Oil Set for Large Weekly Loss Ahead of OPEC+ Meeting on Supply

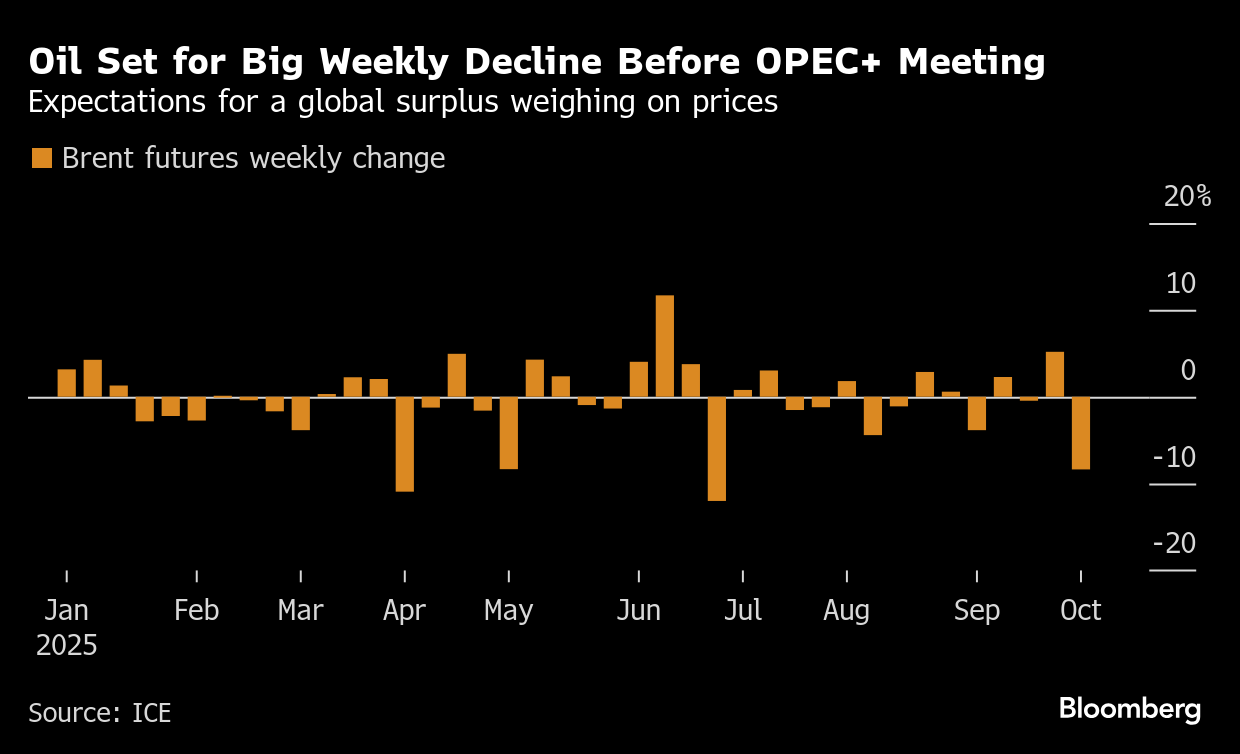

(Bloomberg) -- Oil was on track for the biggest weekly decline since late June, ahead of an OPEC+ meeting that’s expected to result in the return of more idled barrels, exacerbating concerns around oversupply.

Brent traded near $65 a barrel, down around 8% for the week, while West Texas Intermediate was below $61. The alliance is scheduled to meet online on Sunday to make a decision on output for November, and could discuss fast-tracking supply hikes as the group seeks to reclaim market share.

There are already early signs that global oversupply may be emerging in the Middle East, and the International Energy Agency expects the glut to swell to a record next year — in part due to the return of OPEC+ production. Some Wall Street banks predict Brent will slide into the $50s-a-barrel range.

The Organization of the Petroleum Exporting Countries raised production by 400,000 barrels a day in September, formally unwinding output cuts made by the group and its allies in 2023, according to a Bloomberg survey. Saudi Arabia increased supply exactly in line with their OPEC+ quota for the month.

“We believe September marked a turning point, with the oil market now heading towards a sizeable surplus,” JPMorgan Chase & Co. analysts including Natasha Kaneva wrote in a research note.

©2025 Bloomberg L.P.