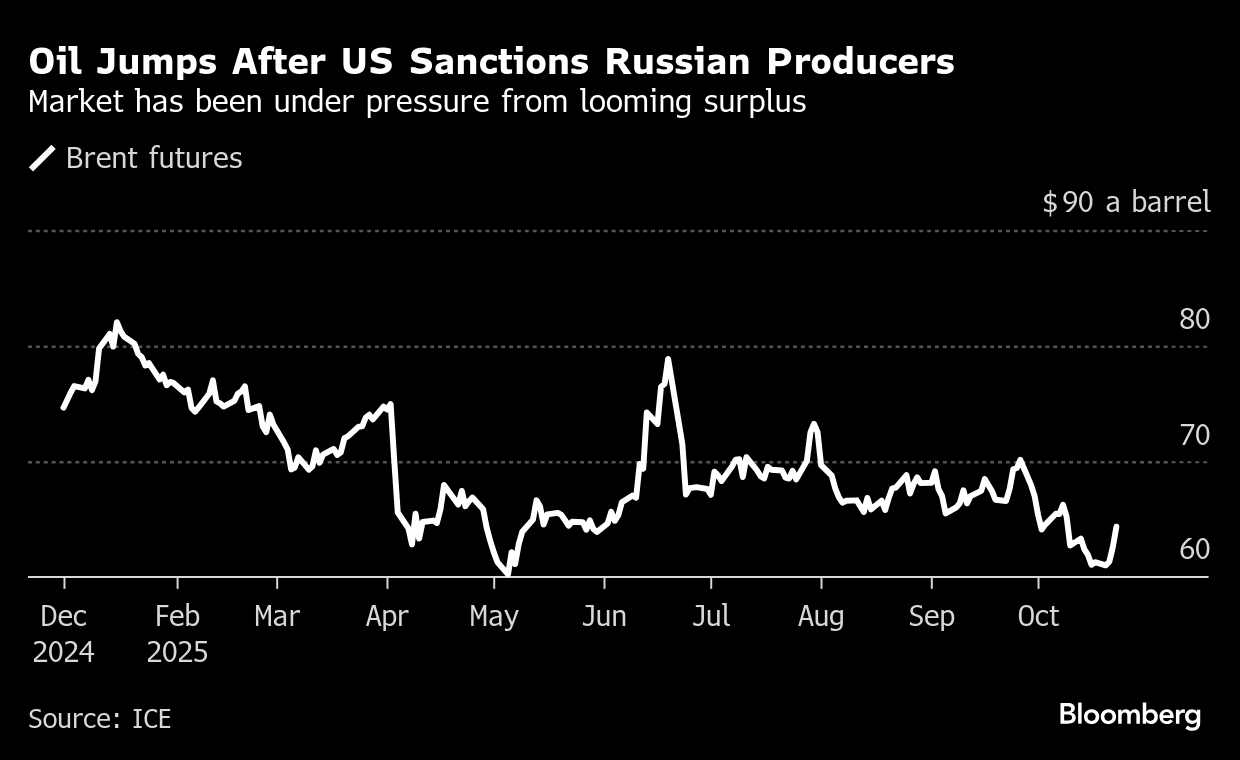

Oil Jumps as Trump Steps Up Pressure on Russia With Sanctions

(Bloomberg) -- Oil surged after the US announced sanctions on Russia’s biggest producers, as President Donald Trump ramps up pressure on his counterpart Vladimir Putin to negotiate an end to the war in Ukraine.

Brent advanced more than 3% to trade above $64 a barrel and West Texas Intermediate rallied past $60 after the US blacklisted state-run giant Rosneft PJSC and Lukoil PJSC, citing Moscow’s lack of commitment to peace in Ukraine. Senior refinery executives in India — a key buyer of Russian crude — said the restrictions would make it impossible for flows to continue.

The sanctions mark a U-turn for Trump, who had announced last week he would meet Putin in the coming weeks and said repeatedly he believed Russia wanted to end the war. But on Tuesday, he said he didn’t want a wasted meeting.

The penalties “mark a shift in President Trump’s approach to Russia and open the door for tougher sanctions down the road, which could ultimately impact Russian oil flows,” said Warren Patterson, the head of commodities strategy for ING Groep NV in Singapore. “The uncertainty is how effective these sanctions will be and what impact they actually have” on exports, he added.

Following the measures, Trump said he planned to speak to Chinese President Xi Jinping about the nation’s buying of Russian oil at a planned meeting next week in South Korea. On Tuesday, the US leader said India’s Prime Minister Narendra Modi assured him that the country would wind down its purchases.

The two nations became the biggest buyers of Russian oil following the war in Ukraine as other countries shunned Moscow for its invasion. Trump hit India with crushing tariffs for the trade, but has spared China from any action. Last week, the UK slapped sanctions on two Chinese energy firms that handle Russian energy, along with penalties on Rosneft and Lukoil.

“This is definitely one of the more meaningful measures the US has taken, but I think it will be blunted by the widespread use of illicit financial networks,” said Rachel Ziemba, an analyst at the Center for a New American Security in Washington. “It really comes down to whether China and India are afraid of further escalation in secondary sanctions.”

Rosneft, headed by Putin’s close ally Igor Sechin, and privately held Lukoil are the two largest Russian oil producers, jointly accounting for nearly a half of the nation’s total exports, according to Bloomberg estimates. Taxes from the oil and gas industries account for about a quarter of the federal budget.

The US measures are a radical change of policy, where previous efforts included a Group-of-Seven price cap on Russian oil that sought to limit revenue for the Kremlin without disrupting supply and causing a spike in global prices.

“The market will take time to digest exactly what this means,” said Vandana Hari, the founder of market analysis firm Vanda Insights, adding that it’s likely to be “a major cause of concern for the refiners in India and China.”

Separately, European Union countries have reached an agreement on a new package of Russian sanctions that are expected to be adopted on Thursday. The measures will target 45 entities that have helped the OPEC+ producer evade penalties, including 12 companies in China and Hong Kong, according to a statement from Denmark, which holds the EU’s rotating presidency.

Brent has bounced back from a five-month low reached on Monday, but remains on track for a third monthly loss due to indications an expected global surplus is starting to emerge. Futures rebounded on Wednesday on signs the latest selloff was overdone and as US inventories shrunk.

©2025 Bloomberg L.P.