Oil Leads Commodity Rally After US-China Truce as Gold Retreats

(Bloomberg) -- Oil and most other commodities powered higher, while gold fell, after China and the US ratcheted down trade tensions that had threatened to slash demand for raw materials.

West Texas Intermediate crude rose 1.5% to settle at $61.95 a barrel in New York, while copper advanced 0.8%. European natural gas, soybeans and iron ore also rallied. Shares of the top mining companies surged.

The truce between the world’s two largest economies brought some temporary relief to commodity markets roiled by tariffs that dented the outlook for global economic growth in recent weeks. Oil watchers have slashed demand forecasts, and the trade war already was showing signs of reducing the volume of goods arriving in the US.

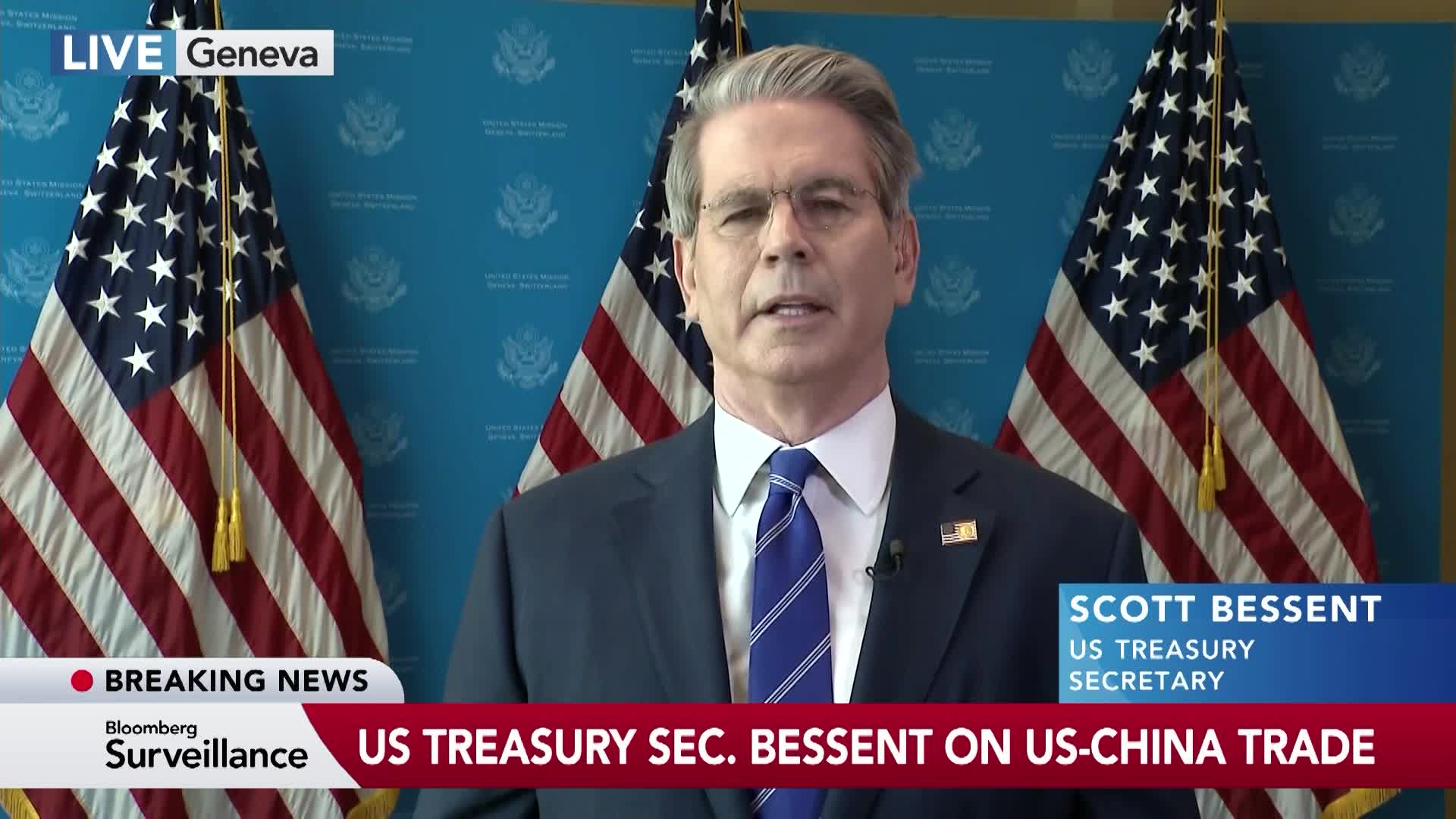

China will reduce tariffs on US goods to 10% from 125%, while America will cut its own curbs to 30% from 145% in an arrangement lasting for 90 days. At a briefing after the talks, US Treasury Secretary Scott Bessent said neither nation wanted their economies to decouple. Both countries said they would establish a mechanism to continue discussions on economic and trade relations.

“The oil market got caught up in the euphoria, but the damage has already been done to demand in the short term,” said John Kilduff, founding partner of Again Capital LLC. Still, reduced trade war tensions have removed $3 to $5 of downside from the market, rendering the new price floor near $60 a barrel, he said.

Commodities have been volatile ever since President Donald Trump first announced so-called reciprocal tariffs in early April. Oil prices are still down more than 10% since then as the market contends with rising supplies from the Organization of the Petroleum Exporting Countries and its allies.

While commodity trading advisers are still largely betting against crude, they’re moving off their extreme bearish stance. The funds, which can accelerate price momentum, liquidated short positions to sit at 82% short in both WTI and Brent on Monday, compared with 91% short on May 9, according to data from Bridgeton Research Group.

The commodity eased off of intraday highs as Trump signaled positive progress in nuclear talks that took place on Sunday between the US and Iran, boosting expectations of relaxed restrictions on Tehran’s crude in the near future. Traders are also focused on Trump’s first overseas trip to the Middle East. Saudi Arabia, OPEC’s de facto leader, will be the first stop.

Companies Rally

Top miners including Glencore Plc and Rio Tinto Plc rose on Monday and were among the best performers in Europe’s equity markets. Energy companies including Exxon Mobil Corp. and Chevron Corp. also climbed.

Copper prices, which fell sharply after tariffs were first announced, have rebounded on signs that demand in China is holding firm for now. But the price increase lagged the pace of gains in crude as investors caution against more trade uncertainty.

“There are still questions as to what the end game will be, as the measure will be operational for 90 days, and what the eventual level of tariffs will be,” said Ewa Manthey, commodity strategist with ING Groep NV. “Although these new levies are lower than expected, they still are significant and that could still hit demand for raw materials.”

In agricultural markets, soybean futures in Chicago extended gains to trade at the highest since February. China is the world’s top soybean buyer, and the trade thaw could help get crop flows moving again.

Meanwhile, gold lost ground as haven demand eased. The decline was compounded by a de-escalation of military hostilities between India and Pakistan after four days of clashes brought the two nuclear-armed nations close to a full-blown war.

The world’s top bullion producers slid following gold’s decline. Newmont Corp., Barrick Mining Corp. and Agnico Eagle Mines Ltd. — the top three miners of the precious metal — all were down more than 6% in New York.

Shares of companies that sell battery systems that rely on cells from China rallied. Fluence Energy Inc. jumped 23% while Sunrun Inc. climbed 16%. Sunrun said last week that the series of tariffs that had been put in place could result in additional costs of $100 million to $200 million.

©2025 Bloomberg L.P.