Argentina’s Markets Surge as Milei Win Eases Fear of a Crisis

(Bloomberg) --

Argentina’s markets rallied sharply after President Javier Milei’s party pulled off a surprisingly strong victory in Sunday’s legislative elections, defying investor fears of a setback that would jeopardize his free-market overhauls and push the nation toward another economic crisis.

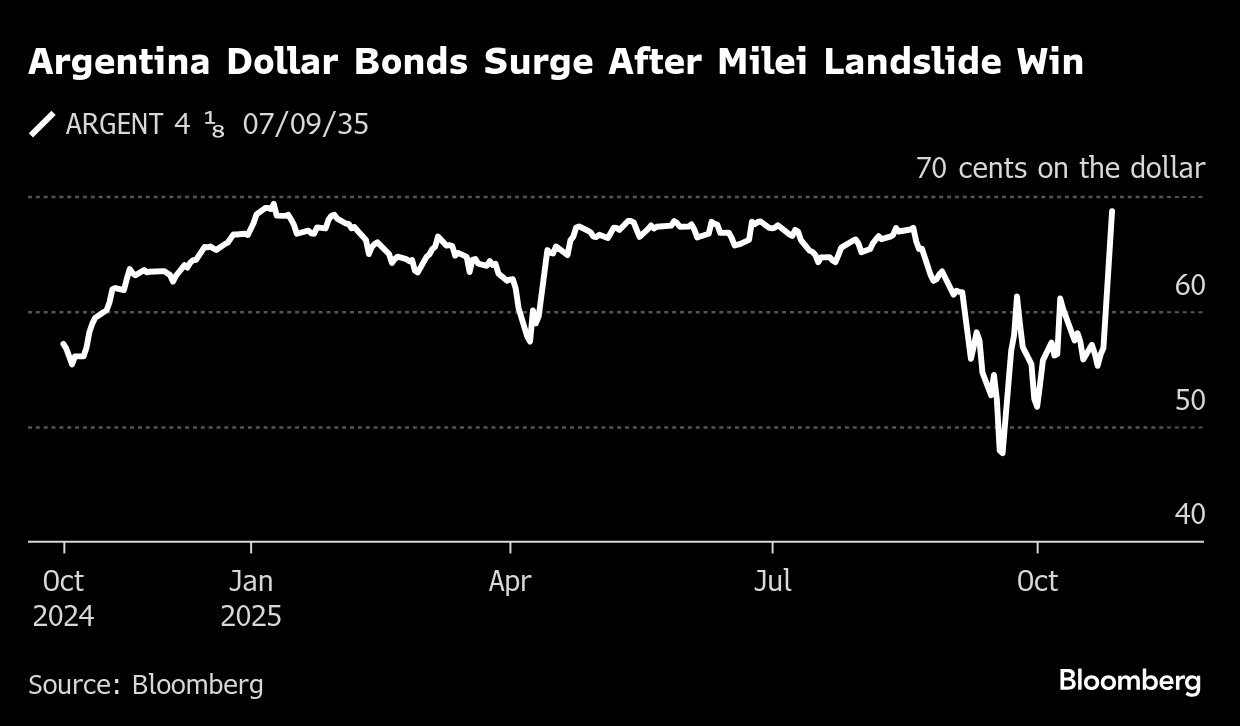

The government’s bonds — which had tumbled ahead of the vote — rose across maturities, with dollar-denominated notes due in 2035 surging as much as 14 cents to 71.26 cents on the dollar. Meanwhile, the country’s main stock benchmark soared as much as 23%, its biggest jump since Milei was first elected in Nov. 2023. The peso ended the session 3.8% higher, paring an advance of much as 10% seen at the open.

The rebounds pull Argentina back from the brink of what had been a steadily building crisis as global investors yanked out cash on speculation that Milei’s ability to push through deeper reforms could be derailed by a resurgent opposition. The pressure grew so strong that the Trump administration took the unusual move of stepping in to buy the peso as Argentina burned through its reserves to prop up up, seeking to prevent Milei from being engulfed by a market panic ahead of the pivotal referendum.

But Milei made a significant comeback to secure 41% of the vote, well ahead of the main opposition party, according to the most recent tally. Markets had been doubtful he would be able to secure much more than one-third of the seats, the level needed to ensure he could veto legislation.

“Yesterday’s outcome exceeded our best-case scenario, and as a result, bond prices are sharply recovering and breaking above historical highs,” said Adcap Grupo Financero’s head of strategy Javier Casabal.

Argentina’s financial markets had been hammered by waves of selling since last month, when the drubbing Milei’s party suffered in a local election was seen as a harbinger of a more significant defeat in Sunday’s vote. As investors pulled out and the nation’s residents rapidly shifted their savings into dollars, the peso tumbled, fanning fears that Argentina was veering toward the sort of crisis that has upended its economy off and on for decades.

The pressure forced Argentina to use up its reserves buying pesos to keep it within its trading band and led the Trump administration to step in with a $20 billion rescue line. US Treasury Secretary Scott Bessent welcomed the election results and indicated it may allow the US to pull back on its intervention by preventing a run on the nation’s markets.

“Now I think the market is going to take care of itself,” Bessent told reporters on Air Force One, as he accompanied President Donald Trump on his trip to Asia. Trump said the US would consider more support for Argentina if it is needed.

Anthony Simond, a money manager at London-based Aberdeen Asset Management Plc, said “it’s too early to talk about an unwind” of US support, given that Argentina has some significant external debt repayments coming up in January, which may need some US help.

“Maybe the US does not need to intervene directly in the FX market anymore,” he said.

Milei’s ascent to power in 2023 had unleashed a powerful rally across Argentina’s markets, lifting everything from stocks to sovereign bonds, on anticipation that his plans to slash spending and regulations would revive an economy that’s been hobbled by high inflation, an unstable currency, and periodic government debt defaults.

But those gains began to rapidly unravel last month after Milei’s poor showing in the Buenos Aires local election was seen as a sign that his support had been significantly eroded by the scale of his spending cuts and a corruption scandal that touched his inner circle.

Yields on sovereign notes due 2035 skyrocketed past 17%, while the currency slumped as much as 7% in a single session as investors questioned Milei’s ability to get enough support in Congress to push through his extensive economic agenda.

“In recent months, there has been a decent position reduction from investors across Argentine bonds, as concerns around Milei’s popularity raised questions around his ability to continue with much needed reforms,” Mike McGill, co-head of emerging market debt and senior portfolio manager at Aviva, wrote in a note. “We expect money to flow back into the bond market post this result.”

Such an influx was evident across Argentina’s markets on Monday, elevating assets of all stripes. The peso jumped to as much as 1,341 to the dollar after closing at 1,492 on Friday. The attention now shifts to whether Milei will seize on the election victory to overhaul his approach to the currency, including potentially widening the trading bands to allow it to depreciate.

“It would be a mistake not to take advantage of this rare ‘alignment of planets’ to take the final step, lifting capital controls leftovers and allowing for a wider FX band. Still, we believe the economic team will refrain from policy changes, at least in the immediate term,” Pedro Siaba Serrate, head of research and strategy of PPI Argentina, wrote in a note on Monday.

What Bloomberg Strategists say...

“The result should go a long way to reassuring investors that Argentina won’t return any time soon to the statist economic nationalism espoused by Cristina Fernandez de Kirchner and Axel Kicillof. ...It will be a lot easier for authorities to meet the $3.2 billion in bond payments that are due in December and January; the market may even allow the country to refinance that debt.”

— Sebastian Boyd, Macro Strategist, Markets Live. For the full analysis, click here.

Ahead of the vote, strategists at some of Wall Street’s main banks were betting Milei would get a third of the vote. That would be enough to secure the president’s veto powers and limit Congress from derailing his plans. For investors, US support combined with a more pragmatic, moderate shift from Milei, could be enough to stabilize Argentina’s markets.

The decisive victory puts Milei’s party “in good shape” to negotiate with other groups to pass reforms, according to Joaquin Bagues, managing director at local broker Grit Capital Group.

“Let the party begin,” he said.

(Updates pricing on second paragraph.)

©2025 Bloomberg L.P.