Saudi Arabia’s New Pitch to Wall Street: Less Neom, More AI

(Bloomberg) -- In 2017, Crown Prince Mohammed bin Salman sat alongside Steve Schwarzman and Masayoshi Son at the first iteration of Saudi Arabia’s annual financial summit to unveil a next-century city called Neom. The two billionaire investors were quick to heap praise on the $500 billion plan that envisioned a metropolis with more robots than humans and enough solar panels to fill out the Great Wall of China.

As the titans of global finance head to Riyadh for this year’s Future Investment Initiative summit, the kingdom is pivoting away from what would have been one of the world’s biggest construction projects. Instead, it’s preparing to pour billions more into areas like artificial intelligence, gaming and high-tech manufacturing as it races to diversify its oil-reliant economy, people familiar with the matter said.

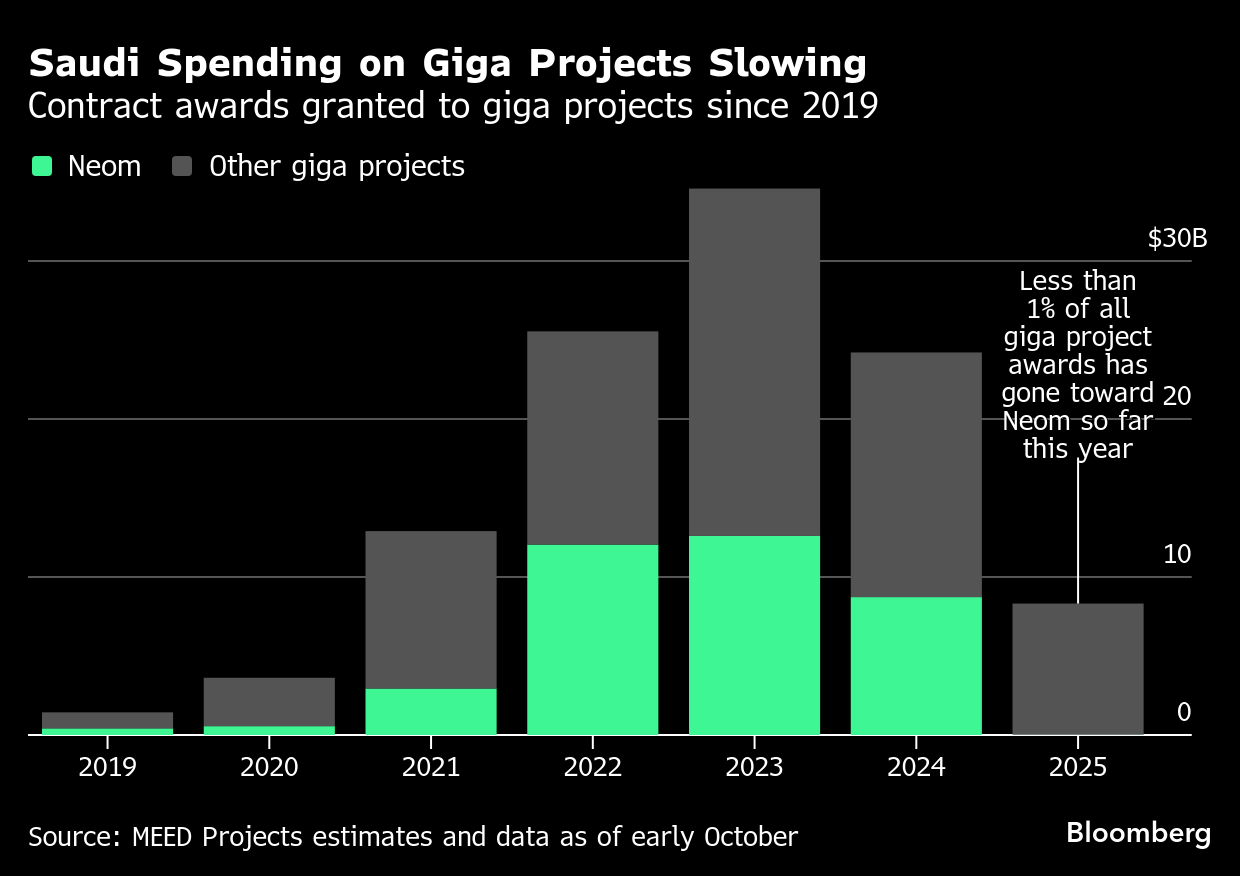

New contracts for Neom have been drying up and the project received no mention in the country’s pre-budget statement for 2026 after being featured for three straight years. Work has slowed on the Line project, a pair of 100-mile-long mirrored skyscrapers, some of the people said. At the same time, other plans like the Sindalah luxury island and the sprawling ski resort Trojena, have also faced setbacks.

The government is reviewing some of Neom’s goals against Saudi Arabia’s other top priorities, particularly with oil prices forecast to stay lower for longer, people familiar with the matter said.

At FII next week, JPMorgan Chase and Co. Chief Executive Officer Jamie Dimon, Goldman Sachs Group Inc.’s David Solomon, Blackrock Inc.’s Larry Fink and Brookfield Corp.’s Bruce Flatt, will be among the hundreds of bankers, consultants, and tech executives trying to divine the kingdom’s plans for the more than $200 billion it draws each year from oil exports.

This inside look at Saudi Arabia’s efforts to reshape its massive outlays is based on interviews with more than half a dozen people with knowledge of the matter, who asked not be named discussing information that isn’t public. Much hinges at home and overseas on the kingdom’s ability to successfully pull off this significant shift. Saudi Arabia’s Public Investment Fund and Neom declined to comment for this story.

Foreign executives continue to count on the Gulf nation to keep generating fees, but the billions of dollars being pumped into projects like Neom have in recent years curbed the kingdom’s ability to allocate capital to international private equity entity firms and hedge funds. Those outlays have also overloaded the local banking system in recent years, leading to persistent liquidity tightness. Crude prices are down more than 10% in London this year, pressuring the Saudi economy because the oil sector accounts for about half of GDP. Saudi Arabia’s fiscal and current accounts would benefit from a rebound in oil prices and production, according to the International Monetary Fund.

The country’s nearly $1 trillion Public Investment Fund, which helms the defacto ruler’s Vision 2030 transformation plan, has been conducting a broader review of some of the megaprojects. Signals of its spending plans are only now starting to emerge, and point to new opportunities for global firms.

Top of the list is the AI vehicle Humain, which is owned by the Saudi wealth fund. The FII conference is likely to feature significant announcements from the company — private equity giants Blackstone Inc. and BlackRock are already vying to invest billions of dollars with the firm, Bloomberg News has reported.

Riyadh is also sharpening its focus on Alat, the homegrown champion for building smart manufacturing hubs, as well as airline Riyadh Air, some of the people said.

Officials have already started to telegraph the changes.

If any strategy or project currently does not make sense to continue, the kingdom “will not have any hesitation of actually changing it, stopping it,” Finance Minister Mohammed Al-Jadaan said earlier this month in Washington DC.

In the nine months through September, only about $8 billion of construction contracts had been awarded across all giga projects, the researcher MEED said, with just $20 million going to Neom. While about $110 billion has been already been awarded in construction contracts for so-called giga projects since 2019, according to MEED, spending peaked in 2023 before plunging over the past two years. While more money could be awarded in the coming months, that’s likely to be well below the peak.

That drop now paves the way for money to end up elsewhere.

The kingdom plans to prioritize projects to construct new homes and offices in the capital Riyadh, while the wealth fund is expected to spend heavily on the World Expo due to be held in the Saudi capital in 2030.

In coming months, the PIF is expected to unveil its strategy for 2026 and beyond, providing an indication of what lies ahead for Neom. The shifts underway at the megaproject are already rippling through the global economy, potentially affecting many attendees at FII.

Some consultants are seeing revenue growth tail off and are relocating staff away from Neom, according to people familiar with the matter. At least one Saudi construction firm has had its Neom work put on hold, while another said it’s keeping machinery on The Line operating at the bare minimum until a decision is made on the project’s future.

Some construction workers remain on site, but it’s unclear in what form The Line will eventually be built, the people said.

The breakneck pace of construction has already created an explosive need for credit from all corners of the Saudi economy. A further slowdown at Neom may ease some of the strain on liquidity, though it's expected to remain tight as loans will still be needed for dozens of other initiatives, like building more affordable housing.

“From a Saudi perspective, the regional and global backdrop has its challenges at the moment,” said Farouk Soussa, Goldman Sachs Group’s economist for the Middle East and North Africa. “But the constraints are not static. There will come a time they are less pressing and the investments can re-accelerate again.”

Mideast Money newsletter

For now, executives coming to FII are likely to push ahead with forging Saudi relationships that could lead to big payoffs.

The $55 billion EA deal, for instance, is poised to generate about $500 million in fees for Wall Street banks that are arranging the financing. The kingdom continues to be central to the financial ambitions of global players and in August, a BlackRock-led group signed an $11 billion lease deal involving Saudi Aramco natural gas facilities.

Saudi Arabia has also issued billions of dollars in sovereign bonds, offering Wall Street yet another way of making money. One Western firm now makes more money in Riyadh from helping arrange bonds and loans than advising on outbound mergers and investments, a senior executive told Bloomberg News this year.

Added investments in areas like AI offer further opportunities for partnerships and deals particularly as recent messaging from the top echelons of government indicates a willingness to change course.

The changes are likely to be view positively by investors “because it says a lot when a government takes a step back and says hey we aren't going to stop all investments but we are moving money to places with immediate needs and quicker returns," said Aathira Prasad, director of macroeconomics at economic and business advisor Nasser Saidi & Associates.

(Updates with details from IMF)

©2025 Bloomberg L.P.