Shell Sticks With Payouts, Spending Plans Despite Oil’s Drop

(Bloomberg) -- Shell Plc stuck to its plans for investor returns and capital spending, saying it had the financial strength to withstand any weakness in energy markets.

Like its peers, Shell faced weakening markets in the first quarter, something that has only worsened since President Donald Trump launched his trade war in early April. The energy giant acknowledged this volatility but saw no need to change its strategy.

“Our strong performance and resilient balance sheet give us the confidence to commence another $3.5 billion of buybacks for the next three months,” Chief Executive Officer Wael Sawan said in a statement on Friday.

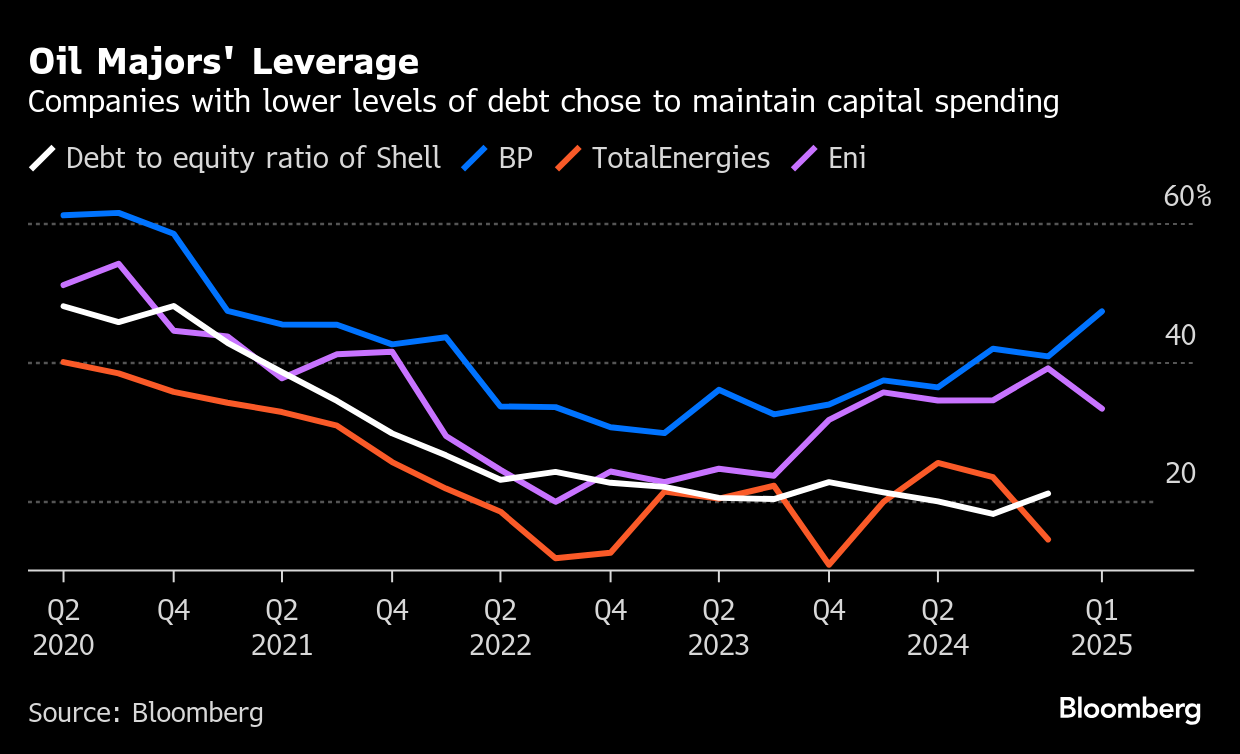

Following the decline in crude prices, every oil major is facing a balancing act between maintaining cash returns to investors — a crucial part of the industry’s appeal — investing in new projects and keeping a lid on debt. BP Plc and Eni SpA chose to trim capital investment, while Shell and TotalEnergies stuck to their spending plans.

Shell’s cash flow from operations dropped to $9.28 billion in the first quarter, down from $13.16 billion in the prior period. Net debt climbed to $41.52 billion, up from $38.81 billion in the fourth quarter.

The first quarter results are an early sign of whether Sawan’s focus in this first two years as CEO on cutting costs, improving reliability and shedding under-performing has positioned Shell to weather an significant industry downturn.

Shares of the company rose 2.2% to 2,491.5 pence as of 8:14 a.m. in London trading.

“We run the company on fundamentals, but we position it for uncertainty,” Chief Financial Officer Sinead Gorman said on a call with journalists. “So we’re just working through our plan and we really don’t change anything. But I do understand for other companies that can be more difficult when they haven’t positioned quite as well.”

Shell’s adjusted net income for the first quarter was $5.58 billion, according to the statement, compared with $7.73 billion a year earlier and beating the average analyst estimate of $5.07 billion.

The results were in-line with expectations and improved in some areas, such as marketing, lower well write-offs, said RBC analyst Biraj Borkhataria. The company can continue distributions to shareholders even if broader energy markets weaken, he said.

(Updates with CFO comment in eighth paragraph.)

©2025 Bloomberg L.P.