Crude Oil Steady With Trade Talks and Surplus Concerns in Focus

(Bloomberg) -- Oil steadied as progress between the US and China on trade that aided the outlook for demand was offset by concerns about a glut.

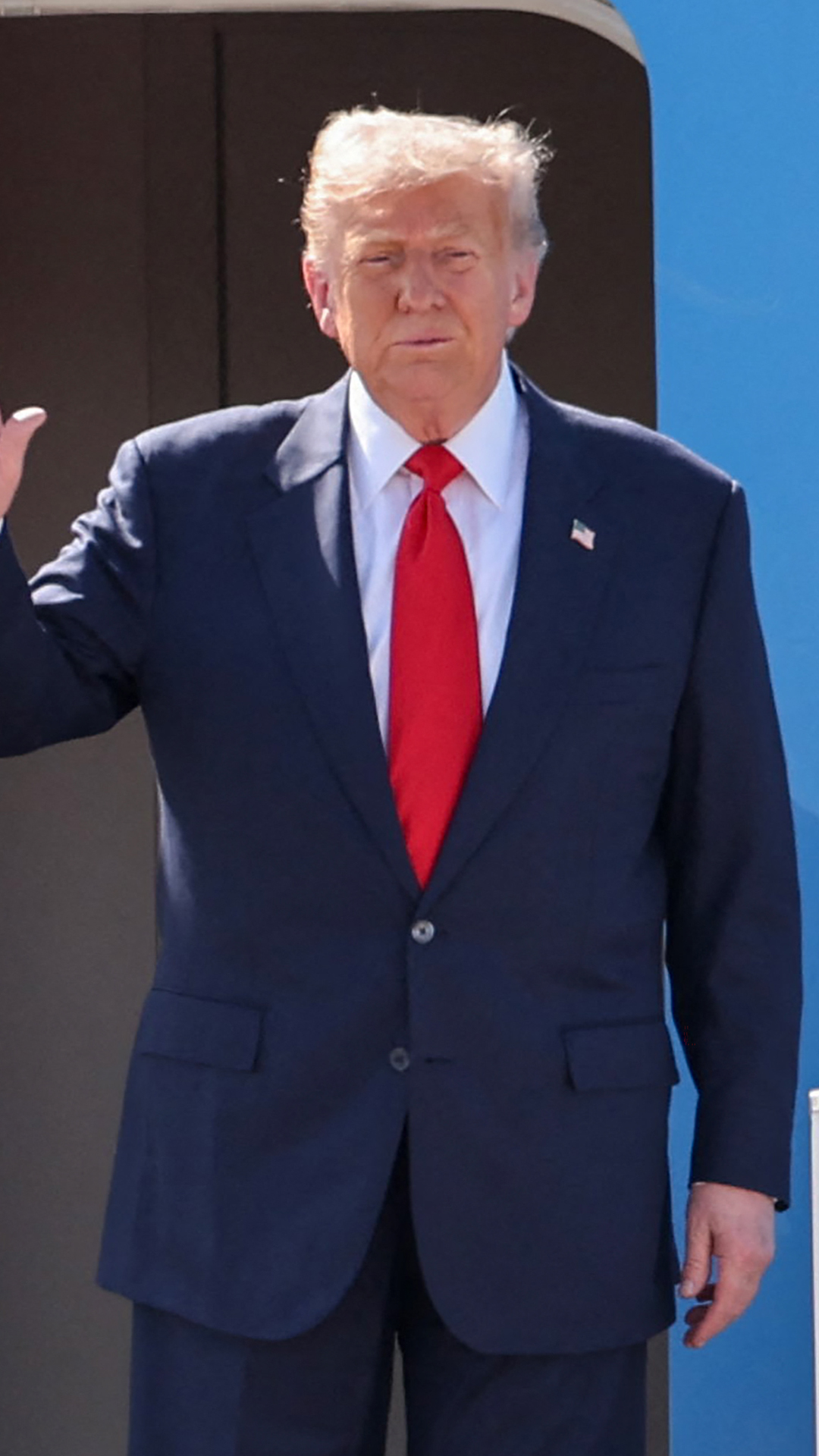

Brent was little changed below $66 a barrel after paring an early move higher, while West Texas Intermediate was near $62. Top negotiators said they came to terms on a range of points, setting the table for President Donald Trump and counterpart Xi Jinping to finalize a deal. The leaders will meet on Thursday.

Trump’s threat of 100% tariffs on Chinese goods “is effectively off the table,” Treasury Secretary Scott Bessent told CBS News. The US and China are the world’s largest economies, and moves to defuse trade tensions that have rattled global markets would be a positive for global economic growth.

Oil rebounded from a five-month low last week — with Brent rallying by almost 8% — after US sanctions on Russia’s two biggest crude producers helped to counter the narrative of a building global surplus. Still, with the OPEC+ alliance continuing to add barrels, and some members including Kuwait suggesting there could be further increments, the concerns about a glut remain.

“Hope of an imminent US-China trade deal is a plus for economic and oil-demand sentiment — it is layering on top of the Russia risk premium this morning,” said Vandana Hari, founder of Singapore-based market analysis firm Vanda Insights. “But I expect the backdrop of excess supply will limit gains. Brent may return to its previous comfort zone in the high-$60s.”

The US administration’s plan in sanctioning Rosneft PJSC and Lukoil PJSC, part of broader efforts to force an end to the war in Ukraine, is to make Russia’s trade harder, costlier, and riskier — but without forcing a sudden supply shock that might spike prices, according to officials familiar with the matter.

©2025 Bloomberg L.P.