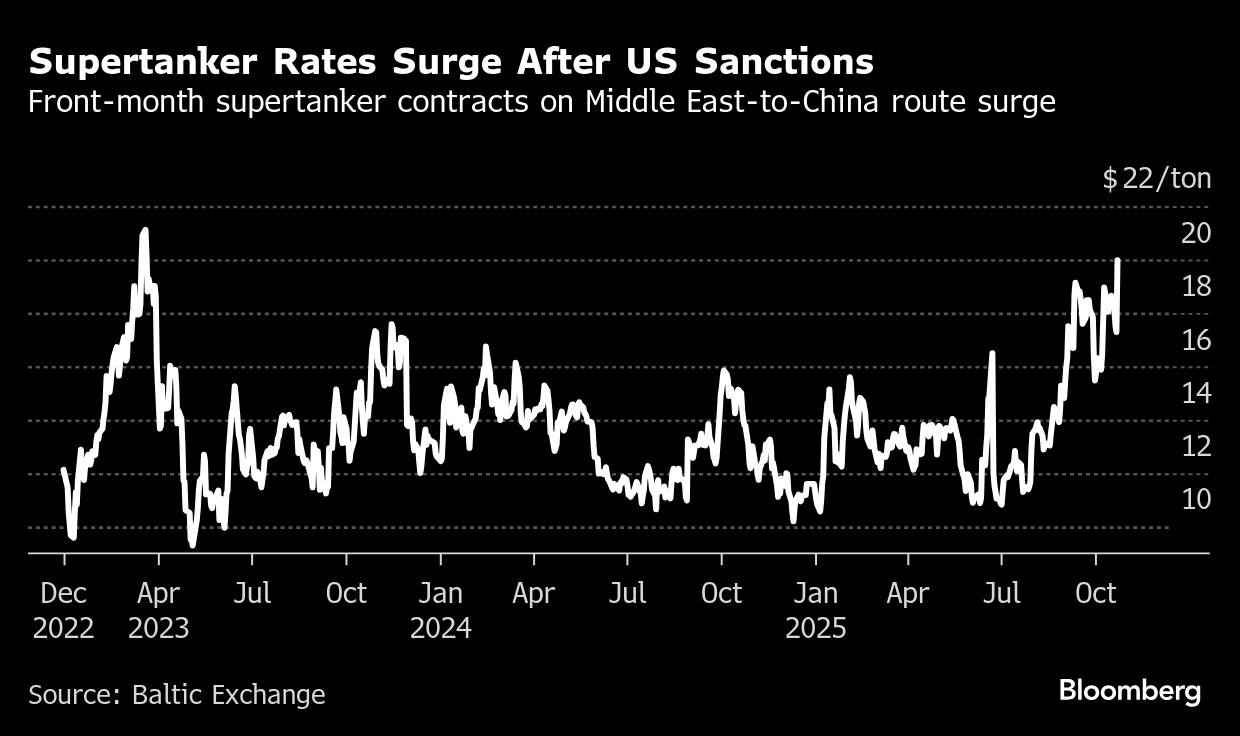

Rush to Replace Russian Oil Sees Supertanker Freight Rates Jump

(Bloomberg) -- Supertanker freight futures have soared after the US’s sanctioning of two major Russian oil producers spurred buyers of the crude to seek alternatives.

Front-month forward freight agreements on the benchmark Middle East-to-China route spiked almost 16% to the highest since early 2023 on Thursday, Baltic Exchange data show. Contracts for December on the same route undertaken by very-large crude carriers rose almost 13%.

The White House sanctioned Rosneft PJSC and Lukoil PJSC on Wednesday, part of a fresh bid to end the war in Ukraine. Indian and Chinese refiners, the major buyers of Russian crude, said they would step back from the market, and are likely to turn to the Middle East to meet any shortfalls, boosting demand for tankers plying those routes.

“We anticipate the rush for replacement crudes will be larger and more sustained because of the exhaustive list of Russian producers under OFAC sanctions,” said Anoop Singh, global head of shipping research at Oil Brokerage Ltd. “Of course, buyers have to react first.”

The US curbs come after a prolonged push by the Biden and Trump administrations to get Asian refiners to stop buying Russian crude, efforts that have so far failed to halt the trade. Russia exported about 7.3 million barrels a day in August, translating to around 7% of global crude and refined fuels consumption, according to the International Energy Agency.

©2025 Bloomberg L.P.