Stocks Fall as Trump ‘Not Looking’ for EU Deal: Markets Wrap

(Bloomberg) -- Wall Street was rattled by President Donald Trump’s threats to impose aggressive tariffs on the European Union and Apple Inc., with stocks falling and the dollar hitting its lowest level since 2023.

Equities held losses as Trump said he is “not looking for a deal” with the EU, reiterating that tariffs would be set at 50%. Earlier in the session, the S&P 500 almost wiped out losses as Treasury Secretary Scott Bessent said the US could strike “several large” trade deals in the next couple of weeks. Benchmark 10-year Treasuries remained higher as Bessent said regulators may ease a capital rule on the market, which could reduce yields.

Trump also said that the tariffs he threatened against Apple earlier Friday would also be aimed at device makers including Samsung Electronics Co. to spur them into moving manufacturing of their products to the US. The president said in a social media post that the higher charge on the EU would start on June 1 because “our discussions with them are going nowhere.”

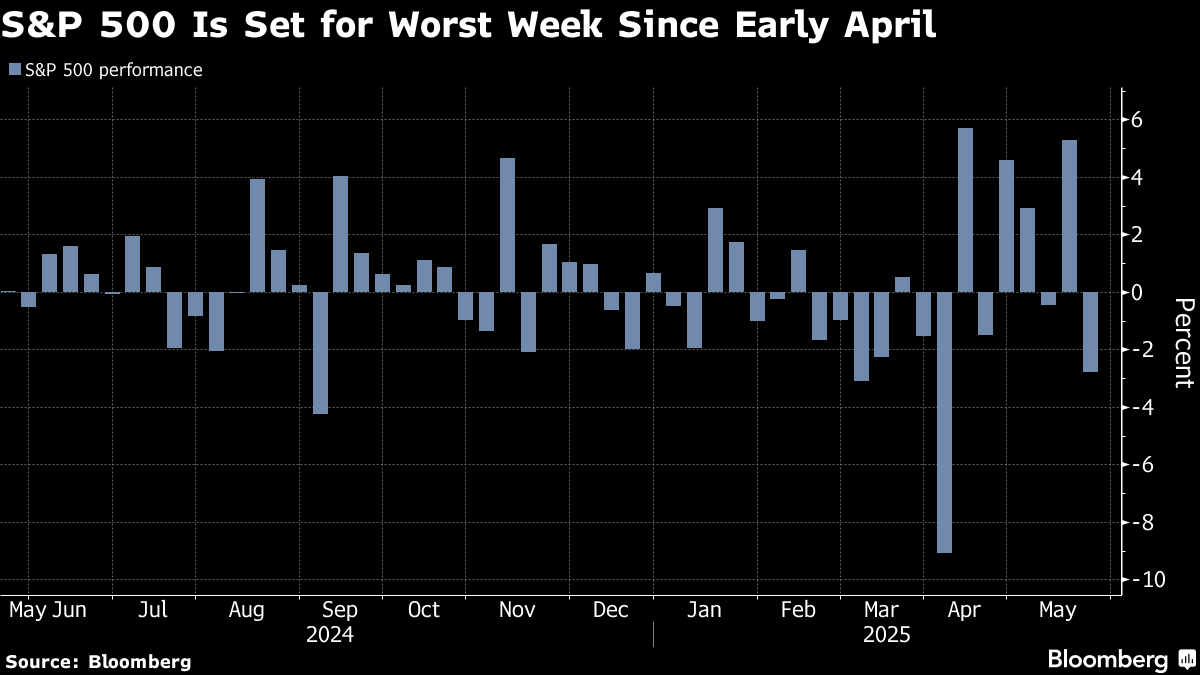

The sudden move underscores the ongoing risk that shifts in US policy can abruptly upend market dynamics at short notice. Markets had rebounded in recent weeks on optimism that Trump was softening his approach to the tariffs and investor attention had turned to concerns about the ballooning US debt and deficits.

“Volatility remains the theme,” said Louis Navellier, chief investment officer at Navellier & Associates. “This is a sharp reminder that the tariffs will continue to be a source of major uncertainty until there are meaningful agreements finalized.”

The S&P 500 dropped 0.4%. The Nasdaq 100 slid 0.6%. The Dow Jones Industrial Average fell 0.3%. Apple led losses in tech giants, with the iPhone maker down 2.9%. It’s the eighth straight down day for the shares - the longest slide since 2022.

The yield on 10-year Treasuries declined two basis points to 4.51% The Bloomberg Dollar Spot Index fell 0.8%.

The president’s tariff threats represented a fresh round of trade brinkmanship, after indicating last week he was looking to wind down talks with partners over his April 2 duties, which he paused for 90 days to allow for negotiations.

“It’s going to keep markets on edge,” said Aneeka Gupta, head of macroeconomic research at Wisdom Tree UK Ltd. “Markets were hoping news on tariffs had abated until at least the 90-day pause expired, but that’s clearly not the case. Uncertainties are here to stay. We’re in for a period of very high volatility.”

To Capital Economics, Trump’s threat of a 50% tariff on the EU from June may well turn out to be a “negotiating tactic” and seems “very unlikely” to be where tariffs settle over the long run.

“At this stage, we are not inclined to change our working assumption that tariffs on the EU will ultimately settle around 10% but this underlines that there are risks and that the road to an agreement could be rocky,” the firm said.

Eric Teal at Comerica Wealth Management said that the EU implications would be less impactful than many of the Asian emerging markets that are key components to the technology sector supply chain.

“Although policy uncertainty injects more investment uncertainty, we believe this is part of the negotiating thesis to cut individual or regional deals, and we still believe that most companies and the economy are well positioned to power through the temporary higher import prices,” he said.

The Trump administration’s fast-changing tariff policies have sent markets spiraling on recession fears and concerns about the safety of US assets, but they’ve rebounded as the president touted progress in tariff negotiations.

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon recently warned against complacency in the face of a slew of risks, citing everything from inflation and credit spreads to geopolitics.

“Concerns over trade, fiscal deficits, and growth may be less evident in equity markets when considering the broader market’s impressive recovery from the April lows, but they still appear to be relevant to the dollar,” said Adam Turnquist at LPL Financial.

Turnquist noted the greenback has struggled to gain traction over the last month as de-dollarization trends continue against a backdrop of rising deficit forecasts and a US debt downgrade.

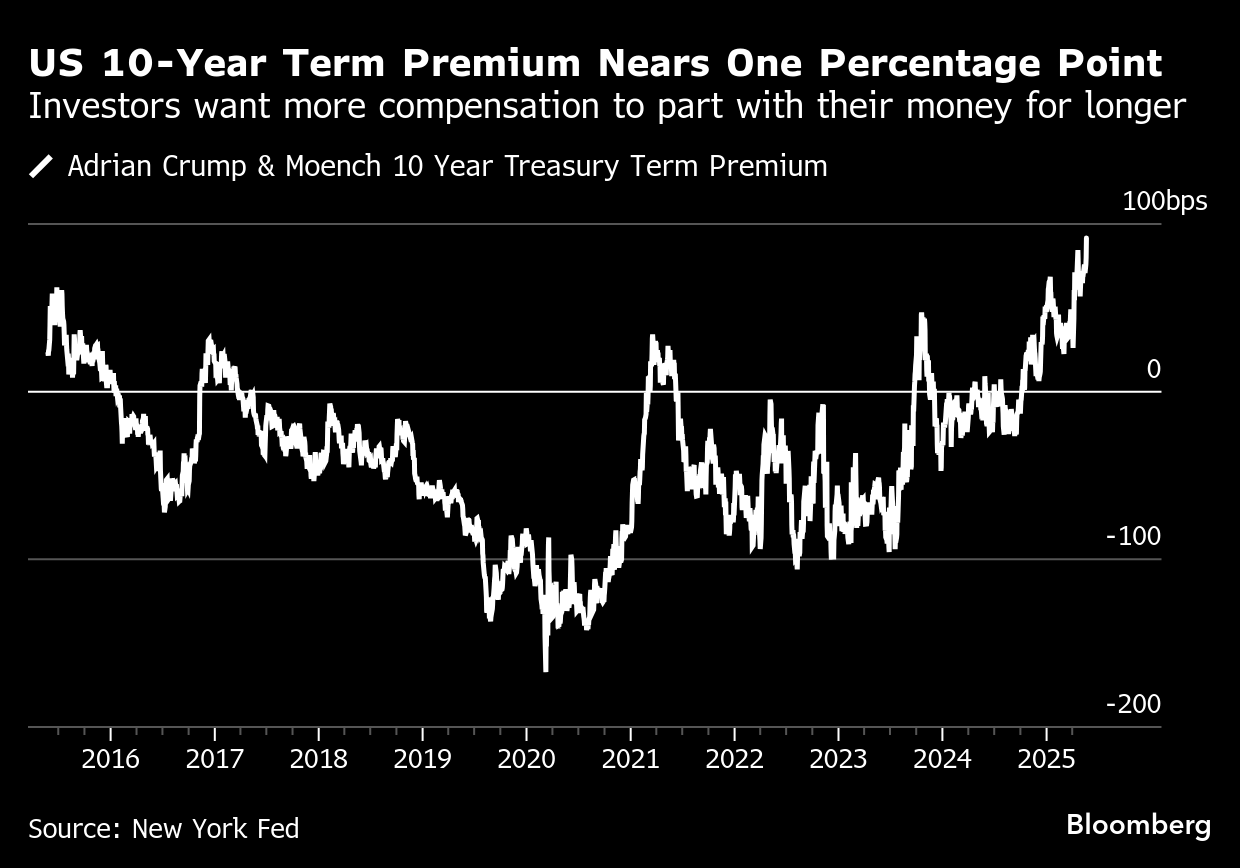

The latest tariff threats came at a time when bond investors are demanding more compensation to hold long-dated US debt as global markets grow anxious about the widening fiscal deficit in the world’s biggest economy.

The US 10-year term premium — or the extra return investors demand to own longer-term debt instead of a series of shorter ones — has climbed to near 1%, a level last seen in 2014. It’s a measure of how jittery investors are about plans to raise the scale of future borrowing.

“While there is a risk that deficit fears lead to progressively higher yields in the weeks ahead, we believe that the Fed and/or Trump administration would likely make adjustments in the event of much higher yields,” said Solita Marcelli at UBS Global Wealth Management.

To Marcelli, that means high grade and investment grade bonds represent good value at current levels for investors seeking portfolio income.

Corporate Highlights:

- President Trump on Friday signed orders meant to accelerate the construction of nuclear power plants, including small, untested designs that offer the promise of rapid deployment but have yet to be built in the US.

- Visa Inc. and Mastercard Inc. fees are under fresh scrutiny from European Union antitrust enforcers, less than a decade after a series of probes ended with hefty fines and an agreement to cut some of their controversial levies.

- Workday Inc. projected subscription revenue in the current quarter in line with Wall Street estimates, disappointing investors looking for the software company to get a boost from new artificial intelligence features for its products.

- Intuit Inc. posted strong revenue growth following the end of the US tax season, suggesting the financial software company is finding success offering users more expensive services.

- Discount retailer Ross Stores Inc. pulled its full-year profit outlook due to heightened uncertainty caused by tariffs.

- Deckers Outdoor Corp. tumbled after the owner of Hoka running shoes and Ugg boots provided a disappointing fiscal first-quarter forecast. The company also declined to provide full-year guidance due to the current macro uncertainty.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.4% as of 2:32 p.m. New York time

- The Nasdaq 100 fell 0.6%

- The Dow Jones Industrial Average fell 0.3%

- The MSCI World Index fell 0.1%

- Bloomberg Magnificent 7 Total Return Index fell 0.8%

- The Russell 2000 Index fell 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.8%

- The euro rose 0.7% to $1.1361

- The British pound rose 0.9% to $1.3534

- The Japanese yen rose 1% to 142.51 per dollar

Cryptocurrencies

- Bitcoin fell 1.8% to $109,070.48

- Ether fell 2.8% to $2,566.68

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.51%

- Germany’s 10-year yield declined eight basis points to 2.57%

- Britain’s 10-year yield declined seven basis points to 4.68%

Commodities

- West Texas Intermediate crude rose 0.6% to $61.58 a barrel

- Spot gold rose 2.1% to $3,365.33 an ounce

©2025 Bloomberg L.P.