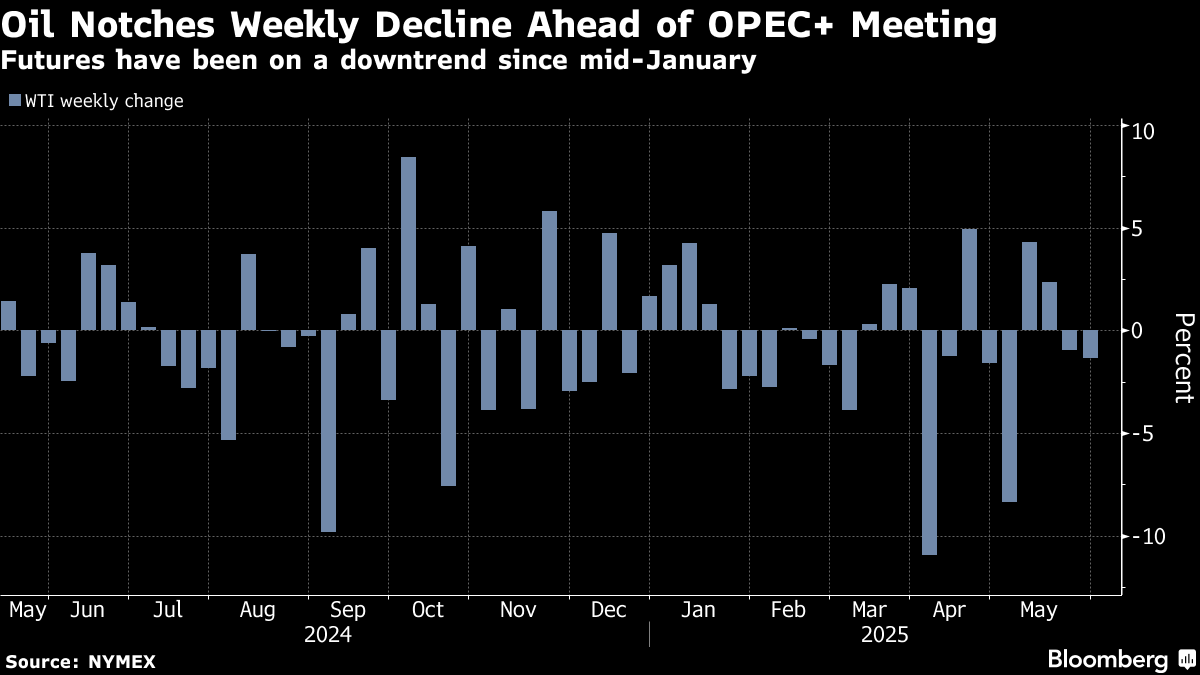

Oil Edges Down on Trade Jitters, Uncertainty Over OPEC+ Meeting

(Bloomberg) -- Oil edged down after a choppy session as traders parsed mixed messaging on the status of trade talks between the US and China.

West Texas Intermediate futures swung in a roughly $2 range before settling down fractionally near $61 a barrel. Futures had sunk after US President Donald Trump said China had violated its trade agreement and threatened to broaden restrictions on its tech sector, reviving concerns that a tariff war between the world’s two largest economies would hurt oil demand. Crude later pared losses when Trump signaled openness to speaking with Chinese President Xi Jinping.

Meanwhile, OPEC+ was said to consider an output increase of more than 411,000 barrels a day in July in a push for market share. The revival of idled output by OPEC and its allies at a faster-than-expected pace has bolstered expectations that a glut will form this year.

“Global oil market fundamentals remain somewhat loose now and should loosen up much more later this year, with growing non-OPEC supply and relatively mild, but persistent stock builds,” Citigroup analysts including Francesco Martoccia said in a note. Geopolitical risks from Russia to Iran continue to provide price support against an otherwise softening physical backdrop, they added.

Meanwhile, commodity trading advisers, which tend to exacerbate price swings, increased short positions to sit at 91% short in Brent on Friday, compared with roughly 70% short on May 29, according to data from Bridgeton Research Group.

Still, some metrics are pointing to near-term strength in the oil market. WTI’s front-month futures were trading about 93 cents more per barrel than the contract for the next month, the biggest premium since early January.

Libya’s eastern government threatened to curb oil production and exports in protest after a militia stormed the state oil company’s headquarters. A shutdown could result in a loss of as much as 600,000 barrels a day for a month, according to Citi. Further supporting prices, wildfires are putting about 9% of Canada’s crude output at risk as a blaze in Alberta’s oil sands region spreads.

©2025 Bloomberg L.P.