Surging Stockpiles of Niche Fuels Are Rewriting Oil Market Math

(Bloomberg) -- Ballooning inventories in a niche corner of the fuel market are compounding the global oversupply of oil and complicating the outlook for benchmark crude prices.

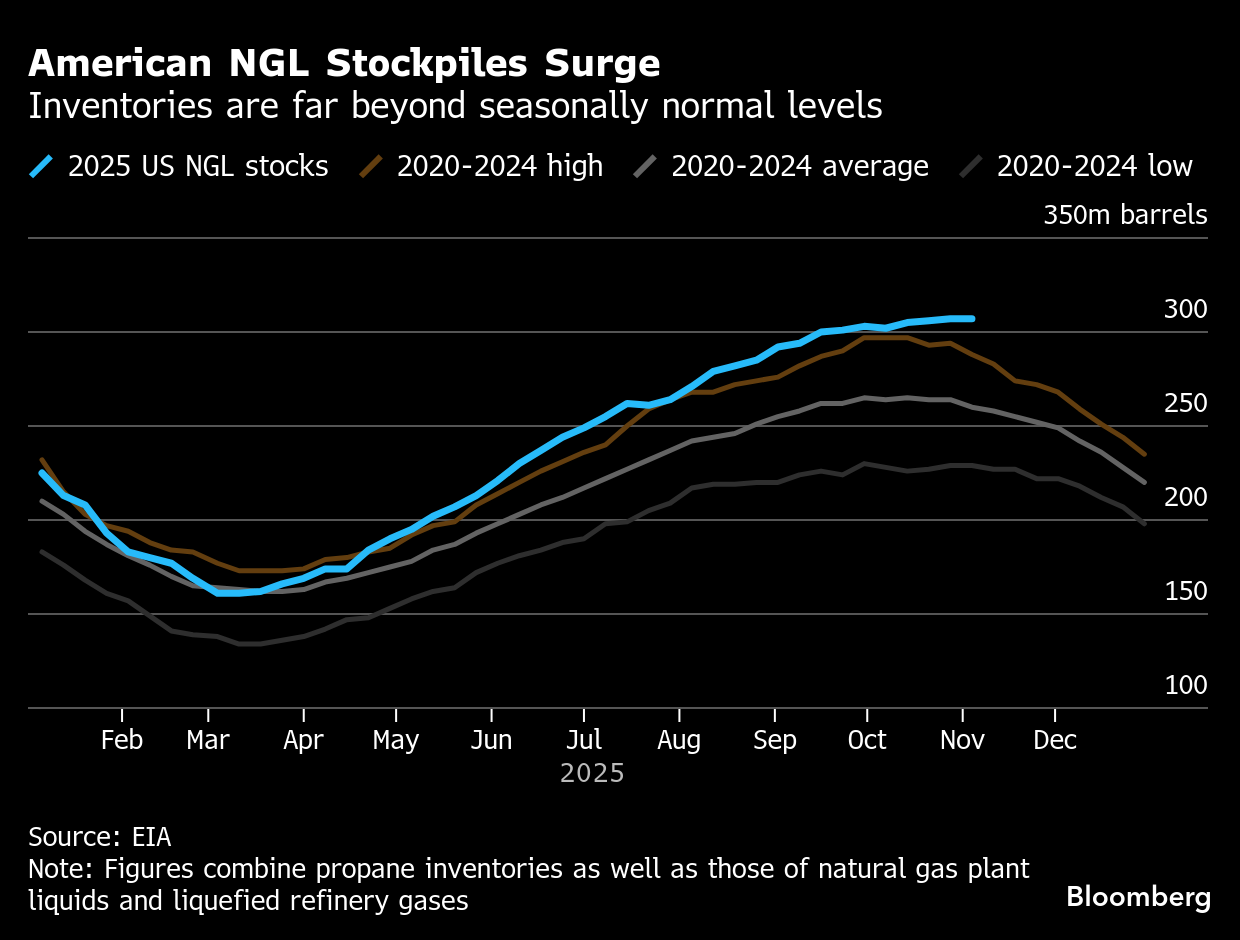

US stockpiles of these fuels — collectively known as natural gas liquids, or NGLs — have climbed to 309 million barrels, according to US Energy Information Administration data. That’s the highest level on record for the time of year.

It’s an issue for the broader market because NGLs often get lumped together with crude and refined fuels when calculating global supply and demand. That means the growth in these inventories is now reshaping the oil balance.

But while the extra barrels contribute to total oil volumes, they have less influence on benchmark crude prices, which are set by trading at a handful of key global hubs. That disconnect is creating challenges for anyone trying to read the pulse of the market.

“Natural gas liquids have dominated both supply and demand growth since the pandemic,” said Toril Bosoni, head of the oil markets division at the International Energy Agency. “It’s really huge — and it’s under-appreciated by many market observers.”

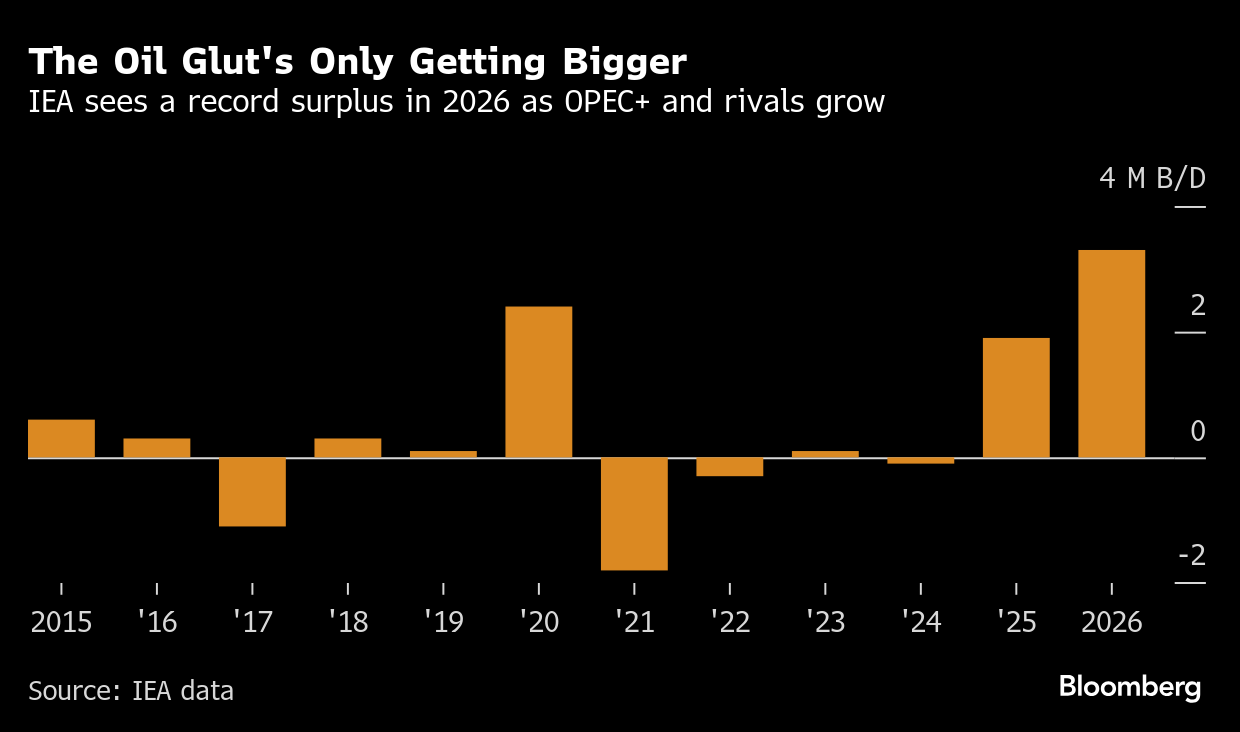

The hurdle comes as Brent crude, the international benchmark, is on pace for a third straight annual decline with experts predicting that the global oil market is tipping into surplus. The IEA in Paris estimates the world is set for an unprecedented glut next year.

Citigroup Inc. estimates that the jump in NGL stockpiles has been the second-biggest driver of the world’s expanding onshore oil inventories this year, behind China’s aggressive crude buying.

In total, the IEA projects that global oil supplies will rise by about 2.4 million barrels a day in 2026. Of that, about a fifth will come from NGLs.

Produced alongside crude oil and natural gas, NGLs include propane, butane and ethane — products often used for heating, cooking, and plastics manufacturing. The twin sources of production can make counting those barrels trickier.

Gas in Favor

Much of the boom for NGL supply has been driven by a broader shift on the US shale patch, where natural gas production has come more into favor.

The US alone is now producing more than 7.5 million barrels a day of NGLs — enough to rank as the world’s fourth-largest oil producer if counted separately. That offers a boost for the Trump administration’s push to export US energy, including to China, which in recent years has gorged on American supplies of the fuels.

Further global NGL output increases will come when production begins at Saudi Arabia’s giant Jafurah gas project, slated to start by the end of the year.

Interest in gas is climbing globally because the fuel can help generate the electricity that powers data centers running artificial intelligence. Europe has also been looking to secure supplies that aren’t Russian

Between 2023 and 2026, the EIA sees US NGL supply growing almost twice as fast as the nation’s crude oil output, in volume terms.

One key driver: US shale “wells are becoming more gassy,” said Don Baldridge, executive vice president of midstream and chemicals at Phillips 66. The company moves about 1 million barrels a day of NGLs through its pipeline network in the US and exports about a third of that.

“There’s more gas per barrel of oil,” Baldridge said. “Even if you get to a flat crude outlook from a production standpoint, you’ll still have good growth from an NGL standpoint.”

Even though US crude output growth has slowed from the peak of the shale boom, production is still holding near records — and today’s wells yield far more gas per barrel than they once did.

East Daley Analytics estimates that about 1.4 million barrels a day of new ethane and liquefied petroleum gas export capacity will come online by the first half of 2028, underscoring the scope for further supply growth.

More than a third of total US liquid fuel stockpiles can now be tied to NGLs, a structural shift in the market, said Julian Renton, an analyst at East Daley.

“Long term, it’s more impactful,” Renton said. “Our Permian crude outlook is relatively flat, but we still expect NGL volumes in the region to keep growing.”

©2025 Bloomberg L.P.