Oil Steadies as Supply Glut Outlook, US-China Tensions in Focus

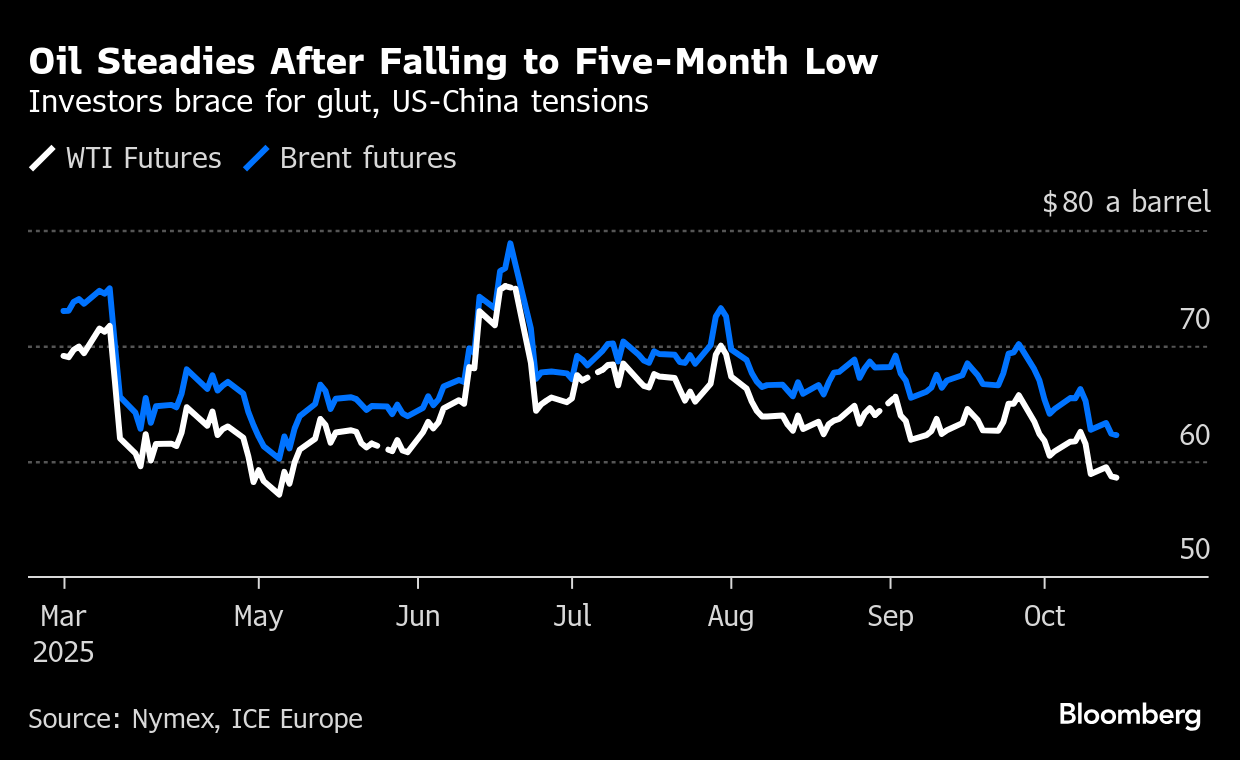

(Bloomberg) -- Oil steadied after falling to a five-month low Tuesday on expectations for a supply glut and escalating US-China trade tensions.

Brent traded near $62 a barrel after sliding 1.5% in the previous session, while West Texas Intermediate was below $59. The International Energy Agency said on Tuesday the global oil market will be oversupplied by almost 4 million barrels a day next year, an increase of nearly a fifth from its previous forecast.

Investors are also bracing for any further retaliation between the world’s two biggest economies, as US President Donald Trump said he might stop trade in cooking oil with China. That came after Beijing sanctioned the US units of a South Korean shipping giant. There were some conciliatory tones, however, with US Trade Representative Jamieson Greer predicting the tensions with China would ease, following the latest talks.

Oil has shed about 17% this year as a bid by the OPEC+ alliance to regain market share by returning shuttered production faster than expected added to the concerns of oversupply. The long-anticipated glut is finally here and is likely to depress prices going forward, executives from top trading firms including Gunvor Group and Trafigura said at an industry event in London.

“The drop below $65 was the beginning of a price reset that will see Brent below $60,” said Robert Rennie, head of commodity and carbon research at Westpac Banking Corp., adding that both OPEC and the IEA pointed out rising production in their monthly reports, “The current glut in crude markets is about to get a whole lot worse.”

Some market metrics are also flashing softness. A closely watched timespread — the gap between the two nearest December contracts for Brent — has flipped into contango, a bearish structure where nearer-term supply is cheaper than that further out.

Meanwhile, Federal Reserve Chair Jerome Powell signaled the US central bank is on track to deliver another quarter-point interest-rate cut later this month. Crude could benefit from the spur to economic activity, as well as any weakening of the US currency.

©2025 Bloomberg L.P.