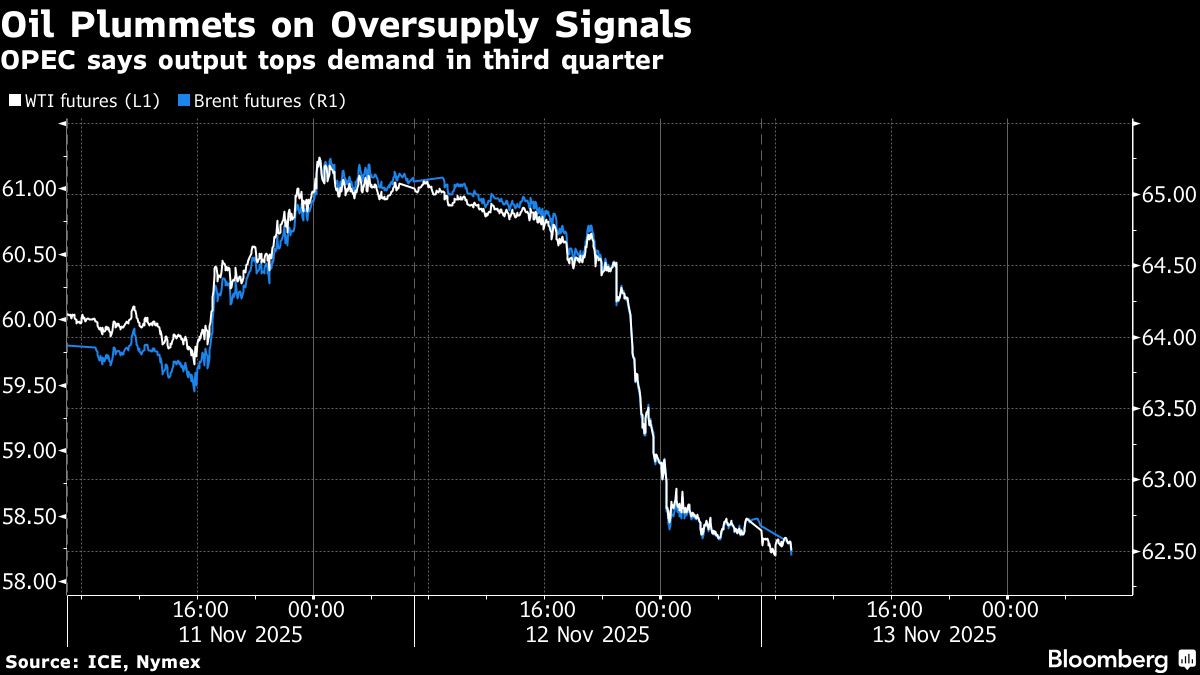

Oil Steadies After 4% Tumble on Signs Global Glut Has Arrived

(Bloomberg) -- Oil steadied after slumping on Wednesday on signs that a long-awaited surplus has finally arrived, with traders braced for a fresh market assessment from the International Energy Agency.

Global benchmark Brent held above $62 a barrel after losing almost 4% in the previous session, while West Texas Intermediate was near $58. Producer group OPEC — which has been restoring idled capacity this year — said in its latest market snapshot that global supply had topped demand in the third quarter, flipping its earlier estimate for the period from a shortfall.

Elsewhere, a key indicator — WTI’s prompt spread — sank into contango, a pricing pattern that signals ample near-term supplies, and the US Energy Information Administration raised its US production forecast for next year. More bearish signals may come later on Thursday when the Paris-based IEA issues its monthly report on market dynamics.

Crude has retreated this year on widespread expectations for a glut, with the IEA already predicting there will be a record surplus in 2026. The slump has been driven by rising supplies from OPEC and its allies including Russia, as well as production increases from drillers outside the alliance. Brent capped a third monthly loss in a row in October, and has lost ground so far in November.

“There’s a lot of oil supply that’s coming back from the OPEC+ countries,” Chevron Corp. Chief Executive Officer Mike Wirth told Bloomberg Television. “There’s a period of time when it would appear we’re going to see more supply coming into the market than demand will be able to absorb.”

Lower crude prices — if sustained — stand to bring down products such as gasoline, reducing inflationary pressures in a plus for central bankers such as the Federal Reserve, as well as for consumers. That may also stand as a win for US President Donald Trump, who has championed cheaper energy.

In recent weeks, the Trump administration has also moved to raise the pressure on Russia to end the war in Ukraine, in part by sanctioning Rosneft PJSC and Lukoil PJSC. That, coupled with Ukraine attacks against Moscow’s energy infrastructure, has helped to support product prices.

“It’s a seesaw battle between Russia risk premium and ample supply,” said Vandana Hari, founder of Singapore-based analysis firm Vanda Insights. “Sentiment may shift again, as the market continues to calibrate the disruption from sanctions. Workarounds appear tougher this time around.”

This year’s surge in OPEC+ supply has been driven by alliance leader Saudi Arabia, although members have signaled they will pause further hikes in the first quarter of 2026. Ahead of that, Saudi Arabia’s Crown Prince Mohammed bin Salman is set to meet President Trump at the White House next week.

In addition to the IEA report, investors will also get official prints for US crude and product stockpiles later Thursday. The American Petroleum Institute, an industry group, has flagged another build in oil inventories.

©2025 Bloomberg L.P.