Stocks Stage Comeback at the End of a Jittery Week: Markets Wrap

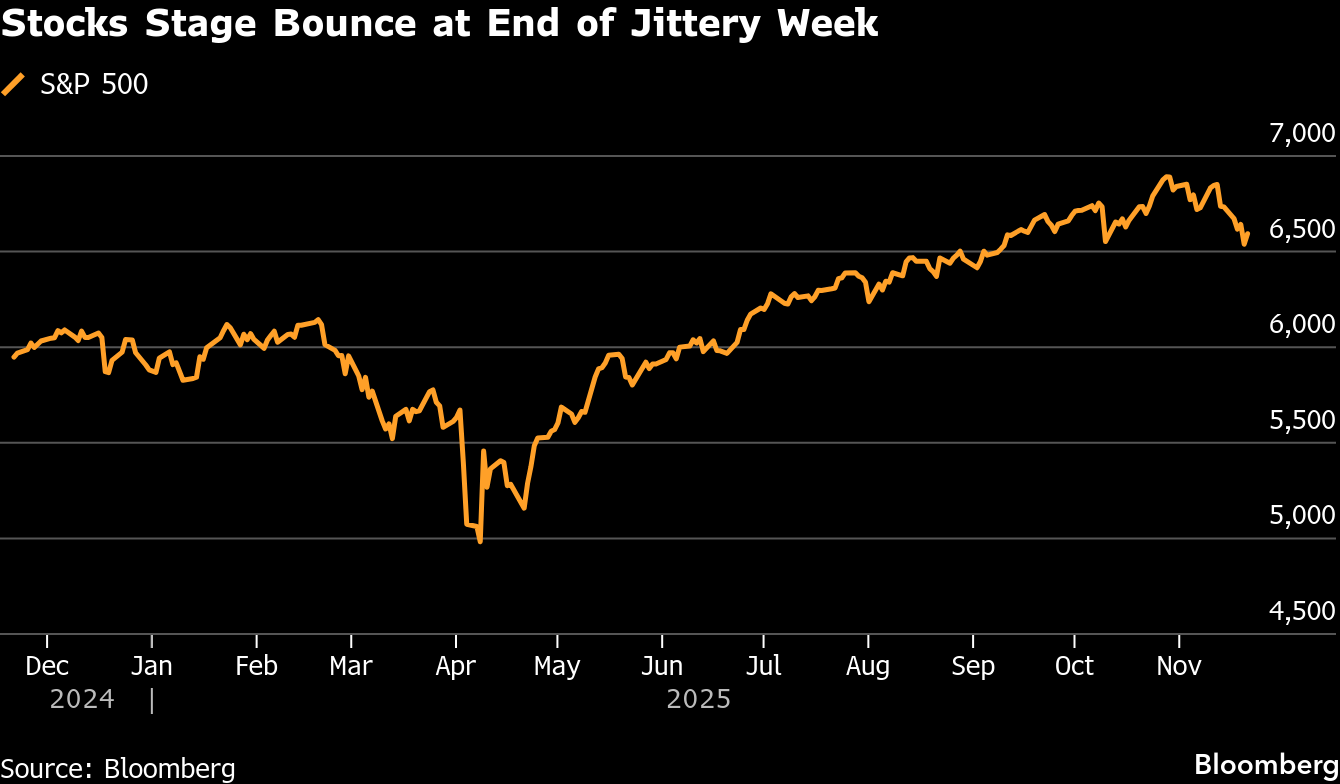

(Bloomberg) -- Wall Street traders drove stocks higher at the end of a volatile week that saw some of the most-speculative corners of the market getting whipsawed, testing investors’ nerves after a relentless rally.

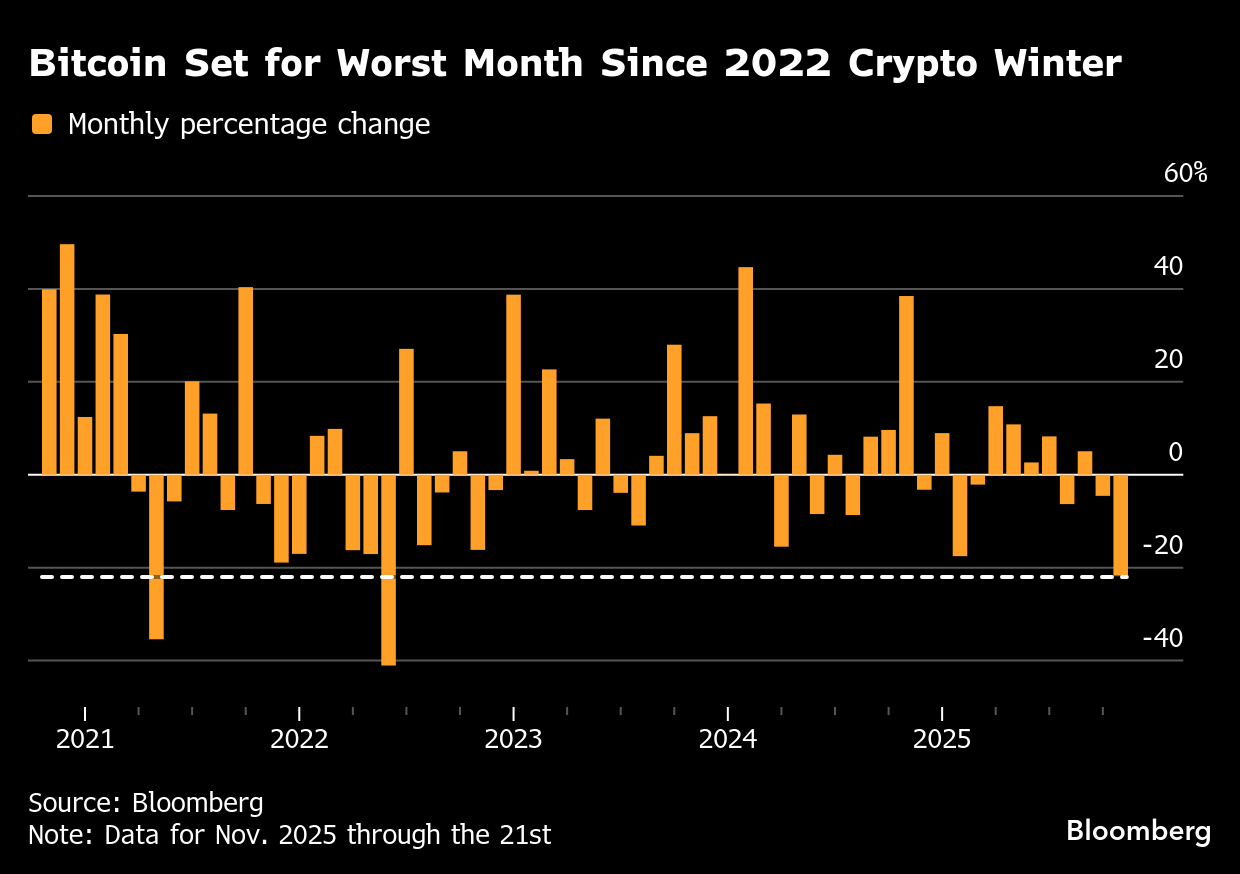

Over 450 shares in the S&P 500 rose, with the gauge up about 1%. Nvidia Corp. trimmed most of a slide that earlier topped 4%. The market got an injection of hope Friday as a Federal Reserve official suggested that another rate cut remains a possibility. Still, sentiment remained fragile, with Bitcoin set for its worst month since a string of corporate collapses rocked the sector in 2022.

This week saw a resurgence in volatility as assets favored by retail momentum traders like crypto and artificial-intelligence winners saw wild swings. The lack of clarity on whether the Fed will be able to cut rates next month has also jolted markets.

“The broader narrative hasn’t broken; it’s simply being tested right now,” said Mark Hackett at Nationwide. “Periods like this often act as a release valve rather than signaling a true trend reversal. Markets need recalibration and a reset in positioning — something investors may have forgotten after six months of relative calm.”

Treasuries edged up after Fed Bank of New York President John Williams said he sees room to ease policy again in the near term. While traders increased bets on a December cut to around 70%, policymakers remain split on whether to lower borrowing costs again.

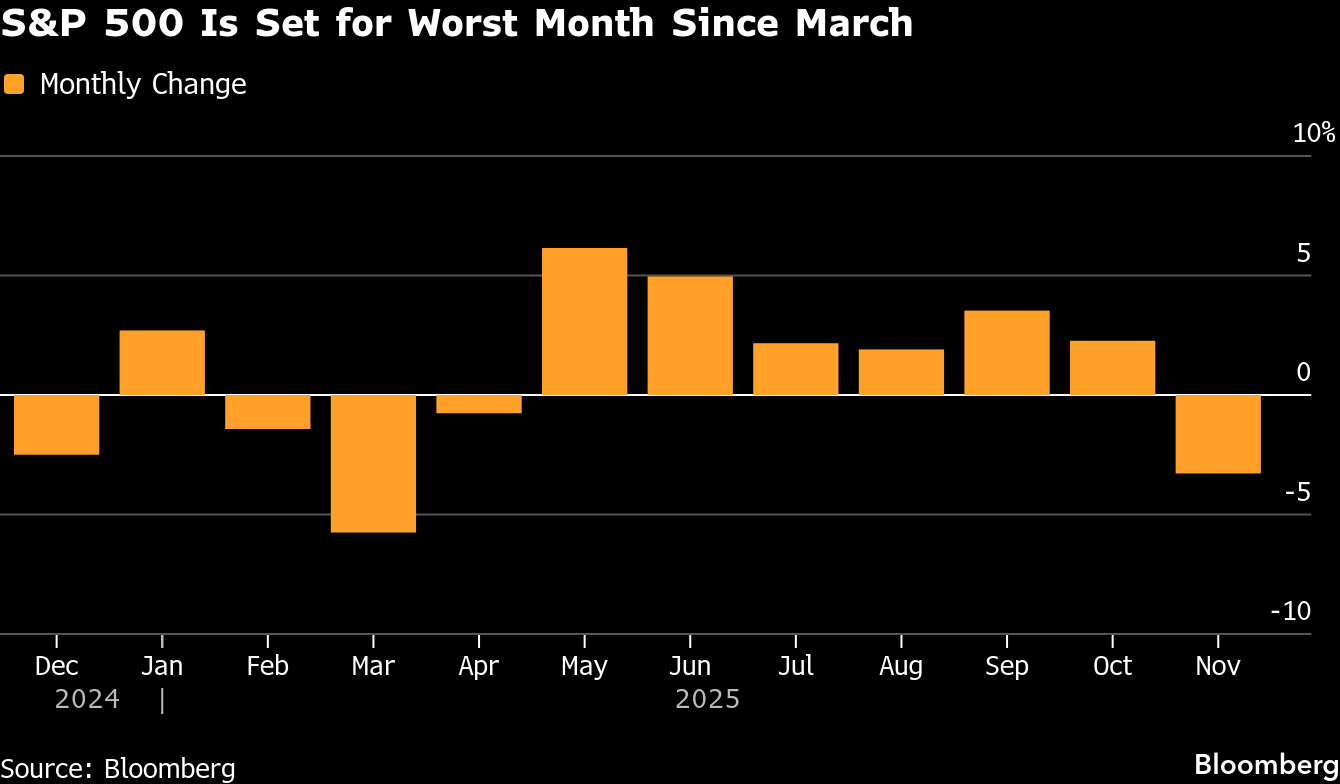

Despite the rebound in stocks, the S&P 500 was still set for its worst month since March. And that’s a rarity given that November is historically a good month for equities. For some traders, the flip side is that the slide might set the market up for a year-end rally.

“It’s hard to call a bottom to the correction, but if the better bets on a December Fed cut come through, we will likely have a material rebound in December,” said Louis Navellier at Navellier & Associates.

The market also saw amplified swings Friday as $3.1 trillion of notional options exposure were estimated to expire.

The yield on 10-year Treasuries fell two basis points to 4.07%. The dollar held near a six-month high. Bitcoin sank to around $83,000.

Goldman Sachs Group Inc.’s Tony Pasquariello sees signs of “capitulation” in US stocks, and expects more selling before the equities market stabilizes.

“While lower prices would likely bring more supply from both the systematic and the discretionary trading communities and while the full hangover from the October party may not yet be washed out, my instinct is this week has seen a significant dose of risk transfer and some elements of capitulation,” Pasquariello wrote.

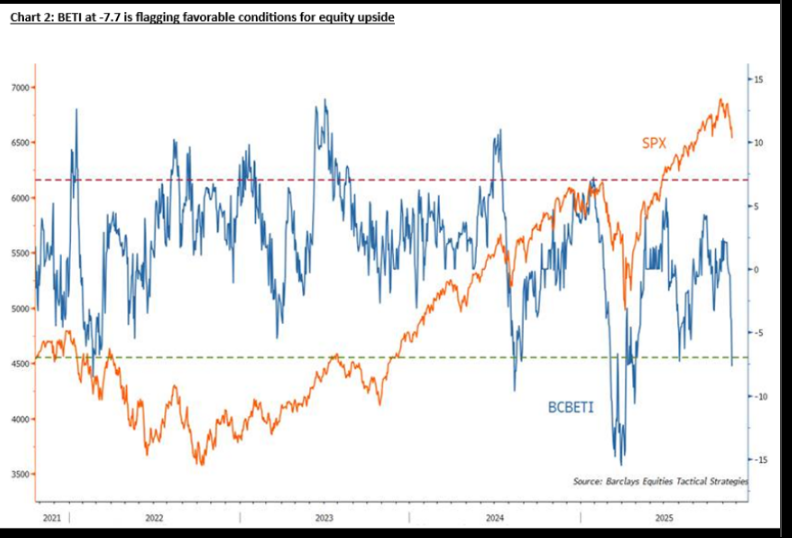

Battered traders looking for a reason to wade back into this week’s turbulent market just got one from a Barclays Plc model with a solid track record.

The firm’s Equities Timing Indicator, known as BETI, fell below -7 for the first time since Aug. 4, Alexander Altmann, global head of equities tactical strategies wrote in a note to clients on Friday. That level has a 10-year track record of signaling near-term advances in the S&P 500.

“A period of derisking should not come as a surprise — we note that equity segments with limited exposure to the AI capex story have also seen sharp drops in recent weeks, said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “Looking forward, we believe that Fed rate cuts, robust corporate earnings, and the AI growth story will sustain the equity rally into 2026.”

“While we expect volatility in 2026, we do expect a positive return with the S&P 500 reaching 7,500 by the end of next year,” said Mary Ann Bartels at Sanctuary Wealth. “We see technology and tech-related stocks maintaining leadership, but they will digest some of their extraordinary gains, in our view.”

Two parallel stories currently drive financial markets: a monetary policy story and an artificial intelligence monetization story, according to Florian Ielpo at Lombard Odier Asset Management.

“These two narratives recently gave the impression of overlapping temporarily, amid confusion introduced by the lack of macro data related to the American shutdown,” Ielpo said. “The fog is gradually lifting, however, allowing us to glimpse how distinct they actually are, and thus carrying different market effects.”

Ielpo noted that the push born from Nvidia’s good results has led to a form of profit-taking rather than a wave of panic.

“If this is indeed a profit-taking phase, then it could prove short-lived – micro and macro factors remain relatively healthy at this stage,” he noted.

Scott Wren says he favors a large-cap and tech focus, but would selectively trim and diversify.

“We believe the next 12-15 months will favor US equities, based on our expectations for accelerating earnings,” said the global market strategist at Wells Fargo Investment Institute.

“AI looks like a classic investment bubble to us, with very high valuations and signs of rampant speculation. But we recognize that while many investors may harbor fears of an AI bubble, they are far from sure of that fact and tend to assume the market is appropriately priced,” said Ben Inker in the latest GMO Quarterly Letter.

While agnostic investors would face more difficult choices if the rally continues, they could also take solace in the strong returns of the well-diversified portfolios that got them to that point, he noted.

“As bubbles go, AI looks like one of the easy ones for an agnostic investor to handle,” Inker concluded.

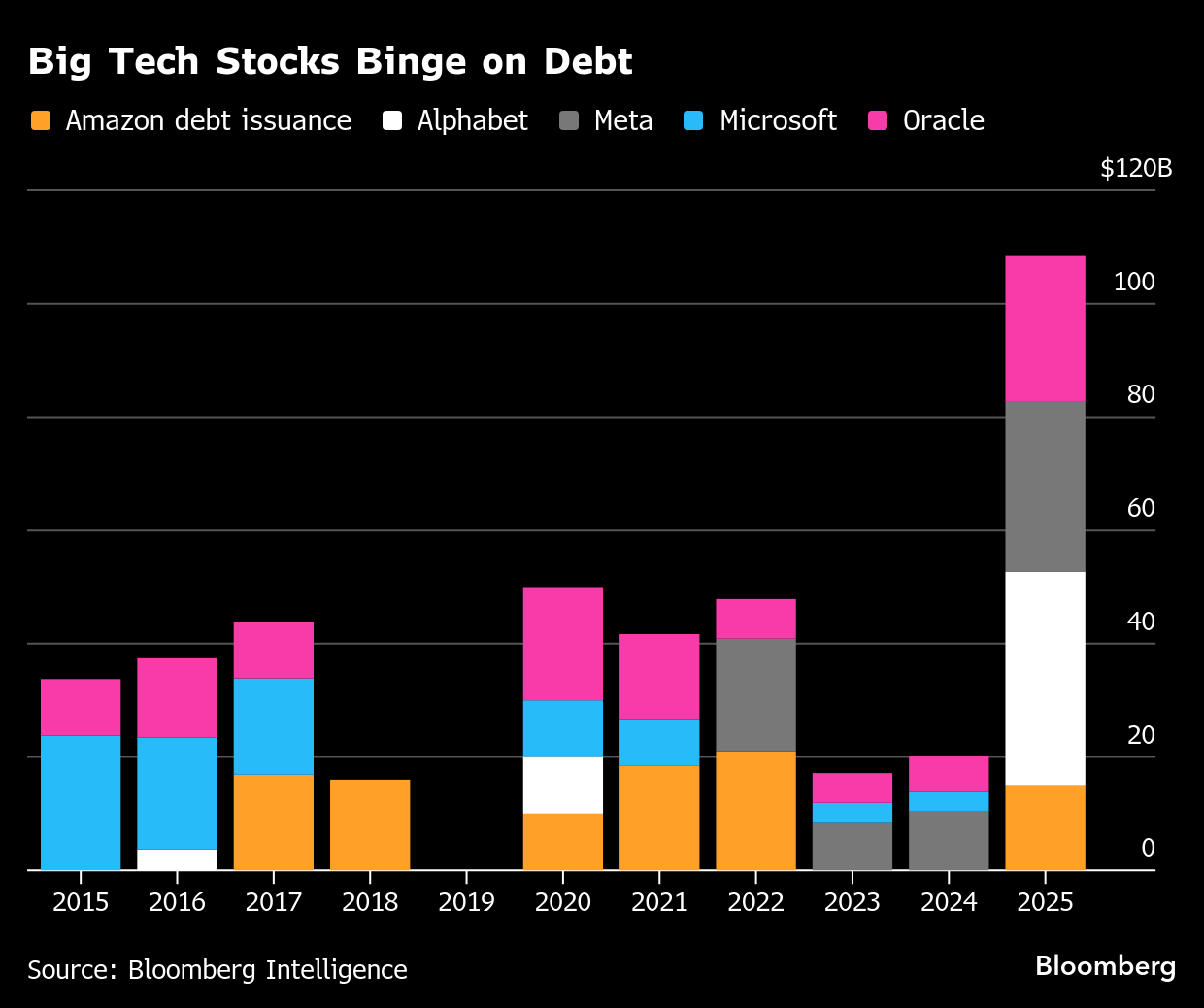

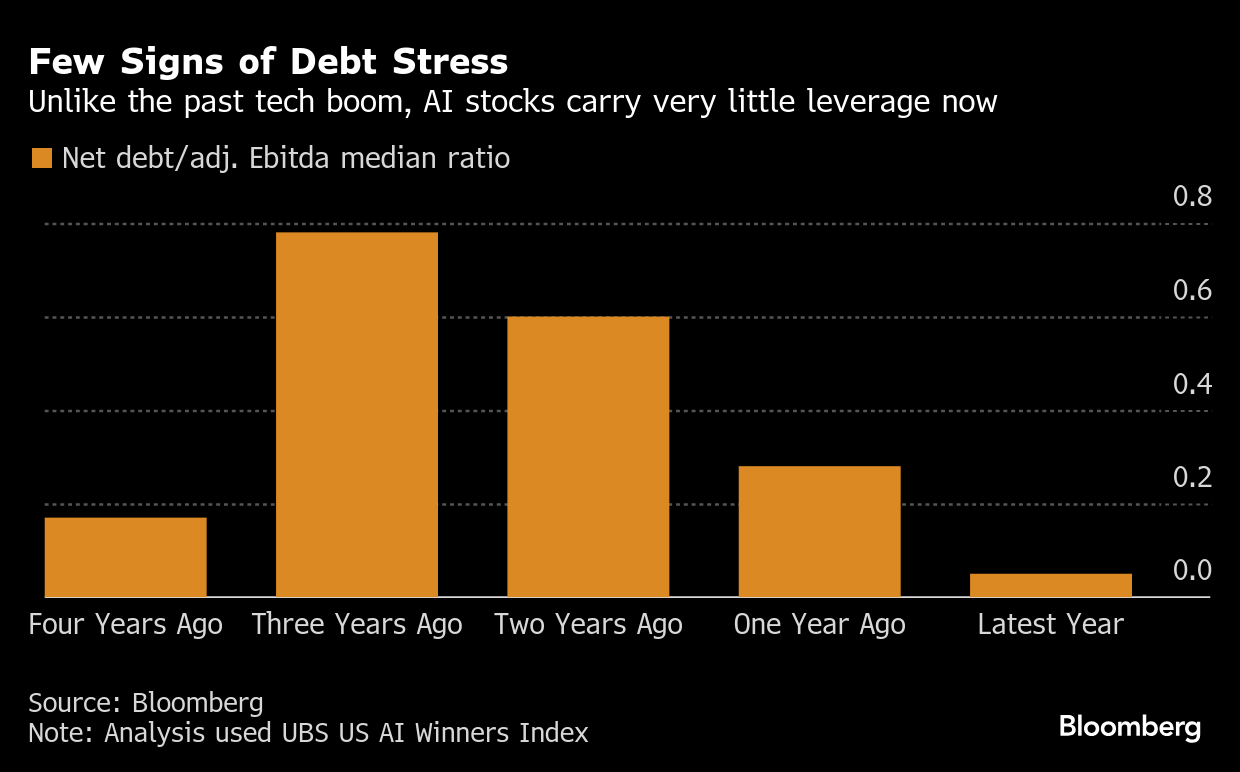

Meantime, equity traders have grown increasingly concerned about the amount of leverage that Big Tech is taking on to build out its artificial intelligence infrastructure as the industry faces rising fears of a bubble.

The enormous sums major technology companies are spending on AI are nothing new, but the record pile of debt they’re raising to do it is. What’s worrying stock traders is the trend represents a break from recent history, when companies tapped their huge cash piles to pay for their capital expenditures. The use of leverage and the circular nature of many of the financing deals introduces a level of risk that wasn’t there before.

“While near-term liquidity and holiday calm may limit volatility, the interplay between corporate credit costs and equity valuations – particularly in technology – will define relative performance,” said Bob Savage at BNY.

Savage says equity managers should remain attentive to margin sustainability and capital discipline as the market transitions from rotation-driven trade to fundamentals-driven returns heading into 2026.

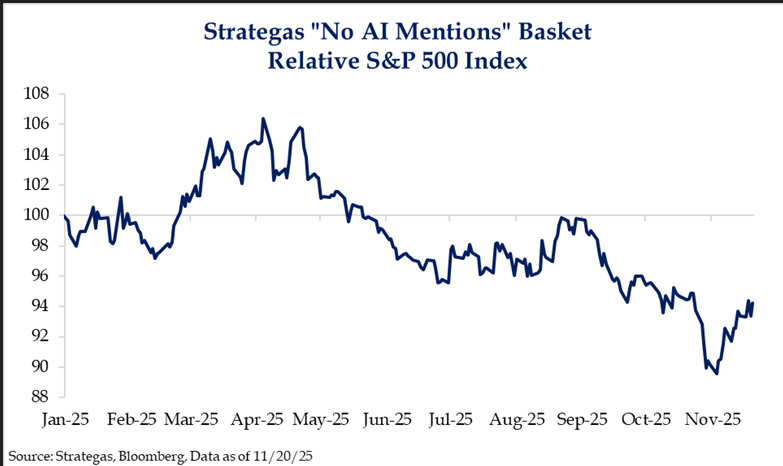

At Strategas, Ryan Grabinski noted that his firm’s basket of companies that haven’t mentioned “AI” in earnings transcripts over the past two years had been showing strong outperformance in the two weeks leading up to Nvidia’s results. However, over the past few days, that momentum appears to have stalled.

“If this trend continues, it suggests the current market correction may be less about the AI capex cycle and more indicative of emerging concerns in private credit or deleveraging within the crypto space.

Bitcoin has now shed about a quarter of its value in November, the most for a single month since June 2022, according to data compiled by Bloomberg. The implosion of Do Kwon’s TerraUSD stablecoin project in May of that year sparked a daisy chain of corporate failures that culminated in the downfall of Sam Bankman-Fried’s FTX exchange.

Despite a pro-crypto White House under US President Donald Trump and surging institutional adoption, Bitcoin has plummeted over 30% since rocketing to a record in early October. The rout follows a crippling bout of liquidations on Oct. 10 that wiped out $19 billion in leveraged token bets, and in turn erased roughly $1.5 trillion from the combined market value of all cryptocurrencies.

Bitcoin outperforms when financial conditions are loose. However, Fed meeting minutes and a better-than-expected September jobs report dampened hopes of a December rate cut and sparked a broader risk-off move, said Pat Tschosik and Philippe Mouls at Ned Davis Research.

Six of eight indicators in their Bitcoin Watch Report are now on a bearish signal.

“We would like to hang on for a potential “Powell Pivot II” but too much technical damage has been done,” they said. “We step aside for now and remove our Long Bitcoin trade.”

Such deep pullbacks are more common in cryptos given their heightened volatility, but the absence of interest is still notable, noted Fawad Razaqzada at Forex.com.

“The next major support zone comes in around $80,000, which served as a launchpad back in April,” he said. “Bitcoin could even dip towards $75,000 before potentially finding support. So, both these levels are important to keep an eye on.”

Corporate Highlights:

- Cathie Wood’s flagship fund bought Nvidia Corp. shares on Thursday following the company’s blowout earnings, reiterating her firm ARK Investment Management’s bullish stance on the chip bellwether.

- Gap Inc. said its sales came in stronger than expected, bucking the trend across the majority of retail and restaurant chains that have been warning of consumers’ deepening caution in recent weeks.

- Eli Lilly & Co. and Novo Nordisk A/S plan to start selling their popular obesity shots to employers through a new approach that would bypass traditional drug sales channels in an effort to expand access to the costly weight-loss medicines.

- Four patients who developed a serious eye disease after using Novo Nordisk A/S’s blockbuster weight-loss drugs have been granted compensation in Denmark, the drugmaker’s home market.

- Netflix Inc., Comcast Corp. and Paramount Skydance Corp. all submitted bids for Warner Bros. Discovery Inc., according to people with knowledge of the matter, setting the stage for one of Hollywood’s biggest companies to be sold.

- Figma Inc.’s stock briefly fell below its initial public offering price for the first time, becoming just the latest of this year’s high-flying listings to retrace its eye-popping early gains.

- IAG SA, parent company of British Airways, has submitted its expression of interest in TAP SA, joining Air France-KLM and Deutsche Lufthansa AG in the bidding process for a minority stake in the Portuguese airline.

- Ubisoft Entertainment SA said it will use money from a Tencent Holdings Ltd. investment to pay off debt after the video-game publisher breached a loan agreement because of its accounting practices.

- Hon Hai Precision Industry Co. aims to spend an initial $1 billion to $5 billion growing its US manufacturing footprint, propelling an expansion aimed at sating the enormous needs of AI sector leaders Nvidia Corp. and OpenAI.

What Bloomberg Strategists say...

“Fears that we are heading for a 2000-style dot-com bust look unfounded, not least because there’s no sign that AI names are cracking under debt stress.” —Tatiana Darie, Macro Strategist, Markets Live. For the full analysis, click here.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1% as of 1:31 p.m. New York time

- The Nasdaq 100 rose 0.7%

- The Dow Jones Industrial Average rose 1.2%

- The MSCI World Index rose 0.6%

- Bloomberg Magnificent 7 Total Return Index rose 0.8%

- The Russell 2000 Index rose 2.5%

- Nvidia fell 0.6%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.2% to $1.1507

- The British pound rose 0.2% to $1.3099

- The Japanese yen rose 0.6% to 156.52 per dollar

Cryptocurrencies

- Bitcoin fell 3.5% to $84,114.85

- Ether fell 4.4% to $2,751.02

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.07%

- Germany’s 10-year yield declined one basis point to 2.70%

- Britain’s 10-year yield declined four basis points to 4.55%

- The yield on 2-year Treasuries declined one basis point to 3.52%

- The yield on 30-year Treasuries was little changed at 4.72%

Commodities

- West Texas Intermediate crude fell 2% to $57.83 a barrel

- Spot gold was little changed

©2025 Bloomberg L.P.