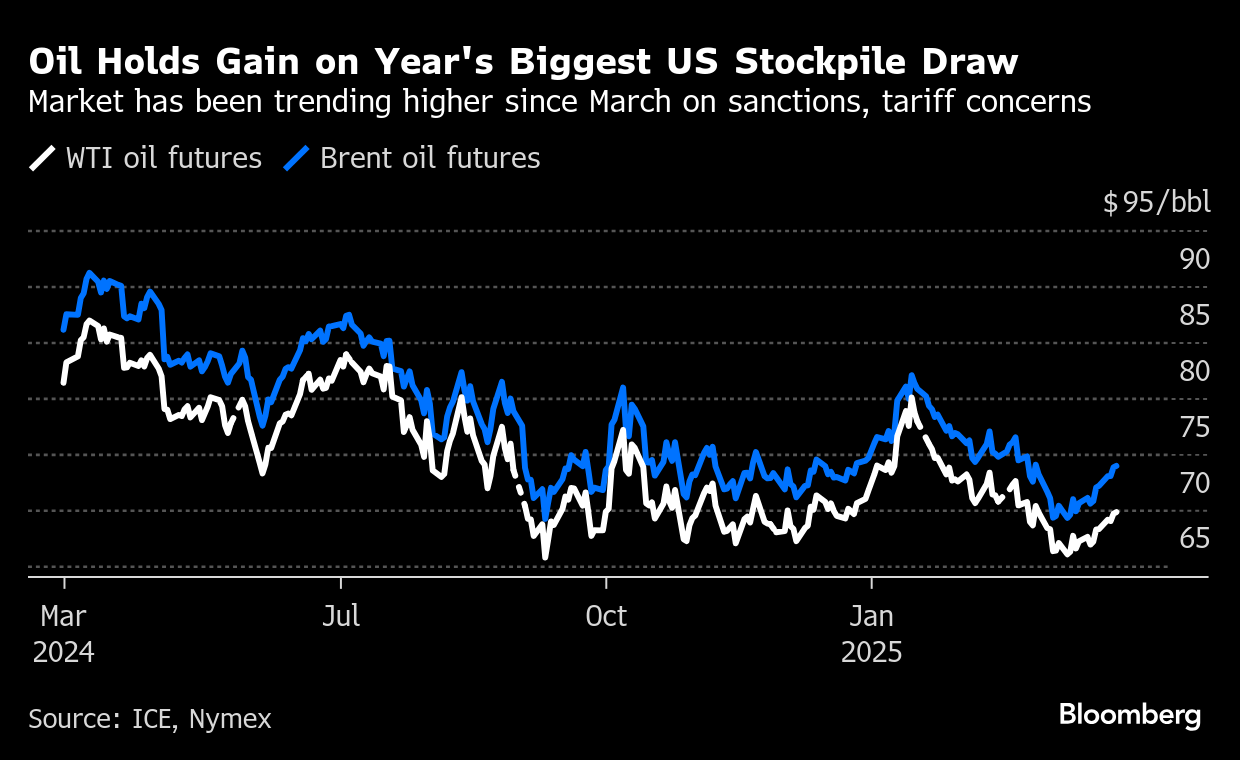

Oil Holds Gain as US Posts Biggest Drop in Stockpiles This Year

(Bloomberg) -- Oil held a gain after US crude inventories fell the most since December, signaling the prospect for near-term supply tightness.

Brent traded near $74 after closing 1.1% higher on Wednesday, while West Texas Intermediate was below $70. American stockpiles shrank by 3.34 million barrels last week, dropping to the lowest level in a month, while inventories of gasoline also dipped, according to government data.

Oil has trended higher since early March as sanctions and tariffs from the Trump administration raise the potential for supply disruption from producers including Iran and Venezuela. That’s prompted traders to snap up bullish oil options to hedge against price spikes.

Still, major oil traders including Trafigura Group and Gunvor Group are bearish on crude prices over the rest of the year due to rising supply, particularly from outside OPEC+. The producer group is also scheduled to start reviving idled output next month, the first in a series of planned hikes.

©2025 Bloomberg L.P.