Asian Stocks Steady as Tech Giants Buoy Indexes: Markets Wrap

(Bloomberg) -- Asian equities were steady as some of the region’s tech giants advanced ahead of hotly anticipated US inflation data due later Thursday.

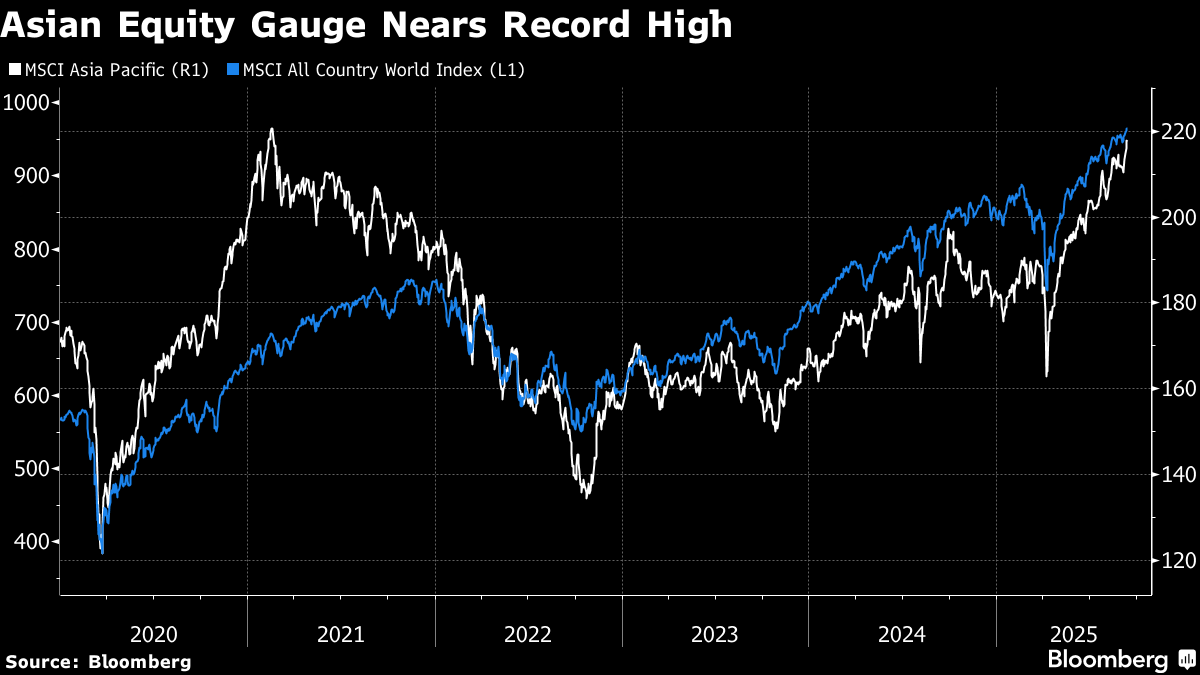

Major benchmarks for Japan, South Korea and mainland China rose, while those for Australia and Hong Kong fell. MSCI’s Asia-Pacific index was flat after five consecutive daily gains. US futures were higher after the S&P 500 set a fresh high Wednesday.

Shares in Japan’s Softbank Group rose around 10% to a new high after major shareholding Arm Holdings Plc rose in Wednesday trading in New York. Chipmakers Taiwan Semiconductor Manufacturing Co and SK Hynix Inc in South Korea also advanced.

Treasuries were steady after a rally across the curve Wednesday, while Australian and New Zealand government bonds rose Thursday. An index of the dollar was little changed and the yen was steady against the greenback.

US producer prices unexpectedly declined for the first time in four months in August. The data soothed worries that elevated inflation would create a challenge for policymakers trying prevent a jobs downturn ahead of US inflation figures due later Thursday.

“Investors are now contemplating the extent to which August’s payrolls, the benchmark revisions, and PPI should drive a conversation about a 50 basis-point cut next week,” said Ian Lyngen and Vail Hartman at BMO Capital Markets. “We are still in the 25 basis-point cut camp. For a half-point to be a real possibility, tomorrow’s core-CPI move will need to underwhelm.”

Monthly US producer prices excluding food and energy declined 0.1% in August from the prior month, falling short of consensus estimates of a 0.3% increase, while July’s figure was also revised down. The data may indicate firms are trying to stay competitive to maintain market-share, said Neil Dutta at Renaissance Macro Research.

“The Fed should cut 50 basis points next week — but I don’t think they will,” Dutta said. “The doves on the FOMC have a very strong case to make. The hawks will argue that the unemployment rate is still low, financial conditions are loose, and that there is still upward inflation pressure in front of us due to tariffs.”

Later Thursday, the European Central Bank is expected to keep interest rates unchanged.

Elsewhere, US President Donald Trump and Indian Prime Minister Narendra Modi pledged to talk and resume trade negotiations, signaling a possible thaw after weeks of a blistering fight over tariffs and Russian oil purchases.

US Inflation

Core CPI, a measure of underlying inflation excluding food and fuel, probably rose 0.3% for a second month, according to the Bloomberg survey median estimate. A weaker-than-expected reading may prompt further speculation for a 50 basis point Fed cut next week.

The combination of a moderation in jobs growth and still-manageable inflation should keep the Fed on track to cut rates, with a 25-basis-point cut expected in September to be followed by three additional consecutive cuts of the same size by January 2026, according to Ulrike Hoffmann-Burchardi at UBS Global Wealth Management.

“Tomorrow’s CPI will carry more weight, but today’s PPI print essentially rolled out the red carpet for a Fed rate cut next week,” said Chris Larkin at E*Trade from Morgan Stanley. “After last week’s jobs report, though, the market was already expecting the Fed to begin an easing cycle, so it remains to be seen how much of a near-term impact this will have on sentiment.”

Alibaba Group Holding Ltd rose after early declines. The company is seeking to raise $3.17 billion in an offering of zero-coupon convertible notes that’s set to be the year’s biggest, according to terms of the deal seen by Bloomberg News.

In commodities, gold was slightly lower after gains in the prior session and oil was little-changed after three days of gains, as investors weighed Trump’s next moves to pressure Russia, raising concerns over crude supplies.

Meanwhile, Mexico is looking to apply tariffs of as much as 50% on cars, auto parts, steel and textiles from China and other countries with which it does not have a trade agreement, according to Economy Minister Marcelo Ebrard.

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 1:10 p.m. Tokyo time

- Japan’s Topix rose 0.2%

- Australia’s S&P/ASX 200 fell 0.5%

- Hong Kong’s Hang Seng fell 0.3%

- The Shanghai Composite rose 1.1%

- Euro Stoxx 50 futures rose 0.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1696

- The Japanese yen was little changed at 147.44 per dollar

- The offshore yuan was little changed at 7.1192 per dollar

Cryptocurrencies

- Bitcoin rose 0.6% to $114,264.28

- Ether rose 1.7% to $4,404.4

Bonds

- The yield on 10-year Treasuries was little changed at 4.05%

- Japan’s 10-year yield advanced one basis point to 1.575%

- Australia’s 10-year yield declined four basis points to 4.24%

Commodities

- West Texas Intermediate crude fell 0.2% to $63.56 a barrel

- Spot gold fell 0.2% to $3,633.66 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.