Oil Holds Losses as Investors Digest Growing Oversupply Evidence

(Bloomberg) -- Oil edged down slightly amid signs of easing tensions between the US and China, while traders took stock of mounting evidence that a long-anticipated surplus is finally starting to emerge.

West Texas Intermediate was little changed to settle near $57 a barrel as investors rolled over positions ahead of the November contract’s expiry this week, adding to choppy trading. US President Donald Trump earlier expressed optimism about a potential deal between the world’s top oil consumers. Enthusiasm surrounding this development was limited, though, as oil stored on tankers rose to a fresh high, among the most tangible signs yet that markets are oversupplied.

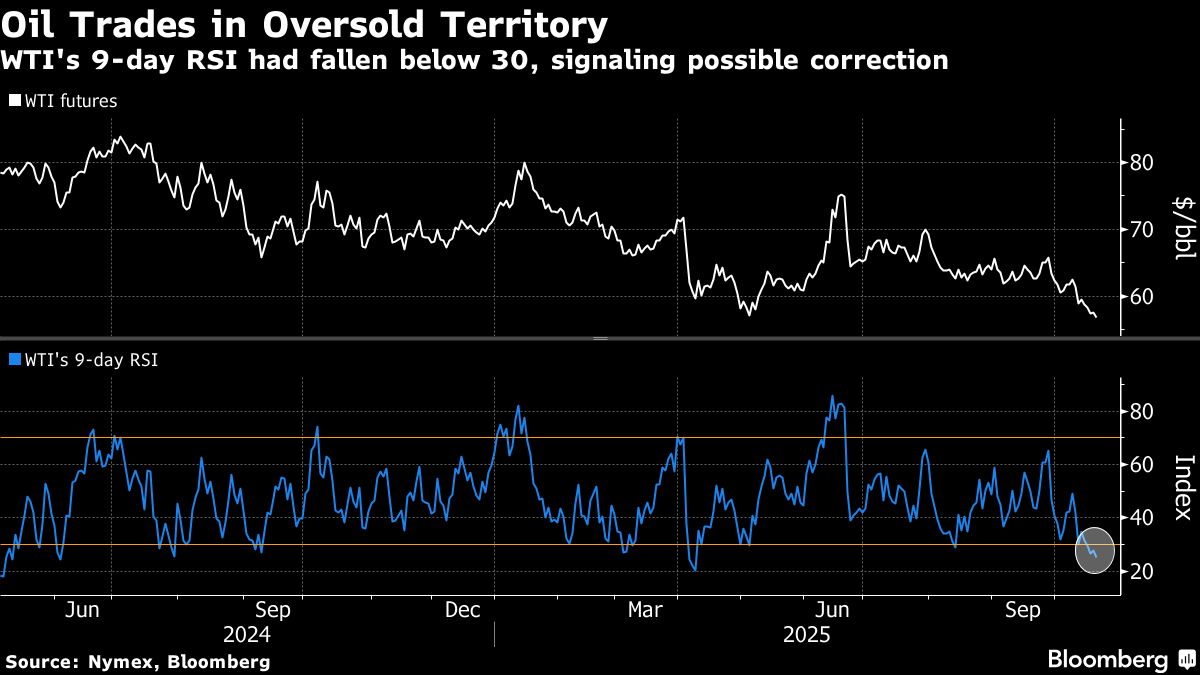

Oil futures have tumbled more than 20% from their summer highs as the Organization of the Petroleum Exporting countries and its allies ramp up production, while major forecasters project a flood of supplies continuing into next year.

Even so, WTI earlier edged into oversold territory on the nine-day relative strength index for the first time since May, a possible indication that prices lurched lower too fast. It also suggests a reversal may be in the cards.

“Crude futures continue to trade on the defensive amid ideas a looming supply surplus is near,” said Dennis Kissler, senior vice president for trading at BOK Financial. Price support for WTI rests at around $56.15, though a close below $55 risks a further price slide, he added.

Geopolitical forces are also at play. Prices have been weighed down by limited progress toward a de-escalation of the war in Ukraine, a scenario that could push oil toward $50 a barrel, according to Citigroup Inc. President Donald Trump last week said he would hold a second meeting with Russia’s Vladimir Putin seeking to end the conflict, though previous talks have done little to stem the hostilities.

Meanwhile, China’s economy slowed for a second straight quarter, undermined by reduced consumer and company spending, though Beijing signaled its full-year growth goal of about 5% is still on track.

Other key market metrics are softening. The US benchmark’s December-January time spread for the first time since May flipped into contango, a bearish pricing pattern that’s characterized by nearer-term contracts trading at a discount to longer-dated ones. The spread between the two nearest December contracts flipped into a bearish contango structure in October.

©2025 Bloomberg L.P.