Oil Climbs on Report That Israel Is Preparing to Strike Iran

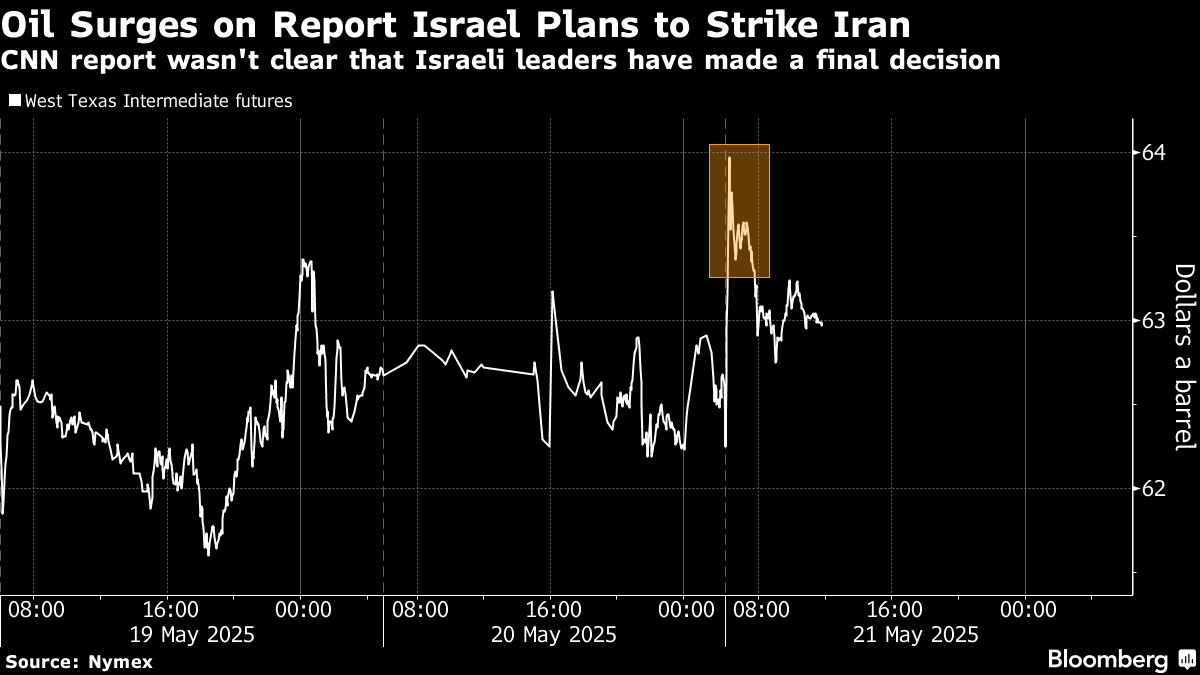

(Bloomberg) -- Oil jumped following a CNN report that new US intelligence suggests Israel is preparing for a potential strike on Iranian nuclear facilities.

Brent crude rose above $66 a barrel while West Texas Intermediate surged as much as 3.5% before paring gains. It wasn’t clear that Israeli leaders have made a final decision on whether to carry out the strikes, CNN said, citing unnamed officials.

Oil has been volatile since last week on mixed headlines about the fate of Iran-US nuclear talks, which could pave the way for more barrels to return to a market that’s expected to be oversupplied later in the year. An attack by Israel would hinder any progress in those negotiations and add to unrest in the Middle East, which supplies about a third of the world’s crude.

“This is the clearest sign yet of how high the stakes are in the US-Iran nuclear talks and the lengths Israel may go to if Iran insists on maintaining its commercial nuclear capabilities,” said Robert Rennie, head of commodity and carbon research for Westpac Banking Corp. “Crude will maintain a risk premium as long as the current talks appear to be going nowhere.”

The CNN report also briefly pushed traditional currency havens including the Swiss franc and Japanese yen higher, before the move pared. The US Department of Defense and National Security Council didn’t immediately respond to requests for comment. The Israeli embassy in Washington declined to comment.

Israel has long weighed targeting Iran’s nuclear program. A big question, however, is just how many of the atomic sites are insulated against anything but the most extreme attack. Earlier, those plans were also believed to have been deterred by comments from then-President Joe Biden following attacks between the nations last year.

Geopolitical concerns have for now overshadowed expectations of looser balances heading into the second half of the year, as OPEC and its allies bring back barrels to the market. US shale oil output hasn’t peaked and can still expand, but not if prices are near $50 a barrel, ConocoPhillips Chief Executive Officer said Tuesday.

Earlier this week, Iran’s Supreme Leader Ali Khamenei said he didn’t think the latest effort to negotiate with the US would lead to a result. WTI prices could tumble as low as $40 a barrel if sanctions on the Islamic Republic’s oil exports are lifted, according to Bloomberg Intelligence.

Iran has been able to keep exporting crude in spite of increasing sanctions by the US and allies including the UK and Europe. Tehran has even managed to boost supply recently, according to Goldman Sachs Group Inc.

“Iran has increased its supply by about a million barrels a day over the last couple of years,” Samantha Dart, Goldman’s co-head of global commodities research, said on Bloomberg Television. “If you remove a million barrels a day from Iran, this could represent an upside of about $8 a barrel to the crude oil price.”

©2025 Bloomberg L.P.