UK Keeps Oil and Gas Windfall Tax in ‘Bitter Blow’ to Sector

(Bloomberg) -- The UK government will stick with a controversial windfall tax for North Sea oil and gas producers until the end of the decade, dismissing complaints that the levy hurts investment and jobs.

The Energy Profits Levy will be replaced in March 2030 by a new tax that only kicks in when prices are unusually high, according to the UK’s budget announcement Wednesday. The industry had been pushing for the change as early as next year, saying faster reform was needed to unlock investments and boost output.

The decision comes as Chancellor of the Exchequer Rachel Reeves looks to raise billions of pounds to shore up public finances, which have been squeezed by higher borrowing costs and U-turns over welfare cuts. It delivers a “bitter blow” to the nation’s energy industry, according to lobby group Offshore Energies UK.

“Today, the government turned down £50 billion of investment for the UK and the chance to protect the jobs and industries that keep this country running,” OEUK Chief Executive Officer David Whitehouse said in a statement. “This is not over. We will keep pressing for change.”

The Labour Party, which committed in its 2024 manifesto not to issue any new exploration licenses, did offer an olive branch Wednesday, saying it will allow “limited” new production that links back to existing fields and infrastructure. With no new exploration allowed, the areas must be “well understood,” it said.

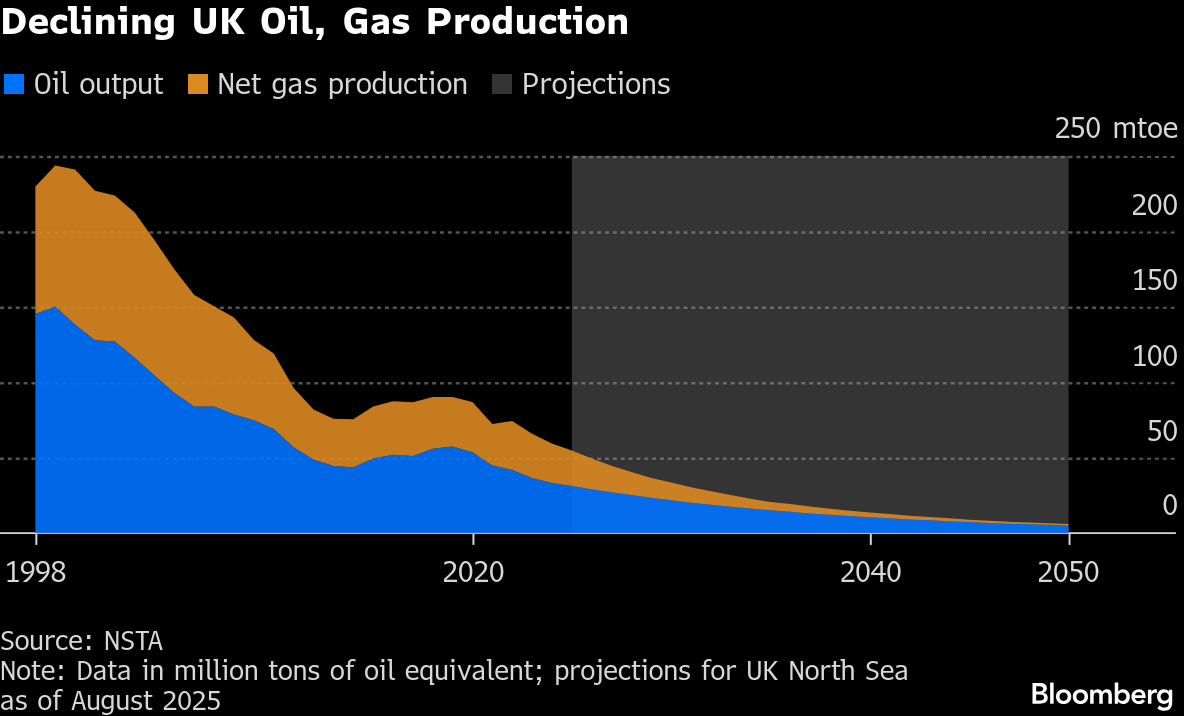

Yet research group Carbon Tracker dismissed the measure as insignificant, saying the “overall direction of travel for investors is clear: a rapid decline of the old energy order.”

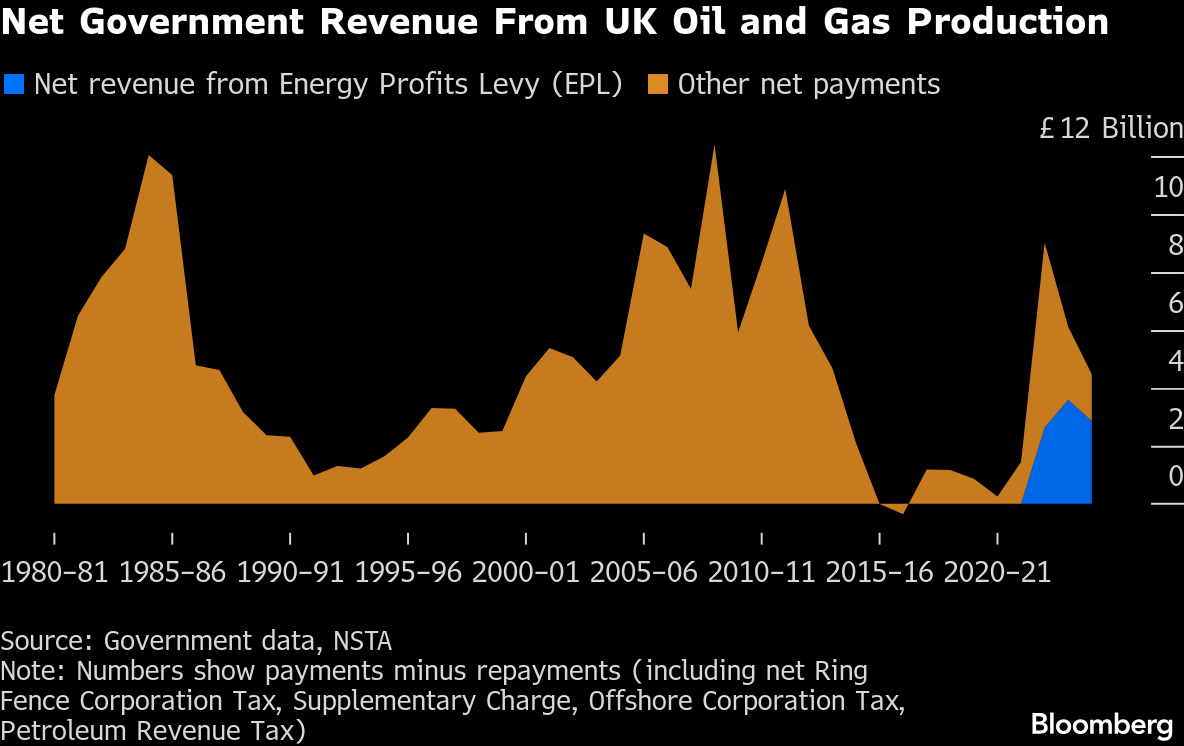

Energy Profits Levy

The EPL was introduced by the previous Conservative government more than three years ago when Russia’s invasion of Ukraine drove up energy prices, swelling profits for oil and gas producers. While prices have since retreated, the tax has remained in place — and even increased — to buoy state coffers.

Last year’s EPL hike to 38% brought the headline tax rate for the oil and gas sector to 78%, making Britain less attractive for investment, producers said. Many of them, already suffering declines at mature North Sea fields, have reassessed their UK activities, opting to sell, merge or scale back operations.

“The budget announcements were a missed opportunity to kick-start investment across the UK North Sea, and there is no justification for maintaining the EPL to 2030,” a spokesperson for producer Serica Energy Plc said in a statement. “We will continue to press the government to replace the EPL as soon as possible.”

The planned Oil and Gas Price Mechanism, which will eventually succeed the EPL, will be revenue-based and apply a tax rate of 35% when oil exceeds $90 a barrel or gas tops 90 pence a therm, the government said. The OGPM will only be brought in earlier than 2030 if both oil and gas fall below a certain price floor.

A statistical analysis by Offshore Energies UK showed this week that reforming the EPL in 2026 rather than at the end of the decade could actually raise tax receipts by £15.7 billion ($20.8 billion) to £48.6 billion within 10 years.

The group said Wednesday that as many as 40,000 jobs in the oil and gas industry and across its supply chain are at risk over the next four years with the EPL remaining in place.

“Waiting four years for reform of this tax is too late,” Whitehouse said. “The North Sea continues to be one of the least competitive places for our industry in the world.”

(Updates with comment from lobby group starting in fourth paragraph.)

©2025 Bloomberg L.P.