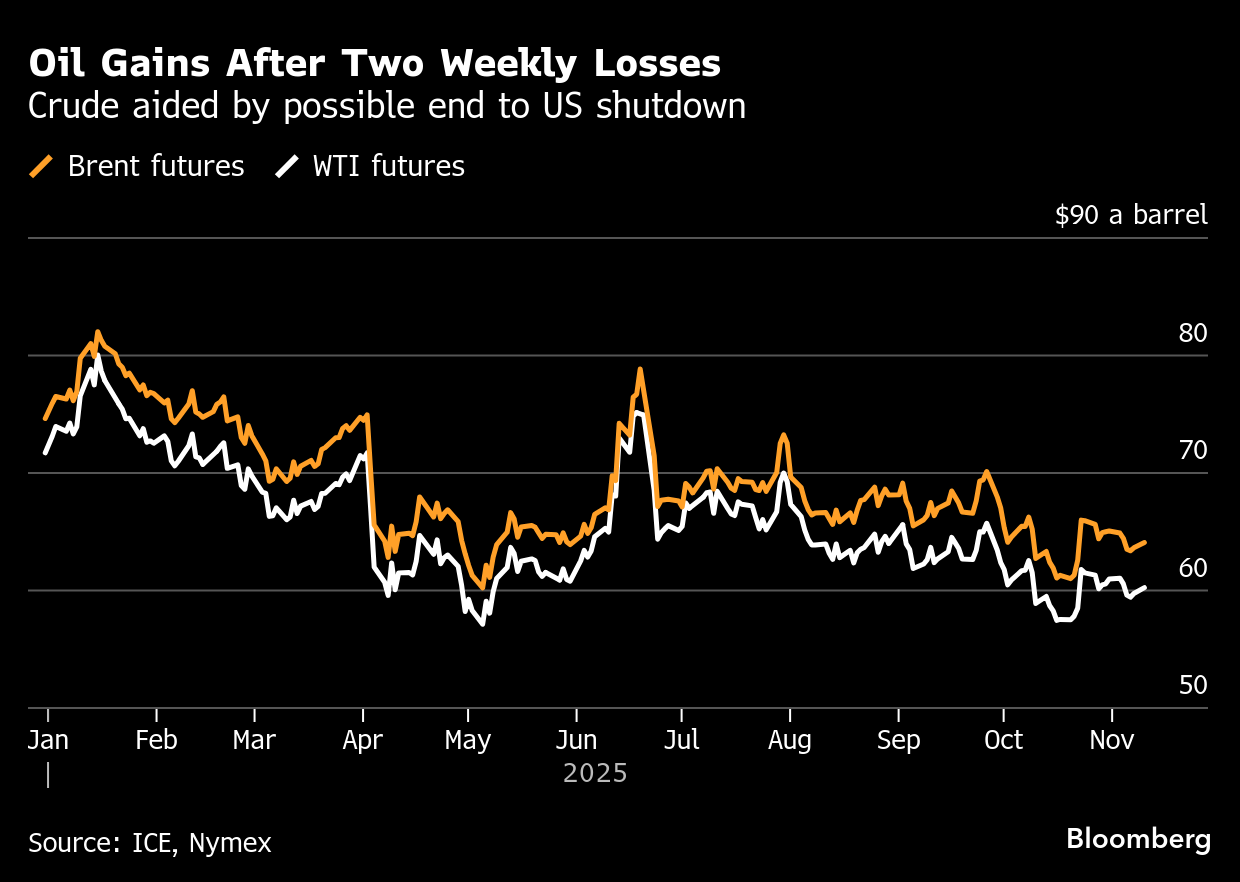

Oil Climbs for a Second Day on Risk-On Tone in Wider Markets

(Bloomberg) -- Oil rose as wider markets were lifted by a push to end the US government shutdown, with crude traders also looking toward a data-heavy week that’ll yield insights into whether a global glut is forming.

Brent climbed above $64 a barrel after two weekly declines, while West Texas Intermediate was near $60. In the US, the Senate took a major step toward re-opening the government, aiding stocks as well as most commodities.

OPEC is due to release its monthly analysis Wednesday, with the International Energy Agency issuing an annual outlook the same day, followed by a regular monthly snapshot on Thursday. In addition, the Energy Information Administration is set to publish the weekly breakdown of US inventory shifts.

Crude has dropped in five of the last six weeks, as the surplus jitters gained greater traction in the market. The Organization of the Petroleum Exporting Countries and its allies including Russia have been loosening output curbs ahead of a planned pause in hikes next quarter. At the same time, drillers from outside the alliance including the US have also been adding barrels.

US sanctions also remained in focus after the Trump administration targeted Rosneft PJSC and Lukoil PJSC in a bid to raise pressure on Russia to end the war in Ukraine. Hungary — which is reliant on Moscow for energy supplies — won an exemption from the curbs after talks with Washington.

“The price action has been a slow grind lower, with tight daily ranges and a reluctance from traders to push prices hard in any one direction,” said Chris Weston, head of research at Pepperstone Group. OPEC’s plan to pause output hikes in the first quarter could have helped offset headwinds, he added.

©2025 Bloomberg L.P.