Oil Steady as Traders Focus on Looming Russia Sanctions Deadline

(Bloomberg) -- Oil steadied as investors weighed the fallout from US sanctions on Russia’s Rosneft PJSC and Lukoil PJSC that are set to take effect on Friday, while the European Union explores more measures to squeeze Moscow.

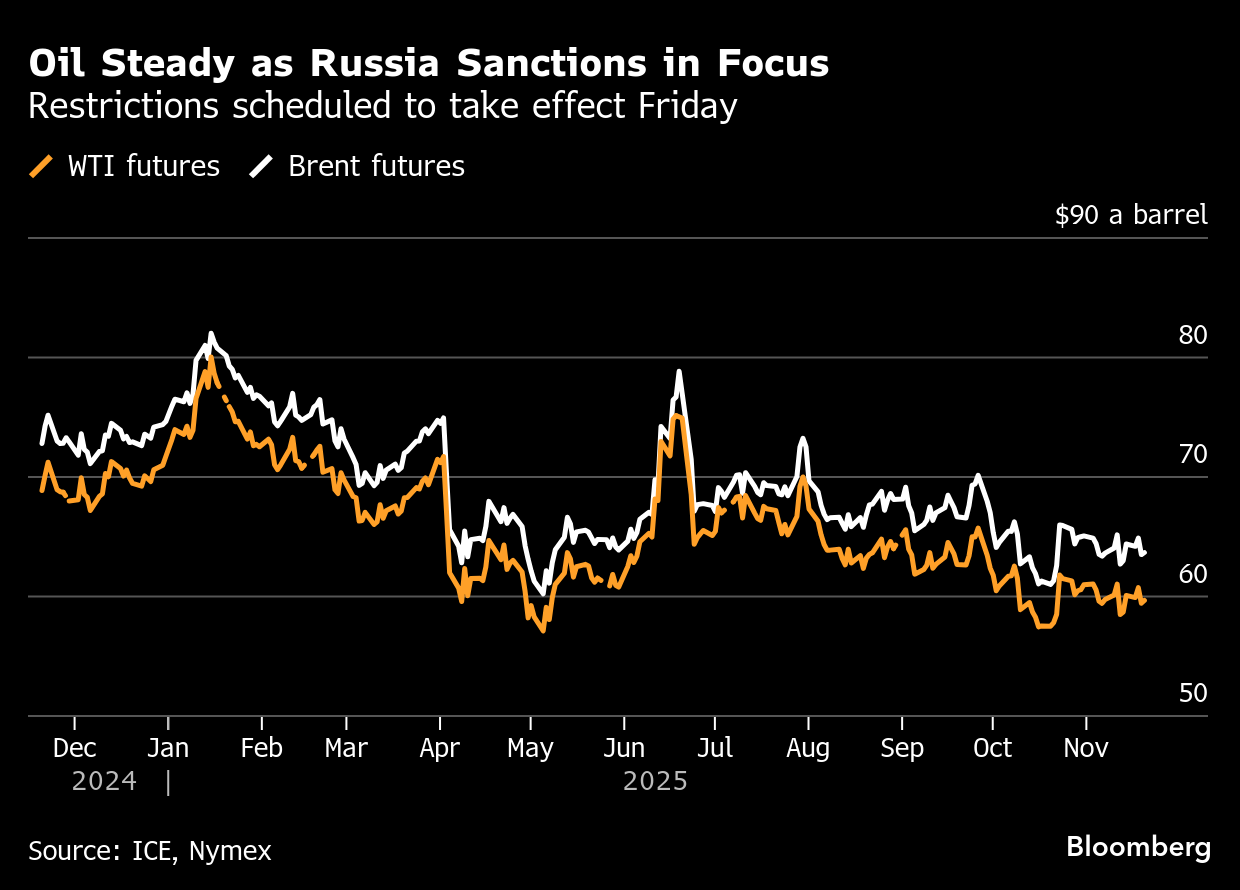

Brent traded near $64 a barrel after declining more than 2% on Wednesday, the most in a week, and West Texas Intermediate was below $60. US penalties on the Russian oil giants have already upended crude flows, most notably to India, and forced Lukoil to seek buyers for its international assets.

Oil is still heading for a yearly loss on expectations for a surplus as OPEC+ and other producers ramp up output, though recent geopolitical tensions have added some risk premium to prices. Russian fuel exports in the first half of November fell to the lowest since the invasion of Ukraine due to attacks on the country’s refining infrastructure and US sanctions.

Suitors are lining up to acquire various parts of Lukoil’s international business following the penalties. Exxon Mobil Corp. officials met with Iraqi Oil Minister Hayyan Abdul Ghani on Wednesday to discuss the Russian company’s stake in the West West Qurna 2 field, which accounts for 10% of Iraqi production.

Meanwhile, the EU is exploring more curbs on entities enabling Russia’s so-called “shadow fleet” of tankers transporting oil in a further effort to disrupt Moscow’s ability to fund its war against Ukraine. The US penalties on Rosneft and Lukoil are also part of a fresh bid to end the conflict.

Futures dropped on Wednesday, in part due to the first increase of US gasoline and distillate stockpiles — a category that includes diesel — in over a month last week. Still, crude inventories fell by 3.4 million barrels, compared with an expected gain flagged by an industry group a day prior.

©2025 Bloomberg L.P.