Oil Loses Ground With US Stockpiles and Sanction Risks in Focus

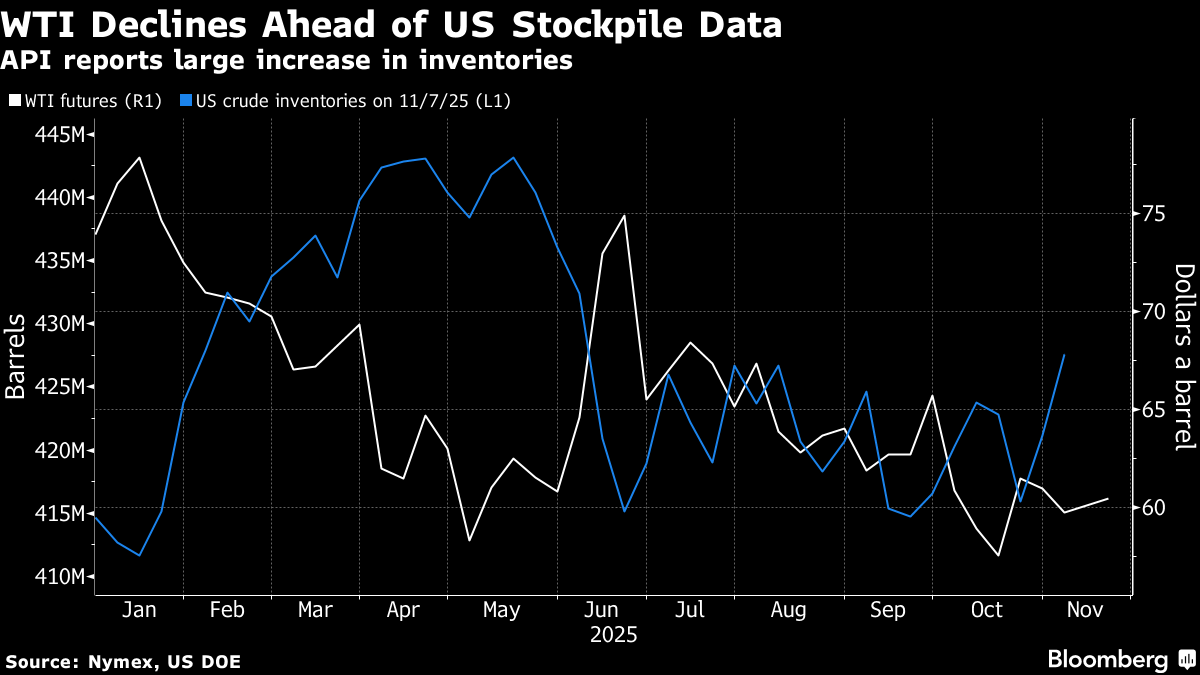

(Bloomberg) -- Oil fell as a report showing rising US stockpiles helped to offset concerns about the fallout from Western sanctions on Russia.

Brent dropped toward $64 a barrel, following a gain on Tuesday, while West Texas Intermediate was near $60. The industry-funded American Petroleum Institute reported a 4.4 million barrel increase in US crude inventories, as well as builds in products. That would take oil inventories to the highest in more than five months, if confirmed by official data later Wednesday.

US sanctions against Russian producers Rosneft PJSC and Lukoil PJSC are set to kick in within days, part of efforts to raise the pressure against Moscow to end the war in Ukraine. Ahead of that, some major Asian buyers have paused at least some purchases, and diesel markets have strengthened in Europe.

Oil has lost ground this year — including a run of three monthly declines through October — on concern that worldwide supplies will top demand. The International Energy Agency has forecast a record glut next year, driven by higher output from OPEC+ as well as nations outside the cartel.

“Crude remains hemmed into a narrow range,” caught between the oversupply view and Russian concerns, said Vandana Hari, founder of analysis firm Vanda Insights in Singapore. “The risk-premium factor is in flux.”

In a sign of burgeoning supplies, the amount of crude being carried on tankers hit another high, with the looming US sanctions deadline focusing attention on the volumes. Almost 1.4 billion barrels were being hauled to destinations or in floating storage last week, according to Vortexa Ltd.

Following the US shutdown, investors are due a slew of backlogged data. Later Wednesday, the Commodity Futures Trading Commission will resume publication of the Commitments of Traders breakdown. As many as two will be released each week until Jan. 23, when the schedule returns to normal.

©2025 Bloomberg L.P.