Oil Holds Sharp Drop With Focus on Gaza Plan and Global Supply

(Bloomberg) -- Oil held the biggest decline in a week on cautious optimism about easing tensions in the Middle East and the outlook for supply.

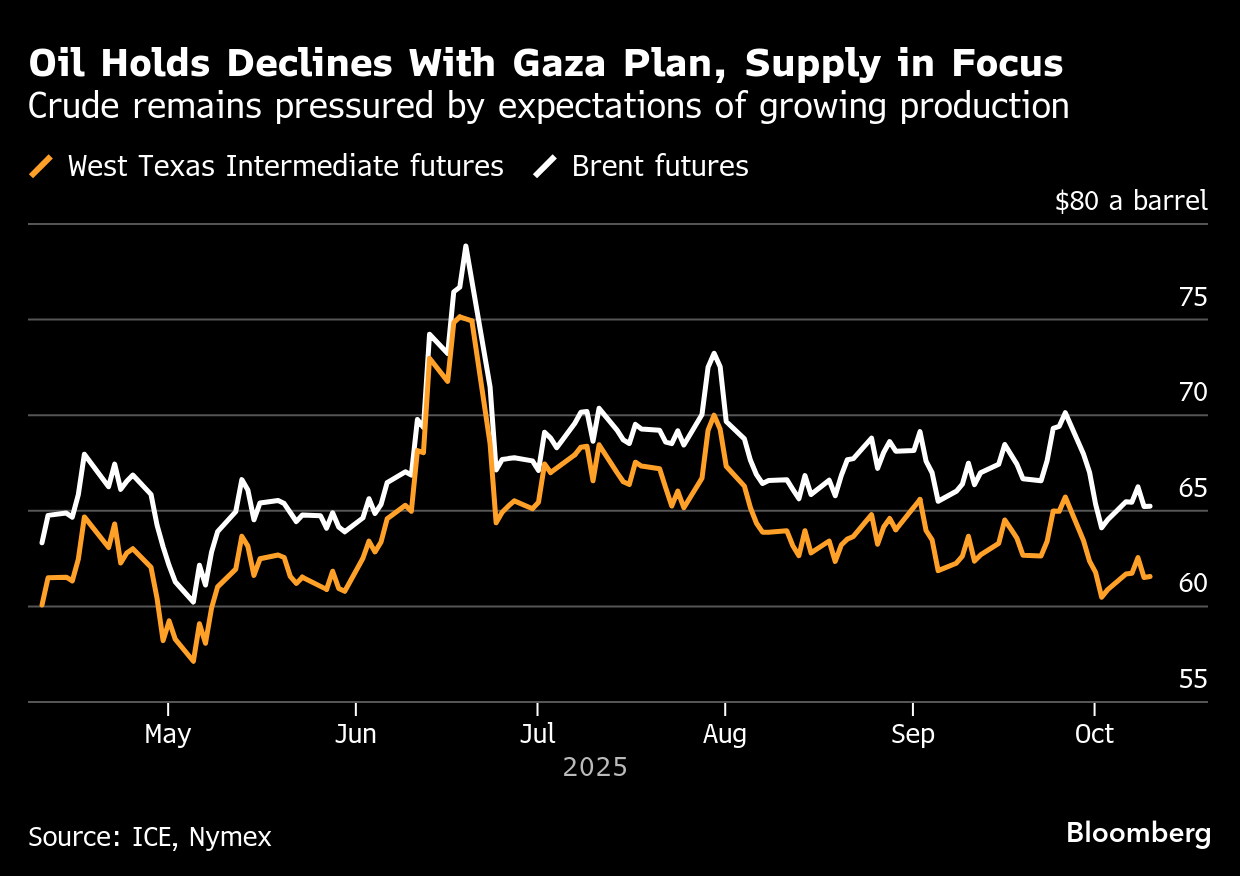

Brent traded near $65 a barrel after closing 1.6% lower on Thursday, while West Texas Intermediate was below $62. Israel approved a framework that would see Hamas release hostages in exchange for prisoners, a major step forward for a peace agreement to end the bloody conflict in Gaza.

The hostilities have destabilized the Middle East and progress toward a peace deal could siphon the remaining war premium out of prices, just as the market faces pressure from a looming surplus into year-end.

On Sunday, OPEC+ agreed to raise production quotas again as the group seeks to reclaim market share. Still, the 137,000-a-day output boost for November was less than some of the figures reported in the lead up to the group’s meeting, which prompted a relief rally in prices at the start of the week.

The surplus is being fueled by additional supplies from the Organization of the Petroleum Exporting Countries and its allies, along with oil from producers in the Americas, including the US. The broad mood remains bearish, though there are discrepancies about how gloomy crude’s prospects are, according to Citigroup Inc., which summarized views from clients.

OPEC+’s increased production targets shouldn’t “automatically lead to a fall in oil prices,” ANZ Group Holdings Ltd. analysts Daniel Hynes and Soni Kumari wrote in a note. “Supply-driven surpluses are rarely unexpected, so the market usually prices in the surplus well in advance.”

Meanwhile, the US has sanctioned more than 50 individuals, firms and vessels involved in the Iranian energy trade, including a key crude-import terminal and a privately-owned Chinese refinery. It’s the latest in a series of penalties this year that have targeted companies in the Asian nation.

©2025 Bloomberg L.P.