Oil Falls a Second Day as Iran Signals Openness to Nuclear Deal

(Bloomberg) -- Oil fell for a second day following a report Iran is willing to forgo nuclear weapons in a deal with the US in exchange for sanctions relief.

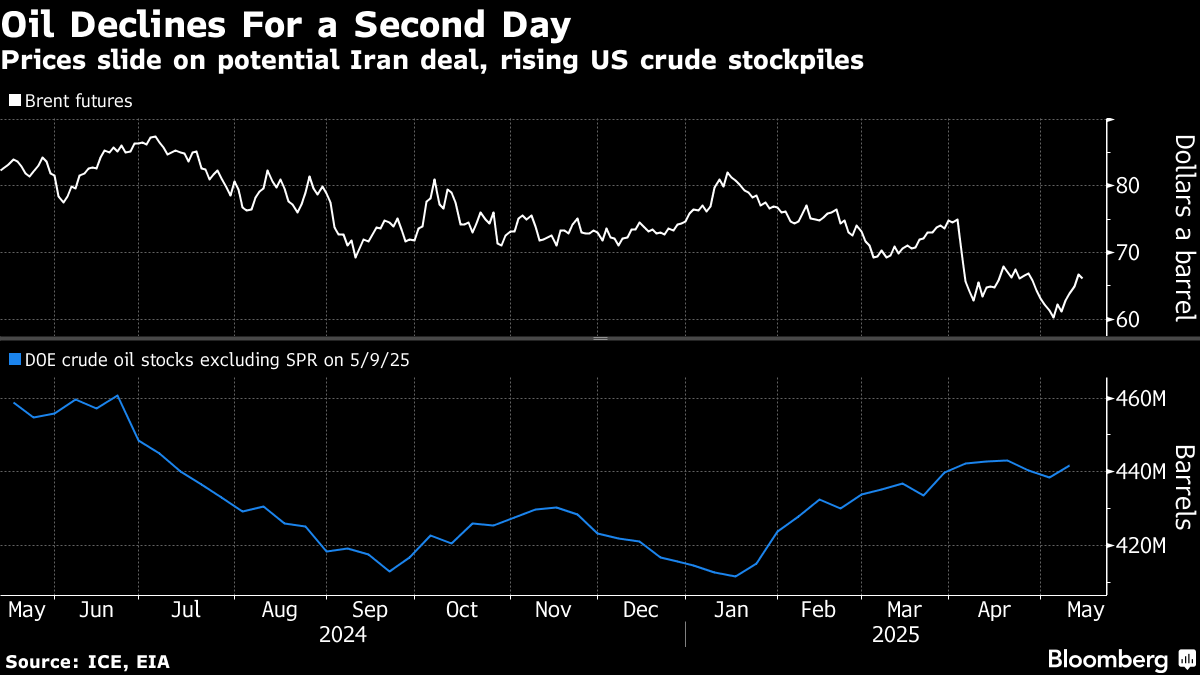

Brent dropped below $65 a barrel, after declining 0.8% on Wednesday, while West Texas Intermediate traded near $62. Iran is ready to sign an agreement with certain conditions, NBC reported, citing Ali Shamkhani, a top adviser to the OPEC nation’s supreme leader.

Crude declined Wednesday after government data showed US stockpiles rose the most since March, ending a four-day rally that had seen it gain almost 10%. The advance had been driven by the trade truce between China and the US and President Donald Trump’s increasingly hostile rhetoric on Iranian supply.

Oil is still down by more than 13% this year, and US producers have said they expect little change in prices before year-end. Increased flows from Iran would add to a potential glut later this year after the Organization of the Petroleum Exporting Countries and its allies last month began restoring supplies idled since 2022.

The group added only 25,000 barrels a day in April, a fraction of the scheduled 138,000 barrels a day, according to a monthly report released Wednesday. The alliance will consider another output increase at a June 1 meeting.

“Crude oil remains in a medium-to-long-term downtrend, with OPEC+ production hikes and geopolitical reprieve continuing to drive a looser supply outlook,” said Zhou Mi, an analyst at a research institute affiliated with Chaos Ternary Futures Co. The pause in US-China tariffs may temporarily boost demand for fuels, which would increase refining margins and limit the downside for crude, he said.

Gasoline is showing signs of strength, with its prompt spread — the difference between the two nearest contracts — near the highest in more than five months in New York. The increasing backwardation, where near-term prices are higher than those further out, is seen as bullish for demand.

The International Energy Agency, which advises consuming nations and publishes forecasts that are more closely watched by oil traders than OPEC’s, will release its latest estimates of supply and demand later on Thursday in Paris.

©2025 Bloomberg L.P.