Oil Holds Drop on US Stockpile Build and Wider Market Selloff

(Bloomberg) -- Oil steadied after a decline as higher US stockpiles reinforced worries about an oversupplied market, and wider financial markets eased.

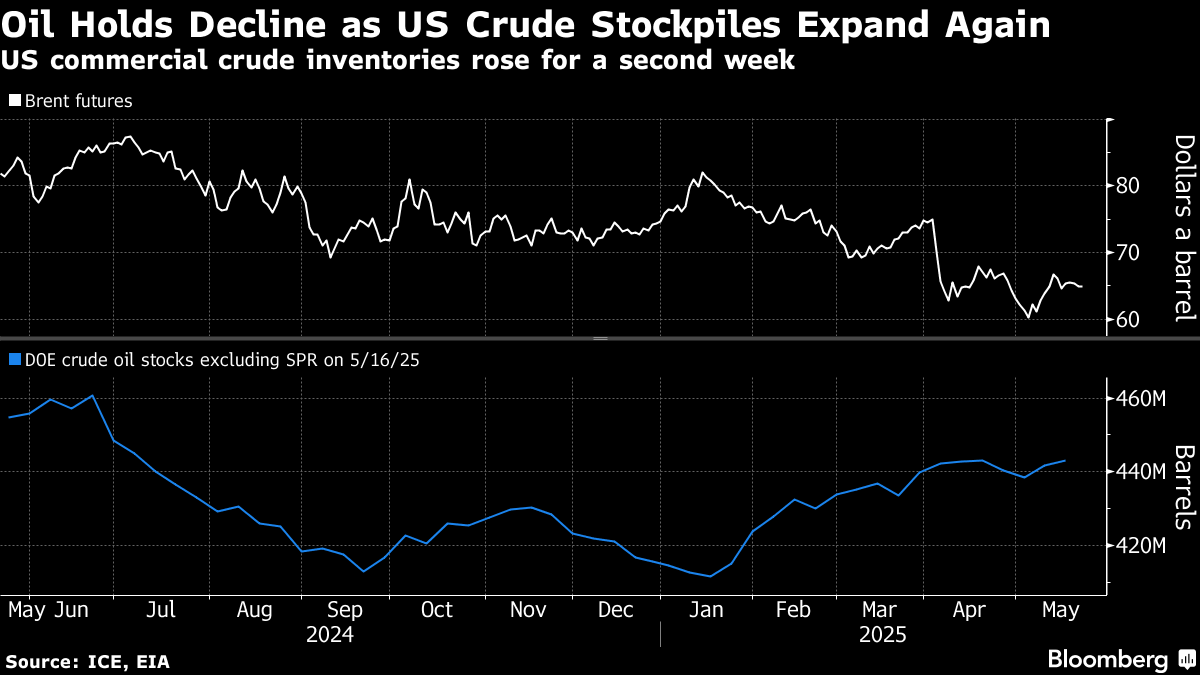

Brent traded below $65 a barrel after shedding about 1% over the previous two sessions, with West Texas Intermediate above $61. Commercial inventories of crude rose for a second week, with gauges of both gasoline and distillate demand also weak — even as the US summer driving season approaches.

In broader markets, concerns about Washington’s ballooning deficit spurred declines in US stocks, government bonds and the dollar, with Asian equities following them lower. The ructions come at a time when investor appetite for US assets was already waning across the globe.

Crude remains under pressure as OPEC and its allies push barrels back into a market that’s already looking well-supplied, with futures about 13% lower year-to-date. The US-led trade war has also driven losses on concerns that the globe-spanning disruption will slow economic growth, hurting energy demand.

Geopolitical elements remained in play, including nuclear talks between the US and Iran, and a report this week that Israel was preparing to strike Tehran. In addition, investors are tracking long-running efforts to bring an end to the war in Ukraine. Both could shift sanctions policy and impact global balances.

On Ukraine, the UK urged Group of Seven allies to cut their price cap on Russian oil, saying after a finance ministers’ meeting in Banff, Canada, that the move was necessary to put further pressure on President Vladimir Putin to end Moscow’s assault.

“Israel-Iran headlines offered a fleeting geopolitical premium, but these tend to fade quickly unless supply disruptions are imminent,” said Charu Chanana, chief investment strategist at Saxo Markets Pte. “US fiscal concerns are adding to the risk-off tone,” limiting the scope for any rally in oil, she said.

©2025 Bloomberg L.P.