Global Stocks Rally as Nvidia Quells AI Jitters: Markets Wrap

(Bloomberg) -- Global stocks advanced after a robust revenue forecast from Nvidia Corp. helped dispel fears of a potential bubble in the artificial intelligence industry that had shaken markets in recent weeks.

Nvidia surged 5% in post-market trading after reporting upbeat earnings, spurring gains in other AI shares as well. Futures on the Nasdaq 100 climbed 1.7%, while the main benchmarks for European and Asian equities rose more than 1%. Bitcoin traded near $92,000.

Strong results from the AI bellwether helped restore a sense of calm after weeks of heavy selling in technology stocks. Wall Street had grown uneasy about stretched valuations and the vast sums being spent on AI infrastructure after the sector powered a nearly 40% rally in the S&P 500 since its April low.

“Nothing stands in the way of a Christmas rally now, really” said Amundi SA Chief Investment Officer Vincent Mortier.

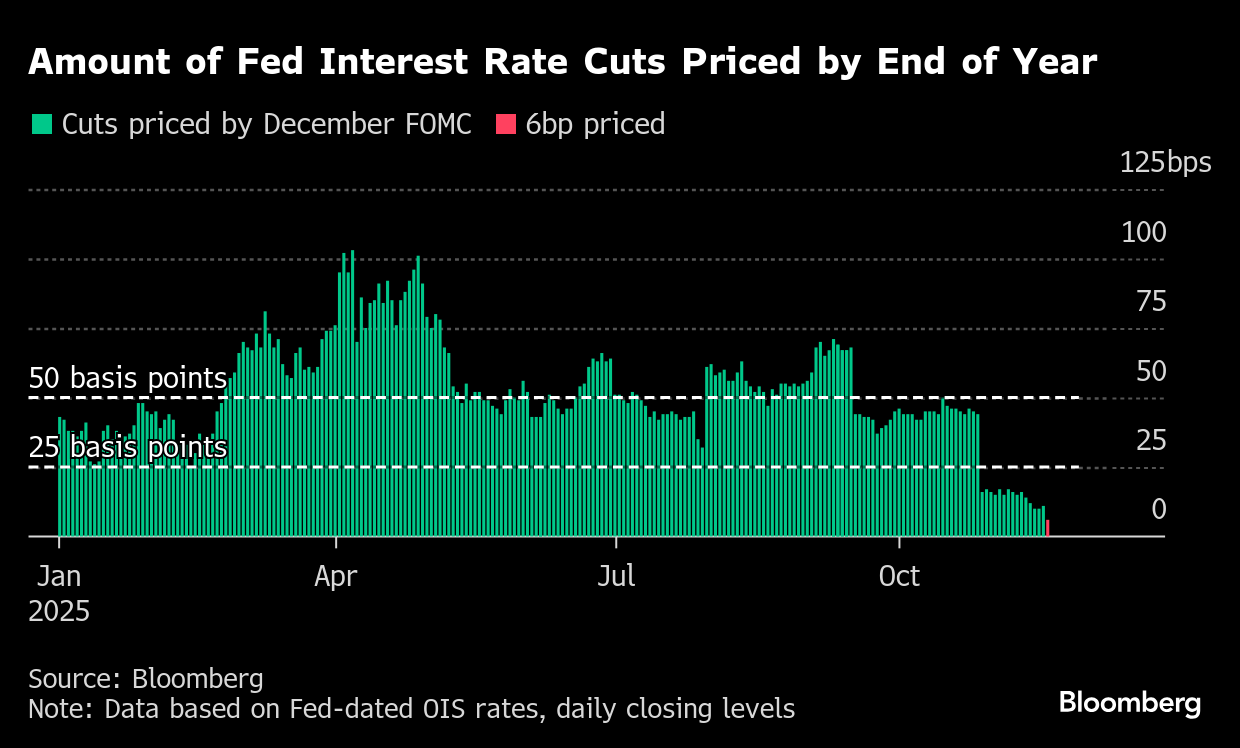

With one of the week’s key events spurring a comeback for equities, attention is now turning to the path for interest rates as markets await the release of the September jobs report later on Thursday. Traders have steadily dialed back bets on a December rate cut amid hawkish comments from policymakers and a lack of government data.

Money markets are currently pricing in about a 30% chance of a Fed cut next month, after the Bureau of Labor Statistics said it won’t publish an October jobs report, but will incorporate those payroll figures into the November data due after the Fed’s final meeting of 2025.

“The September jobs data is clearly dated,” said Wolf von Rotberg, equity strategist at Bank J Safra Sarasin. “They would thus need to show a substantial surprise to the upside or the downside. With the majority of FOMC members in seemingly favor of holding rates at current levels in December, a significant downside surprise would likely have more of an impact on markets.”

The dollar was little changed and Treasuries held steady.

Elsewhere, yields on Japan’s 5- and 10-year government bonds rose to their highest levels since 2008, as markets brace for Prime Minister Sanae Takaichi’s stimulus package, which is set to be unveiled on Friday. The yen is also experiencing sudden, one-way movements that are concerning and which require close monitoring, Japan’s chief cabinet secretary said.

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 rose 1% as of 8:29 a.m. London time

- S&P 500 futures rose 1.3%

- Nasdaq 100 futures rose 1.8%

- Futures on the Dow Jones Industrial Average rose 0.6%

- The MSCI Asia Pacific Index rose 1.2%

- The MSCI Emerging Markets Index rose 1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.2% to $1.1516

- The Japanese yen fell 0.1% to 157.34 per dollar

- The offshore yuan was little changed at 7.1199 per dollar

- The British pound was little changed at $1.3067

Cryptocurrencies

- Bitcoin rose 1.9% to $92,186.26

- Ether rose 1.5% to $3,033.7

Bonds

- The yield on 10-year Treasuries was little changed at 4.13%

- Germany’s 10-year yield was little changed at 2.72%

- Britain’s 10-year yield was little changed at 4.59%

Commodities

- Brent crude rose 0.6% to $63.90 a barrel

- Spot gold fell 0.8% to $4,044.12 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2025 Bloomberg L.P.