Stocks Rally Late After Nvidia’s Blowout Outlook: Markets Wrap

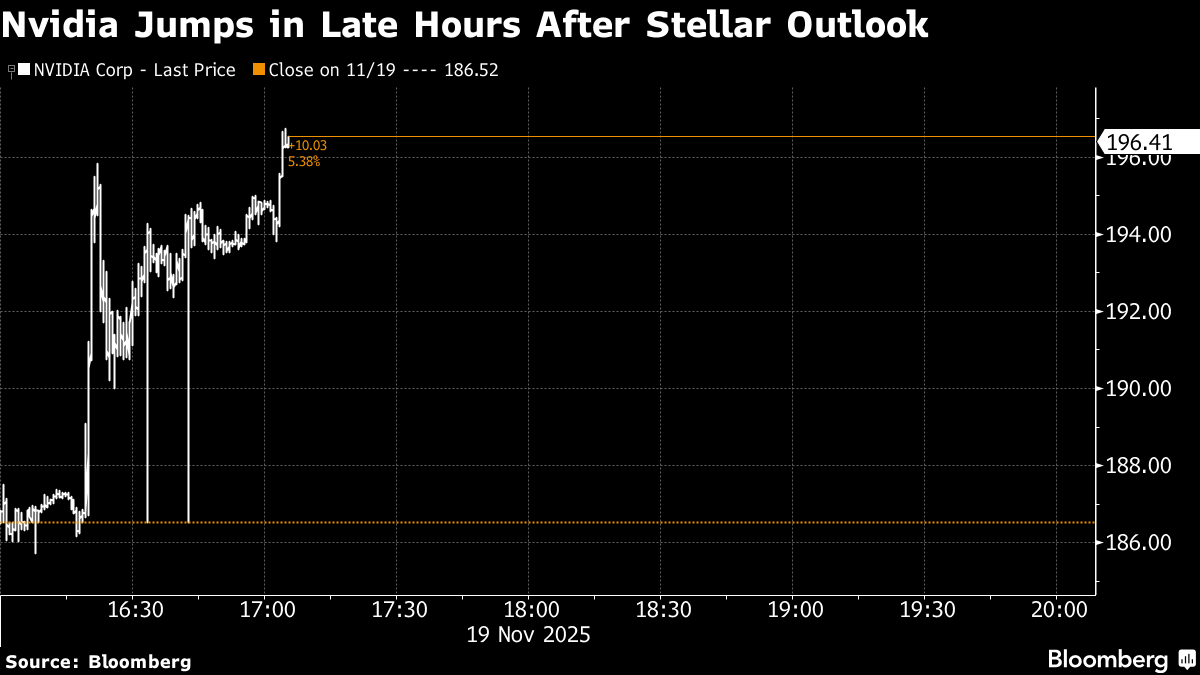

(Bloomberg) -- Shares of the world’s largest tech companies rallied in late hours on speculation that Nvidia Corp.’s blockbuster outlook will help reignite Wall Street’s artificial intelligence-driven rally.

A roughly $390 billion exchange-traded fund tracking the Nasdaq 100 advanced 1% after the close of regular trading. The giant chipmaker that’s seen as a barometer for the revolutionary technology gave a strong revenue forecast for the current period, helping counter concern that a global surge in AI spending is poised to fizzle. The shares spiked about 5%.

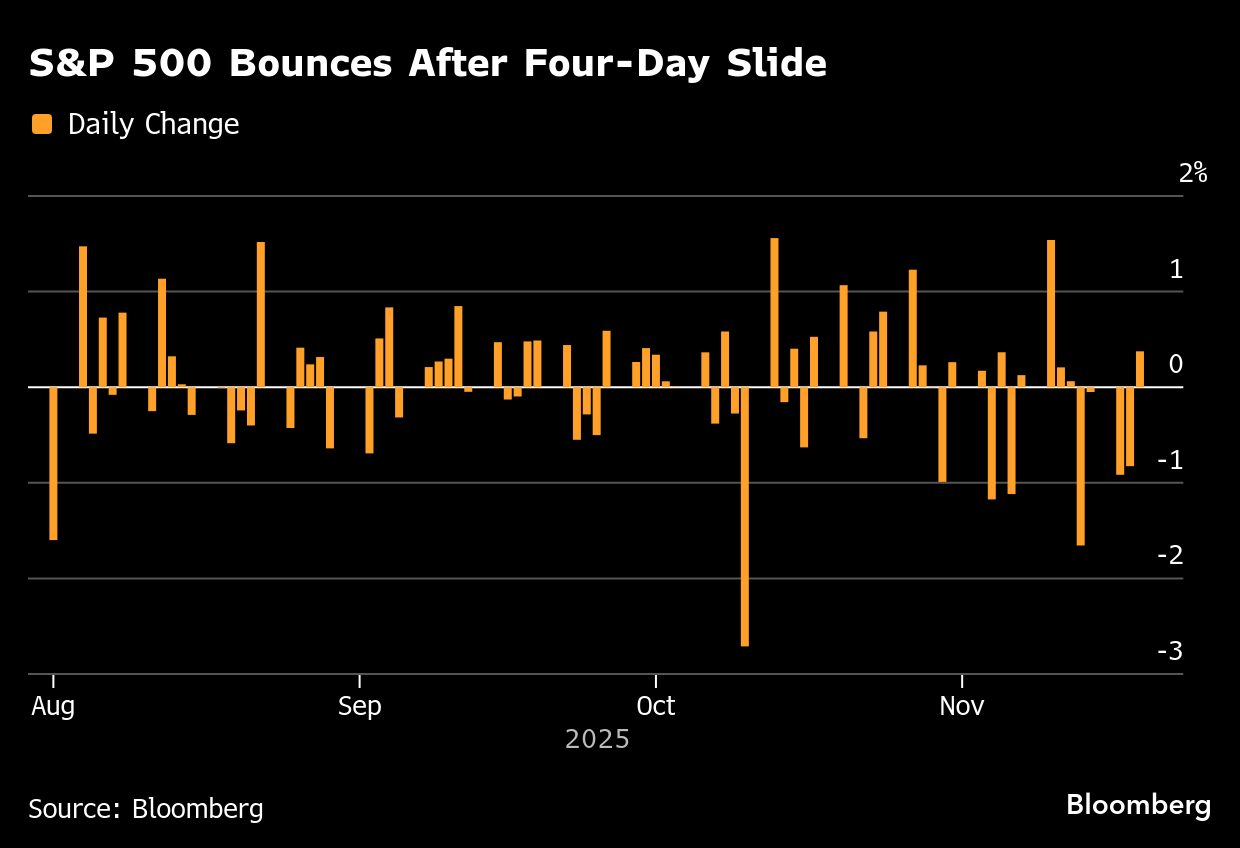

Worries over everything from the durability of the AI trade to the Federal Reserve’s policy path have contributed to a recent equity rout. With investors increasingly skittish about tech spending, how Nvidia’s results are interpreted will be key.

“Market psychology has been negative this month as investors worried that the artificial-intelligence infrastructure build out was a bubble,” said Chris Zaccarelli at Northlight Asset Management. “In the meantime, the largest technology companies in the world are extremely profitable.”

While a market pullback can happen at any time, Zaccarelli says that as long as the economy can stay out of a recession, he expects the bull market to resume and hit new all-time highs later this year and into next year.

In the run-up to results from the giant chipmaker, the S&P 500 halted a four-day slide. The dollar rose, with traders nearly pricing out a rate cut next month as the Bureau of Labor Statistics won’t publish an October jobs report, but will incorporate the payrolls figures into the November data due after the Fed’s final meeting of 2025. Bitcoin sank below $90,000.

Meantime, many Fed officials said it would likely be appropriate to keep rates steady for the remainder of 2025, according to minutes of the October meeting. The document came out on the eve of the September jobs report.

“Uncertainty is running high because of the lost data and the unclear impact of tariffs,” said David Russell at TradeStation. “There’s no consensus at the Fed with policymakers flying blind, but these minutes lean hawkish overall.”

The S&P 500 rose to around 6,642. The yield on 10-year Treasuries rose two basis points to 4.13%. Oil sank after a US government report showed rising inventories of fuel and other refined products, easing supply concerns.

Nvidia’s sales will be about $65 billion in the fiscal fourth quarter, which runs through January, the chipmaker said in a statement Wednesday. Analysts had estimated $62 billion on average, with some predictions ranging as high as $75 billion.

Compute demand keeps accelerating,” Chief Executive Officer Jensen Huang said in the statement. “AI is going everywhere, doing everything, all at once.”

Nvidia’s numbers remain extremely strong now, but there are inevitably questions whether Huang’s company has already reached its high-water mark in terms of growth and market share, noted Russell at TradeStation.

“Ongoing investments in AI, the strong financial health of today’s leading tech firms, and both the potential and growing evidence of returns on investments give us confidence in the next leg of the global equity rally in the months ahead,” Ulrike Hoffmann-Burchardi at UBS Global Wealth Management said before Nvidia’s results.

“We continue to believe that concerns over an AI bubble bursting are overblown at least for now,” Chris Senyek at Wolfe Research said before Nvidia’s results. “We remain buyers of AI-related stocks on share-price weakness.”

To Andrew Tyler, head of global market intelligence at JPMorgan Chase & Co., the recent rout in equities represents a “technical washout” that may have already ended.

“Given that there have not been any changes to the fundamental story, nor does our investment hypothesis rely on the Fed easing, we are dip-buyers,” Tyler wrote in a note to clients on Wednesday.

Bob Diamond, the former chief executive officer of Barclays Plc who now runs investment firm Atlas Merchant Capital, said turmoil in global markets in recent days resembles a “healthy correction” as investors grapple with how to assess elements of technological change.

“We would characterize the November pullback in stocks as a breather, as the market is settling into a more realistic view of the world,” said David Trainer at New Constructs.

Corporate Highlights:

- Adobe Inc. has agreed to buy the marketing software company Semrush Holdings Inc. for $1.9 billion, marking its first takeover announcement since the failed $20 billion acquisition of Figma Inc. in 2022.

- Tesla Inc. has been cleared to offer ride-hailing services in Arizona, one of the states where the carmaker eventually aims to operate a robotaxi business.

- Elon Musk said his xAI artificial intelligence startup plans to develop a 500 megawatt data center in Saudi Arabia with the kingdom’s state-backed AI venture Humain that will rely on chips from Nvidia Corp.

- Brookfield Asset Management Ltd. is targeting $10 billion of fund commitments for a global artificial-intelligence infrastructure program in partnership with Nvidia Corp. and the Kuwait Investment Authority.

- Amazon.com Inc. lost a European Union court fight against regulators’ efforts to draw it under the scope of its digital content rulebook.

- Meta Platforms Inc. warned of significant difficulties identifying and removing underage users as it prepares to comply with Australia’s world-first social media ban for under-16s next month.

- Lowe’s Cos. reported profit that topped expectations on a pickup in online sales and growth in demand from professional contractors.

- Target Corp.’s lengthy slump persisted in the third quarter, underscoring the numerous obstacles the big-box retailer’s incoming chief executive officer faces — from intense competition to a weakening economy.

- TJX Cos. posted sales last quarter above estimates and raised its outlook, signaling that US shoppers are turning to cheaper options as the economy shows signs of stress.

- La-Z-Boy Inc., a home furniture retailer, reported both sales and adjusted earnings per share that beat Wall Street’s expectations.

- United Airlines Inc. shelved two municipal bond issues as the volatility hitting other asset classes makes a rare appearance in the state and local government debt market.

- Abbott Laboratories is nearing a potential acquisition of cancer screening company Exact Sciences Corp., people familiar with the matter said, in what could be the biggest deal of the year in the global health-care sector.

- Constellation Energy Corp.’s plan to restart its shuttered Three Mile Island nuclear plant is getting $1 billion in backing from the US government as the Trump administration pushes to add more atomic power on the electric grid.

- Kraken has filed confidentially for a US IPO, laying the groundwork for the crypto exchange operator to go public as soon as next year.

- WH Smith Plc’s Chief Executive Officer Carl Cowling resigned, as an accounting error forced the British retailer to cut its profit outlook in North America for a second time.

- Porsche AG unveiled an electric version of its popular Cayenne sport utility vehicle, one of the models developed under an ambitious EV push that the luxury-car maker has since scrapped.

- Glencore Plc’s ferrochrome venture in South Africa will start cutting jobs at its last active smelter, blaming the government’s failure to provide cheaper energy to help it vie with fierce competition from Chinese facilities.

- Deutsche Lufthansa AG and IAG SA plan to submit expressions of interest in Portugal’s TAP SA in the coming days, according to people familiar with the matter, joining Air France-KLM in the bidding process for part of the state-owned carrier.

- Ubisoft Entertainment SA said that it will release its results for the fiscal first half before trading opens on Friday, after unexpectedly postponing their publication on the scheduled release day last week.

- Shares in Vivendi SE slumped on Wednesday after Le Monde reported that billionaire Vincent Bolloré’s eponymous holding company could escape having to pay anything to compensate minority shareholders over the recent split of the group.

- Moët Hennessy won a lawsuit against its former finance chief after LVMH’s drinks unit accused him of violating a non-disclosure agreement that he signed last year as part of his settlement when he was dismissed.

- Prada SpA is preparing to revamp Versace by putting Lorenzo Bertelli, the designated heir of the Italian billionaire family, at the helm of the fashion house it agreed to buy earlier this year.

What Bloomberg Strategists say...

“Markets remain in an AI-centric de-grossing; yet technicals, positioning, and sentiment indicate volatility is calming. That leaves the door more open for stocks to gain if Nvidia’s earnings calm AI capex angst.”-Michael Ball, Macro Strategist, Markets Live. For the full analysis, click here.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.4% as of 4 p.m. New York time

- The Nasdaq 100 rose 0.6%

- The Dow Jones Industrial Average rose 0.1%

- The MSCI World Index was little changed

- Bloomberg Magnificent 7 Total Return Index rose 0.8%

- UBS US AI Winners Index rose 1.1%

- The Russell 2000 Index was little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.5%

- The euro fell 0.5% to $1.1526

- The British pound fell 0.7% to $1.3048

- The Japanese yen fell 1% to 157.01 per dollar

Cryptocurrencies

- Bitcoin fell 2.9% to $89,747.51

- Ether fell 4.6% to $2,955.92

Bonds

- The yield on 10-year Treasuries advanced two basis points to 4.13%

- Germany’s 10-year yield was little changed at 2.71%

- Britain’s 10-year yield advanced five basis points to 4.60%

- The yield on 2-year Treasuries advanced one basis point to 3.59%

- The yield on 30-year Treasuries advanced one basis point to 4.75%

Commodities

- West Texas Intermediate crude fell 2% to $59.54 a barrel

- Spot gold rose 0.1% to $4,073.31 an ounce

©2025 Bloomberg L.P.