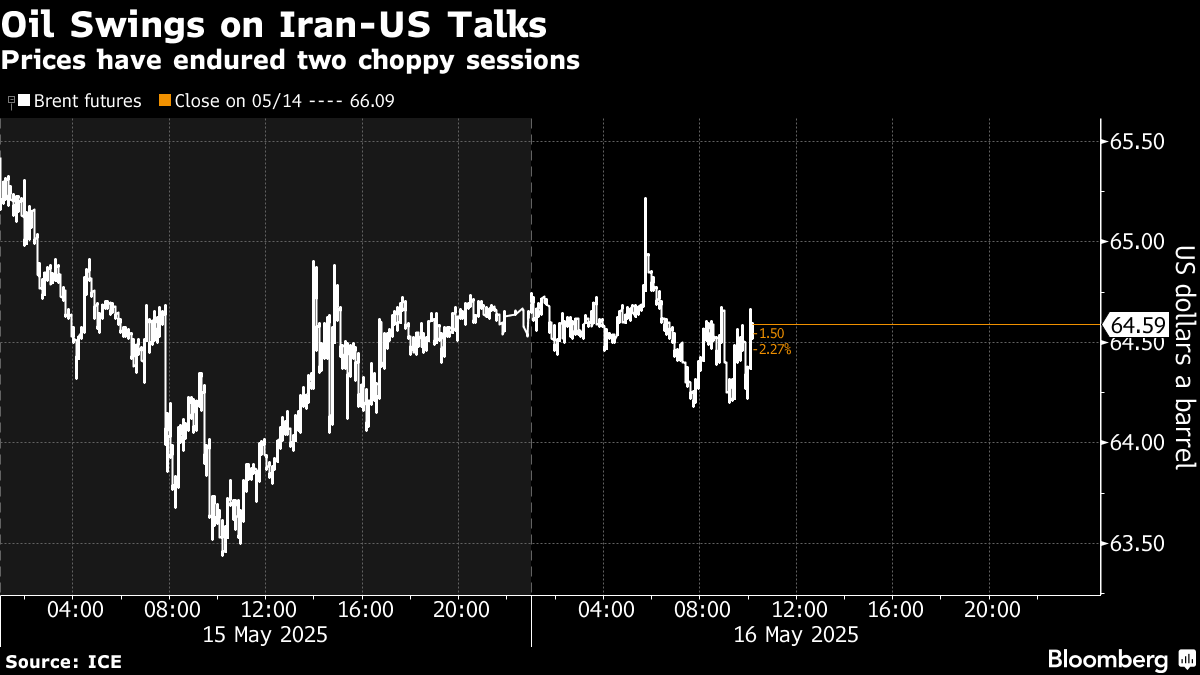

Oil Climbs as Iran Casts Doubt on US Nuclear Deal Negotiations

(Bloomberg) -- Oil rose after Iran’s foreign minister downplayed prospects for a breakthrough in nuclear talks with the US, saying no formal proposal had been received.

Brent advanced more than 1% to settle above $65, while West Texas Intermediate climbed to top $62.

“Iran has not received any written proposal from the United States, whether directly or indirectly,” Foreign Minister Abbas Araghchi said in a post on X. “In the meantime, the messaging we — and the world — continue to receive is confusing and contradictory.”

Prices had slumped Thursday when US President Donald Trump suggested the two sides were closer to a deal, which could pave the way for some extra supply from Iran. But those barrels would have a limited effect on a market already bracing for a surplus.

“Much of the trading action feels reactionary, with geopolitical headlines swinging crude up or down by a few dollars,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Group. “Positioning ahead of the weekend is also likely contributing to today’s move, as traders reduce risk in the face of ongoing uncertainty.”

The International Energy Agency on Thursday reiterated that it expects an increase in new production worldwide to exceed demand growth this year and next, creating a global glut. The excess supply may be even bigger if the Organization of the Petroleum Exporting Countries and its partners confirm further output hikes.

“We wouldn’t overstate the impact on Iranian supply here — a deal might add 200,000 to 300,000 barrels a day to Iranian exports, which isn’t enormous,” said Robert Rennie, head of commodity and carbon research at Westpac Banking Corp. “We maintain the view that Brent should remain in a $60 to $65 holding pattern in the weeks ahead.”

Oil also climbed on reports that Israel struck Houthi-held areas in Yemen, including ports. The escalation raised fears of broader regional conflict, especially after Prime Minister Benjamin Netanyahu warned further military action is imminent.

Oil has now gained for the second straight week, after rising on the détente in the trade conflict between the US and China, the world’s biggest crude consumers.

Prices are still down more than 10% this year because of the twin hit of trade uncertainties and faster-than-expected output increases by OPEC+.

©2025 Bloomberg L.P.