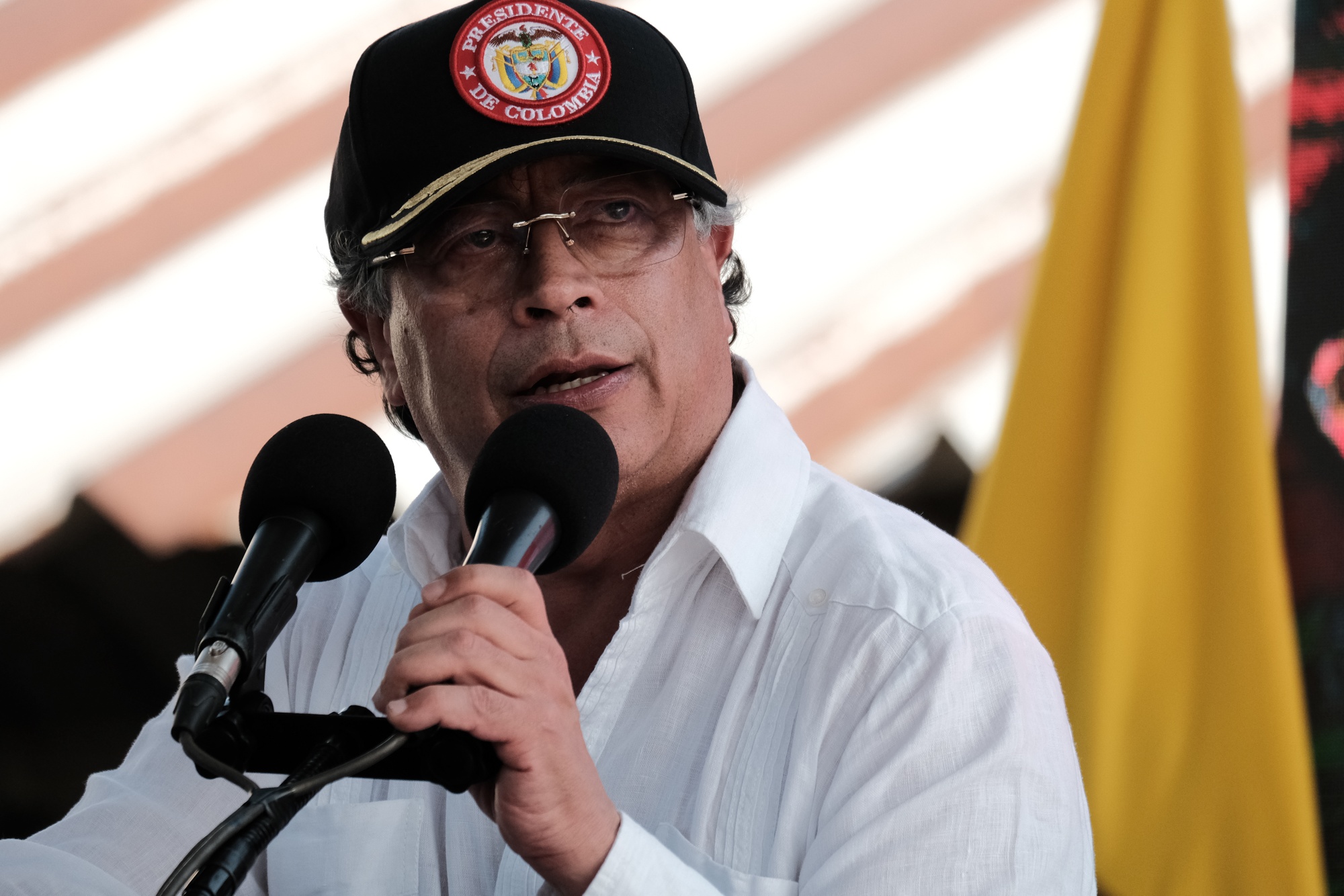

Petro Says Colombia Should Buy Qatar Gas to Fight Rip-Off Prices

(Bloomberg) -- Colombian President Gustavo Petro said state-owned Ecopetrol SA should import natural gas from Qatar to diversify suppliers and cut prices for consumers.

The “monopoly” of gas imports must end, Petro wrote on X on Monday and reiterated calls for the public services watchdog to investigate and “remove” distributors who are selling the fuel at speculative prices.

“Colombia is being robbed,” he added.

Until now Colombia has mainly imported gas from the US and Trinidad and Tobago. Petro’s comments come after a higher-than-expected February inflation print and a recent visit to Doha, Qatar, from where he pledged to diversify trade relations. The US is Colombia’s biggest commercial partner.

Petro has refused to sign new drilling licenses in a push to wean Colombia off fossil fuels, forcing the Andean nation to turn to costly imports to overcome natural gas shortages.

Last month, gas distributors announced increases of up to 36% in prices in cities including Bogotá and Medellín. Cargoes of liquefied gas from the US and elsewhere are as much as two or three times more expensive than domestic supplies.

Any final decision on gas imports would have to be approved by Ecopetrol’s board. Petro recently asked the state oil producer to sell its operations in the US, citing his government’s position against fracking, which he says is destructive to nature and humanity.

Read also: Colombia’s Vow to Quit Fossil Fuel Has Led It to Import More Gas

©2025 Bloomberg L.P.