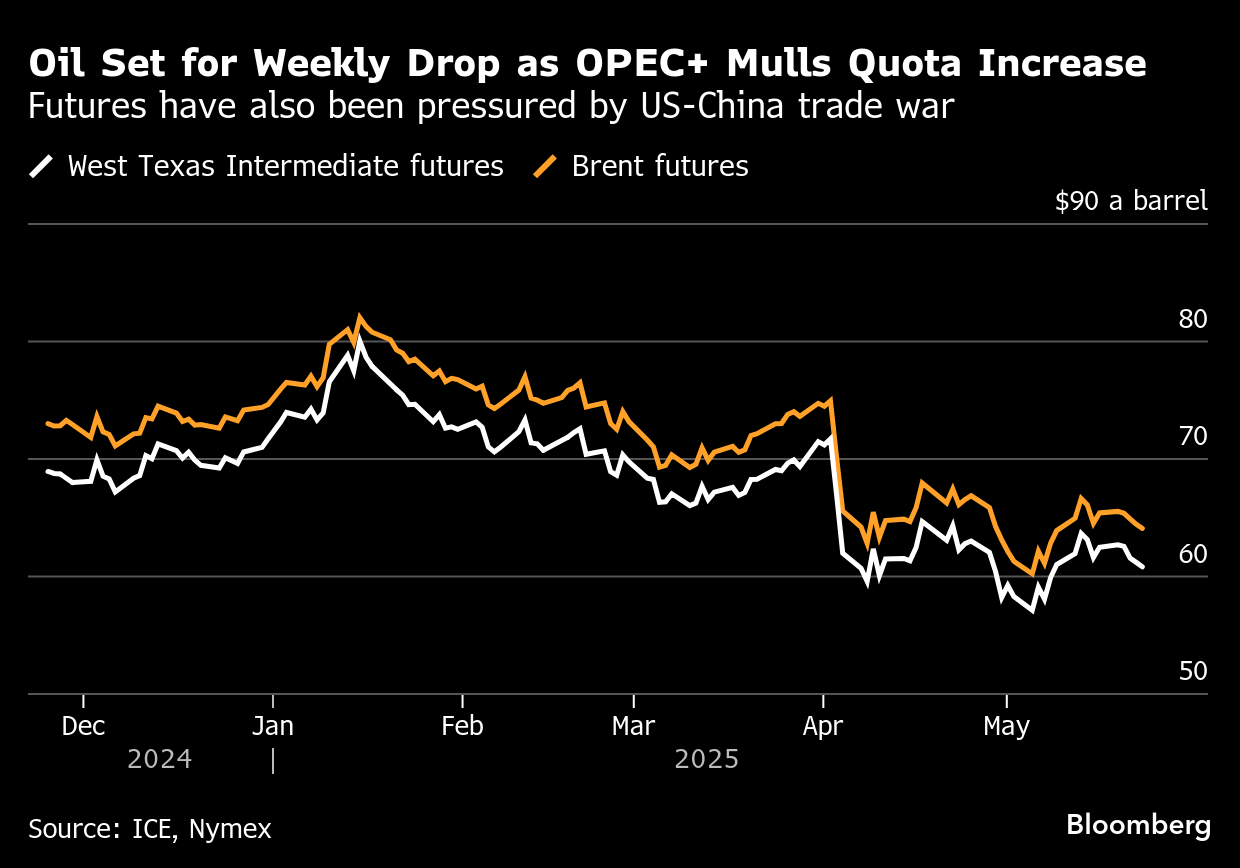

Oil Set for Weekly Drop as OPEC+ Weighs Another Big Supply Hike

(Bloomberg) -- Oil headed for its first weekly decline in three, as OPEC+ weighed another bumper production increase that could add supplies into a market already expected to face a glut.

Brent fell toward $64 a barrel, declining for a fourth session and bringing its weekly loss to about 2%. West Texas Intermediate was below $61. OPEC and its allies discussed another major output-quota increase of 411,000 barrels a day for July, although no agreement has yet been made, delegates said.

Crude has shed about 14% this year, hitting the lowest since 2021 last month, as OPEC+ loosened supply curbs at a faster-than-expected pace, just as the US-led trade war posed headwinds for demand. Data this week showed another rise in US commercial oil stockpiles, adding to concerns about a surplus.

“Focus is increasingly turning to OPEC+ and what the group decides to do with July output levels,” said Warren Patterson, head of commodities strategy for ING Groep NV. “Another large increase for July would cement a shift in policy — from defending prices to defending market share.”

A group of eight key OPEC+ nations, including de facto group leader Saudi Arabia, will hold a virtual meeting on June 1 to decide on July’s production levels. A Bloomberg survey of traders and analysts showed that most expected an output quota surge.

Elsewhere, the European Commission’s economy chief Valdis Dombrovskis said it would be appropriate to lower the price cap on Russian oil to $50 a barrel. The current $60 cap — a move meant to punish Moscow for its war against Ukraine, while keeping the oil flowing — isn’t hurting the producer given lower prices for now, he added.

©2025 Bloomberg L.P.