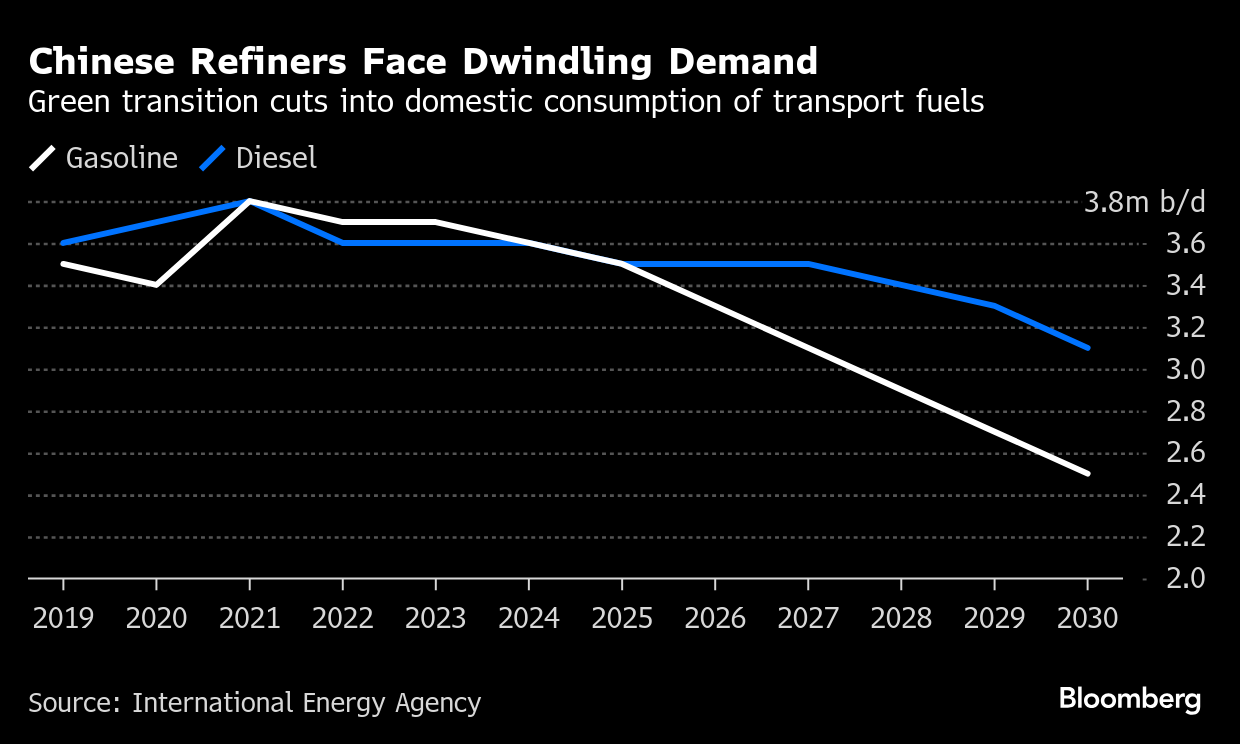

China’s oil refiners need to stop producing so much transport fuel because the energy transition means the demand is no longer there. Overly cheap gasoline and diesel is a problem for the economy because it drives deflation. Oil refining, alongside steelmaking, was specifically targeted by the central government at its annual policy meeting in March. The anti-involution drumbeat has only grown louder since, and a sweeping overhaul aimed at increasing chemicals output at the expense of fuel is in the works.

Other resources sectors like solar manufacturing and copper smelting are in the crosshairs as well, although they’ve largely been left to find their own solutions. The refining and steel industries are arguably getting special attention from Beijing because declining demand makes their problems more acute, and should make it easier to force them to shrink.

The risk is that failing to reduce overcapacity in two of the worst-performing sectors bodes ill for efforts to solve the problem in more vibrant areas of the economy.

Sustainable Footing

Nationwide refining capacity is currently about 920 million tons a year, according to BloombergNEF, below the government’s cap of 1 billion tons that came into effect this year. The gap between the two figures allows for wiggle room to build modern, integrated facilities before smaller, outdated plants are scrapped. In any case, a lot of teapot capacity is heavily underutilized because margins are so thin.

To put the industry on a sustainable footing, about 100 million tons need to be phased out, a process that could take as long as five years, Li Xinhua, global head of trading at independent refiner Rongsheng Petrochemical Co., told a conference in Singapore earlier this month.

Amy Sun, an analyst at industry think tank GL Consulting, said she expects only about 60 million tons to be shuttered by 2030 as wily teapot operators find ways to scrape by. Together with new facilities coming online, Sun thinks capacity may drop just 1.4% by the end of the decade.

To account for the drop in demand for gasoline and diesel, the cut to annual capacity needs to be more than 100 million tons by 2030, according to BNEF analyst Claudio Lubis. But with new refineries due, “the country’s nameplate capacity may actually rise by the end of the decade, not decline,” he said.

Refineries Resurrected

New refineries aren’t the only issue. One of three Shandong plants that went bankrupt last year resumed production in June, while the other two are preparing to restart after being taken over by local rivals, according to people familiar with the matter, who asked not to be named because the information is private.

The new owners were rewarded with additional crude import quotas from the central government, a lifeline for the teapot sector, after successful lobbying by provincial authorities, the people said. They added that local officials would likely provide other support to the refineries, including tax breaks and preferential treatment in project approvals.

The Shandong authorities have also reinstated tax breaks on fuel oil purchases, a cheaper feedstock used by teapots, for at least six local plants after the rebates were reduced at the start of the year, according to Oil Circle Alliance, a local information provider.

Neither the Shandong provincial government nor its economic planning agency responded to phone calls seeking comment.

On the Wire

Global money managers are venturing back into China after years of aversion, piqued by a world-beating stock rally and the country’s advances in high-tech industries.

China’s September business surveys will probably provide more evidence the economy slowed in the third quarter, according to Bloomberg Economics.

Chinese industrial profits surged after months of declines, signaling that national campaigns to tackle overcapacity and excessive competition are bearing fruit. The increase was driven by lower costs and not stronger demand, BE said.

China’s automakers will need permits to export electric vehicles starting next year, adding to signs the country’s officials are tightening their management of the world’s biggest car market.

This Week’s Diary

(All times Beijing)

Monday, Sept. 29

- Nothing major scheduled

Tuesday, Sept. 30

- China’s official PMIs for September, 09:30

- RatingDog’s China PMIs for September, 09:45

- Govt deadline for review of energy conservation measures at polysilicon firms

- Yichun province’s deadline for lithium miners to submit reserves reports

Wednesday, Oct. 1

- Public holiday in China through Oct. 8

Tuesday, Oct. 7

- China’s foreign reserves for September, including gold

©2025 Bloomberg L.P.